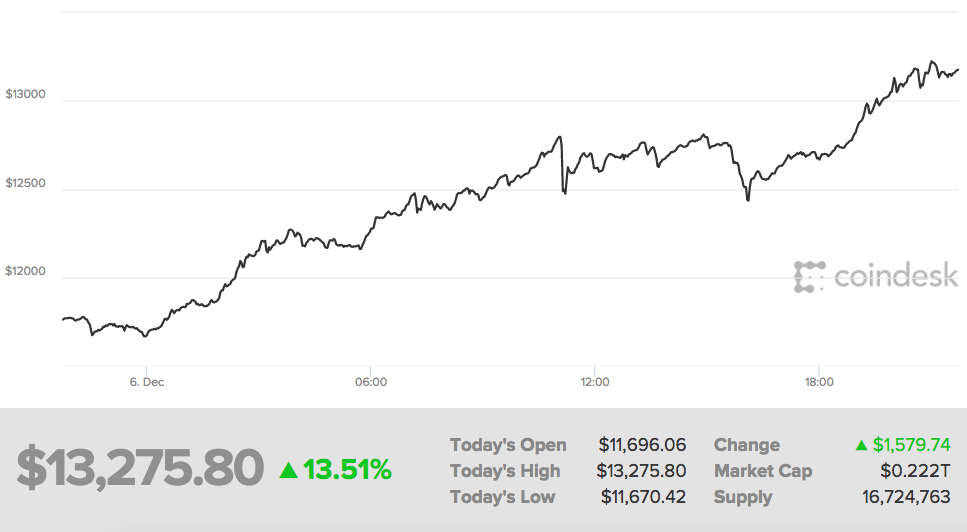

Bitcoin started Wednesday with a major rally that pushed its price beyond $12,000—and then really started taking off in a stunning 18-hour run that saw its price reach as high as $13,275 by late afternoon. [Update: Shortly after this story, bitcoin broke the $14,000 mark.]

The latest buying spree, which defies chatter about a bubble ready to pop, appears to have driven by a recent frenzy of interest among South Korean speculators and news that bitcoin derivatives will be sold in the U.S. by next week.

Wednesday’s run also reflects how $1,000 price gains for bitcoin, which used to take place over weeks or months, now occur in days or hours. Today’s jump is reminiscent of how bitcoin jumped from $10,000 to $11,000 in around 12 hours on November 29.

Here is a chart, courtesy of Coindesk, that shows what the bitcoin market looked like in the last 24 hours:

Not everyone, of course, is convinced that the bitcoin gains are here to stay. The latest voices to pour cold water on bitcoin come from Scandinavia, where the CEO of Nordea Bank AB called it a “joke” while the head of Denmark’s largest pension fund said the currency is “something we basically don’t feel comfortable with.”

Those voices, and those of others like long time bitcoin skeptic Jamie Dimon, CEO of JP Morgan Chase, have so far done little to quell investor enthusiasm for the world’s most famous crypto-currency especially in Asia. As Bloomberg reports, South Koreans are so infatuated with bitcoin that they regularly pay premiums to get hold of it.

Meanwhile, bitcoin’s next big test is likely to come next week when futures contracts for the currency begin trading in the U.S. next week. The sale of these derivates are expected to attract a flood of new capital from hedge funds and others who want to gain exposure to bitcoin, but have been waiting for a way to hedge their positions.

The arrival of the futures market is also coming as a source of alarm for some, however, including billionaire and Interactive Brokers CEO Thomas Petterfy, who told Fortune there is a chance the derivatives could trigger a 2008-style financial crisis.