Apple and Facebook may expand their already outsized share of U.S. technology revenue when they report their earnings this week, as investors look for evidence to justify this year’s U.S. stock market rally.

The two are the last of the top five U.S. tech companies by market value to release their quarterly results, following reports from Alphabet, Microsoft and Amazon.com last week. Those reports impressed analysts and fueled confidence in the sector, which has so far been the top performer on Wall Street in 2017.

“If we look at the lion’s share of the numbers, they’re performing above expectations,” said Daniel Morgan, a portfolio manager at Synovus Trust, which owns shares of Apple worth about $41 million and shares of Facebook worth $68 million.

“It gives validity to my position, which is that tech is, by far, the most exciting sector,” Morgan said.

For more about Apple, watch:

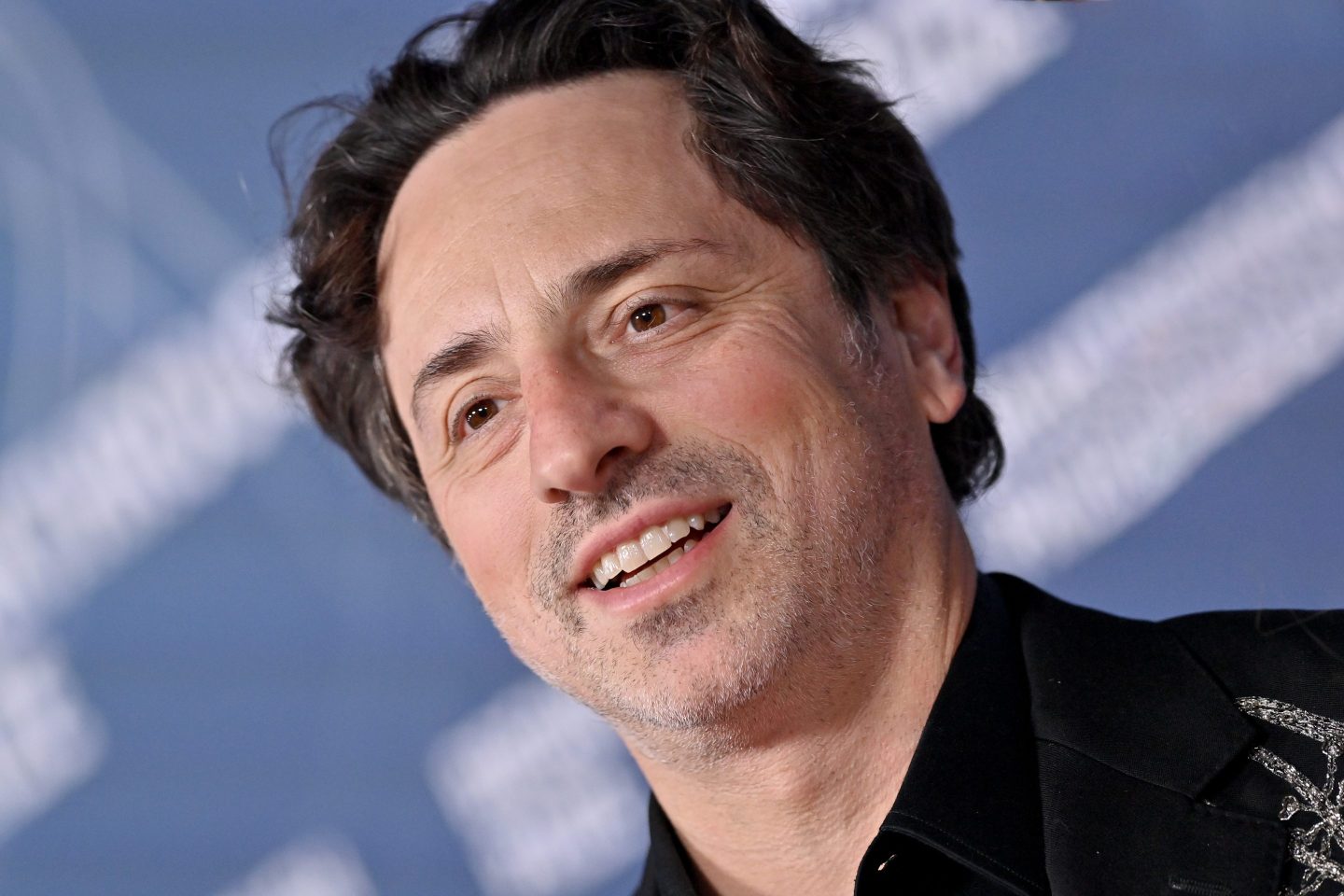

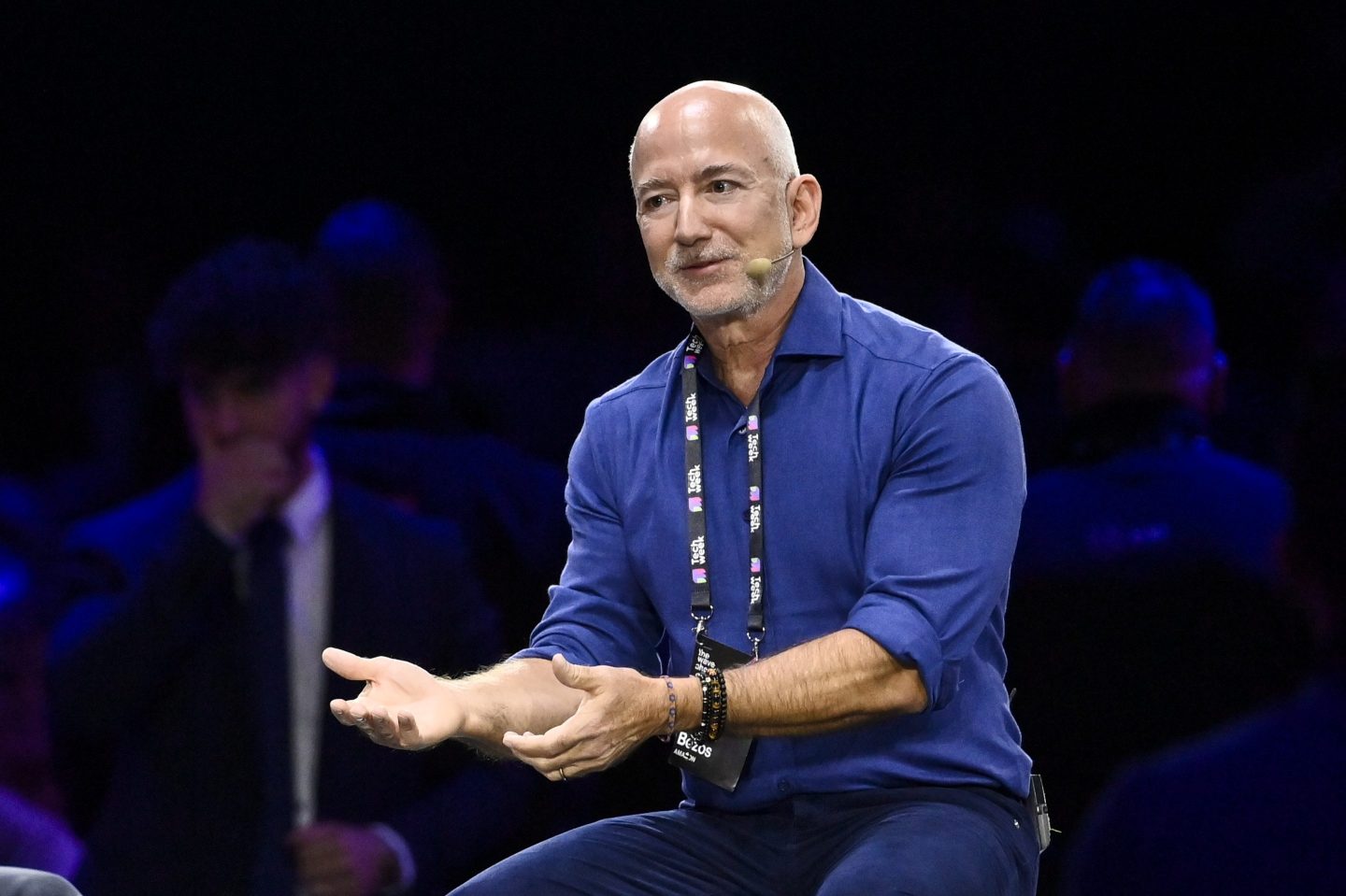

Shares of Facebook (FB) and Apple (AAPL) both hit record highs on Tuesday, up 0.53% and 0.75% respectively.

Surges in Apple, Facebook and other Silicon Valley heavyweights have pushed the S&P 500 technology index up by 16% this year.

And planned measures by President Donald Trump for steep corporate tax cuts and the easing of tax restrictions on profits made abroad would help Apple and other technology companies return more cash to shareholders.

The largest five Silicon Valley companies for years have been increasing their share of revenue and profits generated in the technology sector at the expense of smaller competitors.

Those five players boosted their share of revenue among technology companies in the benchmark S&P 500 index to 46% in 2016, from 38% in 2013, according to Thomson Reuters data. Their share of net income increased to 46% from 42% during the same time.

Facebook and Google, which is owned by Alphabet (GOOG), received 77% of gross spending on digital advertising in 2016, compared to 72% the year before, according to industry data analyzed by Pivotal Research analyst Brian Wieser.

Get Data Sheet, Fortune’s technology newsletter.

Technology company earnings are expected to have grown 17.7% in the latest three months, the strongest quarterly expansion since 2014, according to Thomson Reuters I/B/E/S.

Apple is expected by analysts to have boosted its revenue by 4.8% when it reports on Tuesday.

On Wednesday, Facebook is expected to post a 45.6% leap in revenue and a similar increase in earnings per share, according to analysts’ estimates.