If this isn’t the No. 1 question on your mind right now, then you’ve done a pretty good job of avoiding the financial media this year. For everyone else, the question of whether your portfolio is prepared for the inevitable rise in interest rates is the all-consuming topic of the day.

Everyone has an angle when they offer an answer to this question. From hedge funds to newsletters, from financial advisors to unconstrained bond funds, there are calls to action coming from every corner of the investment universe that range from mildly alarming to downright terrifying.

But never fear: Your favorite investing columnist has put together the definitive guide to whether your portfolio will be able to withstand the coming rate hike cycle, whether it begins this fall or sometime in early 2016.

It’s unclear when the first hike will take place. Nor is it clear what the duration of the cycle will be or where rates will peak. Many will attempt to forecast these items, and the majority will fail spectacularly. I won’t be throwing a hat in the ring with forecasts of my own. Instead, I will be offering the context you need about how various asset classes have responded to rising rate periods in the past.

One important caveat before we get into the data itself: No hiking cycle looks exactly the same as any other. Each era has its own unique economic, market, demographic, and political variables, making comparisons to our situation today imperfect. Even the stock and bond indices have evolved in important ways over time. We’re almost always comparing apples to kumquats in an exercise like this one.

However, prior interest rate hike cycles offer some useful guidance for what we are about to face today, even with the wide range of outcomes I’m about to describe. This is because the predominant variable of the markets – human behavior – doesn’t change very much from generation to generation, even if the environment around us does.

My research director, Michael Batnick, and I looked at the history of effective Federal Funds rates as provided by the Federal Reserve. Specifically, we focused on how various asset classes acted before during and after historical rate hike cycles. For the purposes of this investigation, we define “rate hike cycle” as any period in which the Federal Reserve has raised the Fed Funds rate in a minimum of three successive meetings without a cut. Going back to 1976, there were eight such rate hike cycles, the shortest of which was nine months and the longest representing a total of 39 months.

Below, we highlight the most important insights about U.S. stocks, international stocks, U.S. bonds and then a portfolio made up of each of these asset classes:

U.S. stocks: Surprisingly resilient as interest rates rise

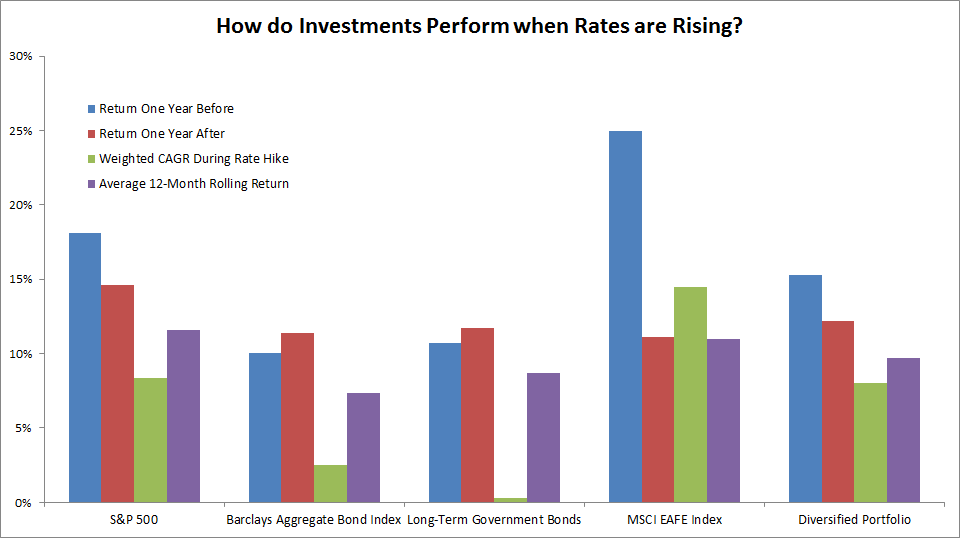

In the one year period leading up to a rate hike cycle, the S&P 500 has done significantly better than the typical 12-month rolling period, with an average return of 18.11% versus 11.6%.

In the one year period following the final rate hike of a cycle, the S&P 500 has also done better, with a return of 14.6% on average.

During the rate hike cycles themselves, stocks typically do worse than average but still manage to earn positive returns for investors. The S&P 500 has posted a weighted average compound annual growth rate (CAGR) of 8.3% during the eight rising rate periods of the last four decades. And volatility has actually been lower than normal during six of these eight periods.

International stocks: The special ingredient that keeps performance on track

On average, foreign stocks massively outperform U.S. stocks before and during rate hike cycles. In the one year period leading up to a Fed Funds rate hike, the MSCI EAFE Index (European and Asian stocks) has delivered an average return of 25% versus the typical 11% rolling 12-month period.

During rising rate periods, the EAFE index has posted a weighted average compound annual growth rate of 14.5%. Foreign stocks have been negative in just one of the last eight rising rate periods.

In the year following a U.S. rate hike cycle, foreign stocks perform in line with their long-term average 12-month returns of 11%.

U.S. bonds: Not nearly as bad as you think

U.S. bonds, which we represent using the Barclays Aggregate Bond Index, have done better than average during the year before and the year after a rate hike cycle begins. The Barclays Aggregate has gained an average of 10% (total return) in the 12 months leading up to the first hike of a cycle. It has gained an average of 11.4% in the 12 months after the cycle ends. Note that these average returns compare favorably to the average 12-month return of 7.32% for all periods.

U.S. bonds do not do particularly well while the hiking cycle is in progress, but it is far from a disaster. The weighted average compound annual growth rate for the Barclays Aggregate Index was 2.5% during the last eight rate hike cycles. In only two of these eight periods have bonds posted negative returns for investors. Volatility for bonds was only slightly higher in these periods, with a standard deviation of 6% versus the typical 5.5%.

The majority of the pain felt in bonds happened at the long end of the curve. Consider that 5-year Treasury notes during rate hike periods had a 2.6% CAGR while long-term Treasury bonds returned just 0.3%.

Diversified portfolio: This is how you win

The good news is that by adding foreign stocks, investors have been able to offset the pressure of rising interest rates on their other holdings. We tested a portfolio consisting of 30% S&P 500, 30% MSCI EAFE, and 40% Barclays Aggregate Bond that was rebalanced annually. Historically, this portfolio comes through rising rate cycles with flying colors.

The average CAGR for the diversified portfolio during rate hike cycles has been 8%, which is lower than the overall 12-month return of 9.7% but still quite robust. In the year leading up to the first hike of a new up-cycle, the diversified portfolio returned an average of 15.2% and then 12% during the year after the cycle has ended.

Now, here’s the most important takeaway: Of the eight rising rate periods since 1976, there have been zero instances where this diversified portfolio has produced a negative return. The worst compound annual growth rate for the diversified portfolio was 0.5%, suffered during the February to October 1987 rate hike cycle. This is hardly a catastrophic outcome.

As you can see in the chart below (click on it to expand), while U.S. stocks and bonds tend to struggle in a rising rate environment, the average results we’ve seen have been nothing to panic over. And the diversified portfolio, which includes international stocks, has never lost money due to rising rates and has delivered returns that were just slightly below long-term averages.

As of this writing, the futures market is pricing in a decent probability that the first Fed rate hike will happen in the fall. There is no doubt that you will continue to be inundated with opinions, scare tactics, and all sorts of other noise the closer we get. You are now ready to face this cacophony with the knowledge that a globally diversified portfolio has provided investors with all the rising rate protection they’ve needed over the last 40 years.

Please see Michael Batnick’s companion post, which includes more information about our research methodology for this article.