Some companies embrace change. Some get suffocated in change’s embrace. And shares of International Business Machines (IBM) have performed dismally in recent years because investors have no idea which of those categories it belongs to.

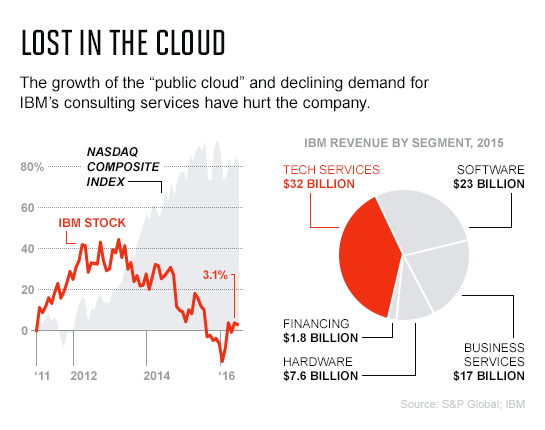

IBM (IBM), the Armonk, N.Y., tech giant that turned 105 years old this week, has been stuck at a junction since before Ginni Rometty took the helm as CEO in 2012. The older computing technology on which the company and its white-button-down, black-tie consultants built their dominance in the 20th century, such as servers and mainframes, has crept toward obsolescence. IBM knows that its future lies in cloud technology and artificial intelligence—and Rometty steadfastly preaches that gospel. But the old tech is declining faster than the new tech is growing. Revenue has fallen for 16 consecutive quarters, to $81.7 billion in 2015, and since its March 2013 peak, IBM’s stock is down 30%, trailing the S&P 500 by a mercy-rule-invoking 62 percentage points. “We don’t know when that will end,” laments Barclays analyst Mark Moskowitz.

The advent of cloud computing, which enables corporations to store and manage their data without investing in their own costly infrastructure, changed everything for IBM. The cloud slashed demand for both its servers and the highly profitable consulting and support services that IBM paired with them.

IBM is competing in the cloud, which accounted for $10.8 billion, or 13% of its overall revenue over the past year. But the company has thrown much of its effort behind so-called hybrid cloud services that incorporate private servers, allowing the company to continue providing “middleware” and support to clients. Middleware accounts for about 40% of IBM’s profits, according to Moskowitz. But that business model puts the company at a disadvantage against competitors like Amazon (AMZN) and Microsoft (MSFT) that emphasize less expensive “public cloud” services. “You don’t get fired for going with Amazon Web Services,” UBS analyst Steven Milunovich says that company CIOs have told him. “It’s the new IBM.”

With IBM well below 10% in cloud market share by most estimates, few investors think that business will help the company turn its fortunes around. Bulls are placing their bets instead on IBM’s machine learning and artificial intelligence (AI) efforts—represented in the public eye by Watson, the glib-toned box showcased on Jeopardy! and innumerable commercials.

Morgan Stanley (MS) analyst Katy Huberty, who earlier this year upgraded her recommendation on IBM from the equivalent of neutral to buy, considers IBM a front-runner in the AI race, since Watson’s analytical capabilities have potential applications in fields ranging from travel to finance to retail. Huberty says she’s encouraged by IBM’s recent push to acquire a monster trove of AI-oriented data—especially in the health care sector, where IBM Watson Health bought Truven Health Analytics in February for $2.6 billion.

IBM doesn’t break out figures for its AI work—a sore point among investors who are looking for clearer data, says Moskowitz. But analysts say that IBM’s “strategic imperatives” business, which includes AI efforts as well as cloud, security, and other initiatives, will surpass 50% of revenues by mid-2017. The business accounted for $28.9 billion in sales in 2015, up 17% from 2014. While there’s plenty of competition in this realm too—Google (GOOGL) and Microsoft have their own AI ambitions—Huberty believes that if IBM manages even a 25% market share, AI will be “easily a $50 billion business” for the company.

For more on IBM, watch this Fortune video:

That, of course, is a big if, and one many investors aren’t willing to bet on. Only seven of 26 analysts who follow the company rate it a buy or strong buy—an unusually low ratio in that bullish community. Institutional investors such as mutual funds and pension funds have also fled, accounting for only 66% of IBM shares, according to Morningstar; for comparable tech giants like Hewlett Packard Enterprise and Cisco Systems (CSCO), that figure is 82% or more. But if IBM does finally reverse its revenue declines, those institutions could pile back into the stock—generating a nice pop for people willing to invest in it now. (“Another reason not to be super bearish,” notes Milunovich.)

Investors who take that gamble would be buying a still-profitable company for a very low 11 times 2017 earnings, and collecting a 3.4% dividend (far above the S&P 500’s average) while they waited. They would be waiting in prestigious company. Warren Buffett’s Berkshire Hathaway (BRKA), IBM’s single largest shareholder, has bought more than 12 million shares since the end of 2013, giving it a total of 81 million. Buffett bought nearly 200,000 in the quarter that ended in March.

Of course, Buffett has also admitted that he may be wrong. The takeaway: Don’t bet money on IBM that you can’t afford to lose.

A version of this article appears in the July 1, 2016 issue of Fortune with the headline “Pondering the Puzzle of IBM.”