VF Corp (VFC) has finally broken its acquisition dry spell.

The company, whose brands include Vans, The North Face and Timberland, said on Monday it is buying the maker of Dickies hospital scrubs and Kodiak boots for $820 million, its first major acquisition since its transformative deal for Timberland six years ago.

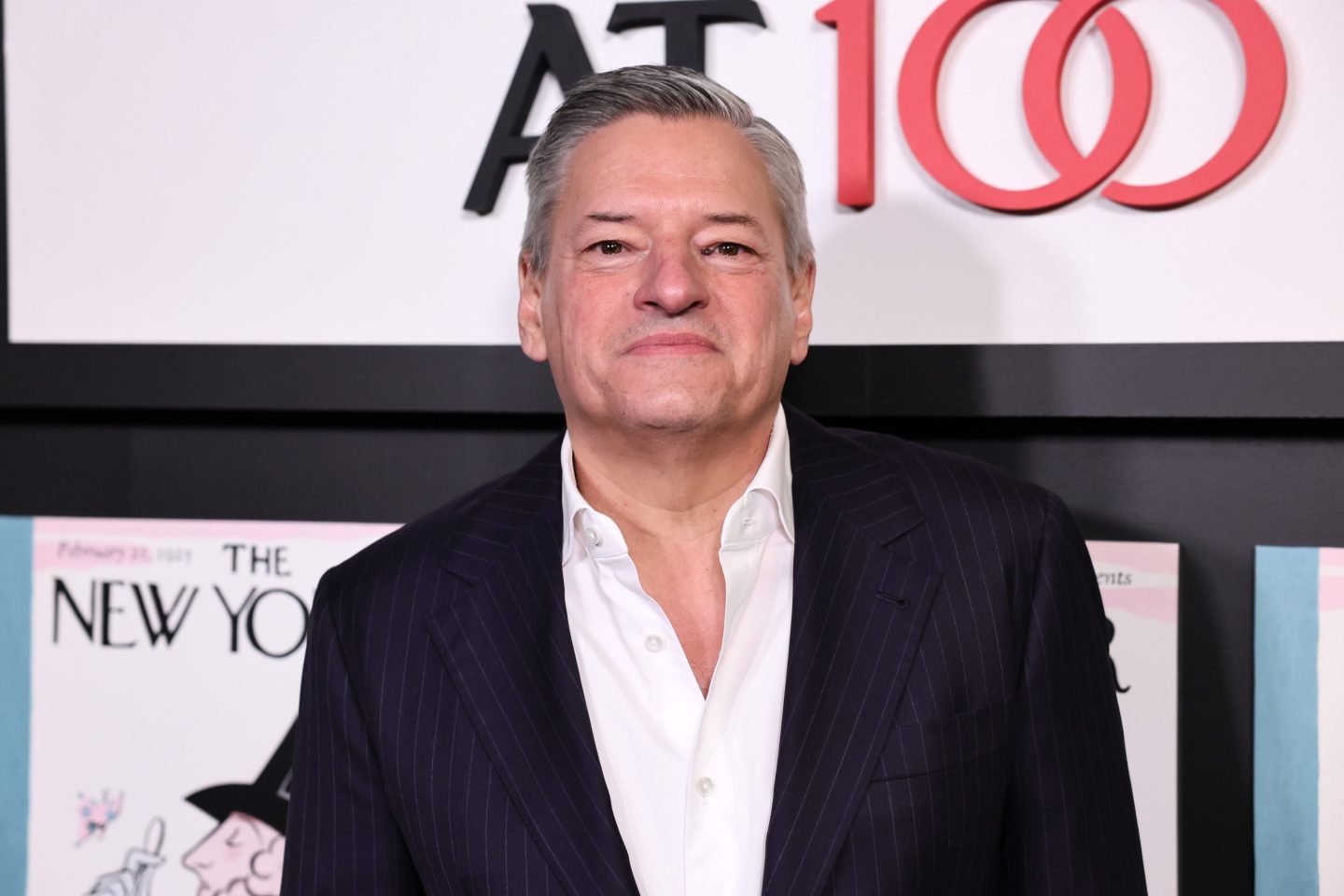

The cash deal for the private, family owned the 100-year old Williamson-Dickie Mfg, will instantly double VF’s workwear business to $1.7 billion in annual revenue, VF Chief Executive Steve Rendle said in a statement. Williamson-Dickie, also known for its outdoor coveralls, generated revenue of $875 million in the last year. (Rendle told Fortune this spring that VF’s deal sweet spot were companies with the potential to achieve $1 billion in annual revenue.)

“VF is the ideal steward to honor that heritage while providing a platform for growth that ensures continued success for another century,” Rendle said.

The move comes as VF has been working to update its portfolio in recent years but frustrated investors by the absence of a major deal. VF is well regarded in the apparel industry for its ability to take a popular but underperforming brand, bring it in-house and rehabilitate it with disciplined management, apparel tech and the manufacturing cost benefits of being part of a mammoth company.

VF earlier this year landed a deal to sell its licensed sports business to online retailer Fanatics but investors have been clamoring for a larger deal that would make the company a bigger player in a growing category. VF raised its forecast on annual revenue by $200 million to $11.85 billion and lifted its adjusted earnings guidance by 2 cents to $2.96 a share, news welcomed by investors who sent shares up 2% on Monday.

The company’s shares had until recently tumbled, with profit per share and revenue growth between 2013 to 2016 falling short of the targets promised to investors. Notably, VF had promised compounded sales growth of 8% a year, but delivered only 6% during that period. In June, at its analyst day, VF told Wall Street to expect a compound annual growth rate through 2021 of 4% to 6%, an ambitious goal in a difficult apparel and footwear market. For the company to hit that mark, the top line needs the kind of big boost that a new, growing brand could bring. Ergo, the Williamson-Dickie Mfg.

Dealmaking has long been VF’s hallmark. In the 1990s and early 2000s, the company picked up The North Face and Vans. Rendle’s predecessor and mentor, Eric Wiseman, oversaw the $2.3 billion purchase of Timberland in 2011, instantly doubling VF’s footwear business. The three are now among VF’s five billion-dollar brands. Other deals haven’t played out as well: The online athleisure wear brand Lucy, which it bought in 2007, was a bust and will be shut down this year and folded into The North Face. And the company last year sold off some of its brands, including designer-denim maker 7 For All Mankind.