In late February, Unilever (UL) received a gigantic $143 billion merger offer from Kraft Heinz (KHC). The move dazed some casual observers: Could the corporate giant that makes Lipton teas and Hellmann’s mayo so easily be subsumed by an American rival? Unilever’s board thought not, and turned down the deal. But the rebuff may not be an ending so much as a harbinger of things to come. If investors get their way (and they usually do), it won’t be long before Big Food is forced to digest another big merger or two.

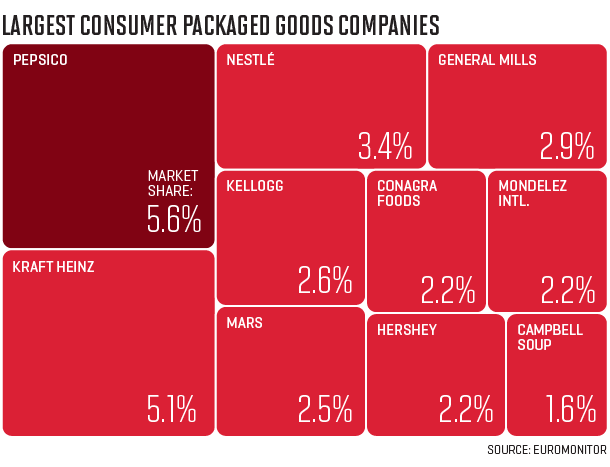

Kraft Heinz, notably, is still hungry for a deal. And that has Wall Street fantasizing about concoctions no whiz in the kitchen would dare dream up. Should Coca-Cola (KO) buy Hershey (HSY)? Or perhaps Mondelez should? Maybe PepsiCo (PEP) will make a play for Kellogg. General Mills plus Pinnacle Foods (PF)? Kellogg acquires Campbell Soup? The possibilities are endless.

Why is Big Food likely to binge on buyouts? Times are tough for major consumer packaged goods companies. Shoppers in the U.S. and other Western markets are gravitating toward the perimeter of the grocery store, where healthier fare is found, putting pressure on sales of packaged items like soups, cereals, and sodas. Critically, those are the products on which America’s food giants built their empires. And as a result, sales this year are poised to drop at big players like General Mills (GIS), Kellogg (K), and Conagra (CAG), while they’ll barely increase at Campbell Soup (CPB) and Mondelez (MDLZ).

“With revenue now in negative territory for a lot of these companies, the sense of urgency to do a deal is going to be higher,” says Credit Suisse analyst Robert Moskow.

Related: How Kraft Heinz Plans to Build a New Global Food Giant

Mergers are also on Wall Street’s radar because of a Big Food bogeyman: Brazilian private equity firm 3G Capital. 3G was behind the 2015 merger of Kraft and Heinz, last year’s mega-beer deal between Anheuser-Busch InBev and SABMiller, and most recently Burger King–Tim Hortons takeover offer for Popeye’s. Kraft Heinz and AB InBev, in particular, will almost certainly want to pick off more targets.

With the Kraft Heinz/Unilever deal off (for now) some expect the company to narrow its focus and try to buy Unilever’s food and beverage portfolio, without the added cost of nonfood brands like Dove (soap) and Axe (fragrance). But with U.K. regulations prohibiting revived talks for six months, observers think it’s just as likely to make a play for Oreo- and Triscuit-maker Mondelez.

Also worth watching: AB InBev, fresh off its SABMiller acquisition, will still likely need another deal to hit its goal of $100 billion in revenue by 2020. PepsiCo and Coke are potential targets. The soda giants have done a better job innovating to stay competitive in the U.S., but that may not be enough to ward off a looming bid. “3G is the catalyst. They are out there with a plan to consolidate the industry,” says SIG analyst Pablo Zuanic.

The buying spree leaves struggling Big Food players with two options—do their own deal, or potentially get devoured. And the latter might be uncomfortable: Kraft Heinz and AB InBev are known for buying companies, aggressively cutting costs, and then moving on to the next big target.

The cost cutting could be bad news for an industry that already has a reputation for not spending nearly enough on innovation. Plus, any deal that comes with big layoffs would face scrutiny from a Trump administration that bristles at U.S. job losses or factory closings.

Yet despite those challenges, investors may ultimately prefer a 3G-led buyout. Since absorbing Kraft, Kraft Heinz has cut 5,150 jobs, closed six factories, and consolidated distribution, but it’s poised to lift operating margins to an astonishing 30% this year. Results like those leave shareholders salivating. (For more on Unilever, see “Stocks That Are Better-Off Single.”)

Investor Warren Buffett, who was part of the Kraft Heinz deal, is a fan of the 3G way. He says they aren’t just productivity winners, but savvy marketers and product developers too. “When people see what the 3G management has accomplished,” he said on CNBC, “it may make shareholders of other companies somewhat unhappy.” In other words, if Big Food doesn’t shake itself up, big investors might do it for them.

A version of this article appears in the March 15, 2017 issue of Fortune.