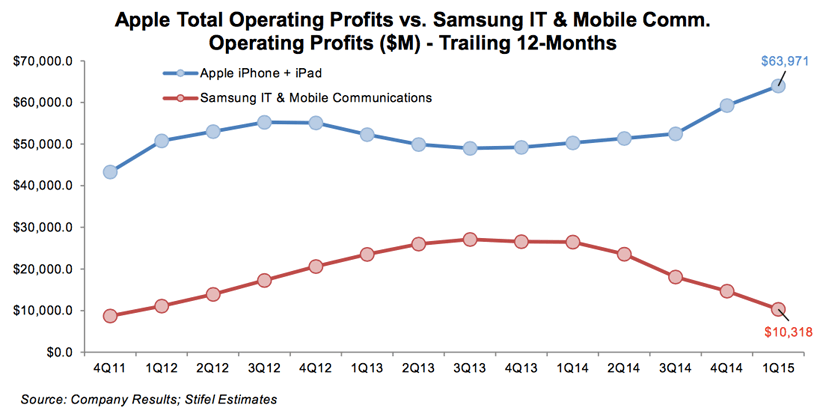

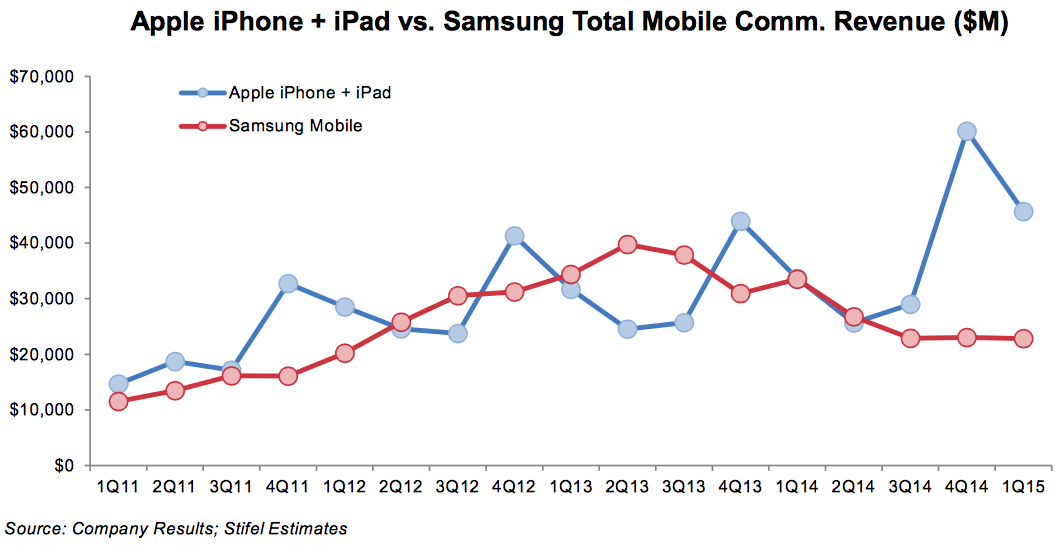

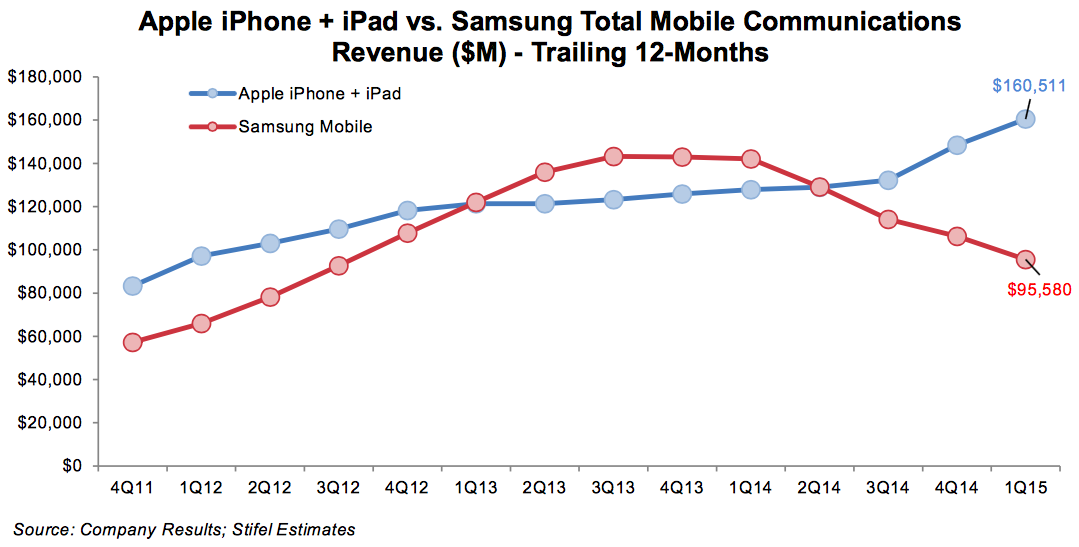

Two days after Apple reported quarterly earnings up 40%, Samsung reported that its earnings were down 40%.

There are a lot of moving parts here, but mostly it’s about smartphones.

For Apple, last quarter’s results were sweet vindication of its decision to go after Samsung Mobile’s most profitable market with a line of jumbo smartphones of its own. It’s not clear if Tim Cook has another trick like that up his sleeve, but the damage inflicted on Samsung by the iPhone 6 and 6 Plus has been done.

For Samsung, squeezed between Apple on the high end and Xaiomi et al. on the low, the results lay bare the weakness in Samsung’s mobile strategy. As reader Fred Stein put it in another forum:

We see the flaw in the open hardware side of the Android business model. It’s not just Xaiomi’s competitive price. “Open” also means Android hardware makers have to spend more on advertising and likely incur greater inventory expenses for write-downs. As Android, not iOS, reaches saturation, the Android hardware market becomes a zero sum game.

This does not mean that the Android platform fails, and certainly Google is doing fine. It does indicate that the iOS platform can continue to thrive. Apple’s increasing profits means they can out-invest (in R&D) the Android competitors, for the foreseeable future.

To be sure, Samsung is selling a lot of low-margin phones. See for example CNET’s Samsung regains smartphone sales crown from Apple.

But the upbeat guidance Samsung gave investors Wednesday is based on the premise that the Galaxy S6 will be an iPhone-sized hit. Without any hard data, the question of whether Samsung’s flagship phone is off to a strong or weak start is a matter of partisan debate in the Korean press. See here and here.

The attached charts are from a note to clients issued Thursday by Stifel’s Aaron Rakers. “Samsung,” he writes, “expects smartphone and tablet demand to stagnate (emphasis his) due to weak seasonality in the June quarter.”

Click to enlarge.

Follow Philip Elmer-DeWitt on Twitter at @philiped. Read his Apple (AAPL) coverage at fortune.com/ped or subscribe via his RSS feed.