Donald Trump and Janet Yellen don’t share much common ground.

The president-elect and the Federal Reserve Chair have clashed over Trump’s claims that the Fed was picking sides in the election. He has also at times criticized the Fed’s recent easy-money policies as creating a “false economy.”

But during a hearing before the Joint Economic Committee on Thursday, the Fed Chair indicated an area where she might welcome Trumpian reforms.

During her testimony, Yellen argued that there were two worrying trends in the American economy: slow productivity growth and lackluster business investment. “My advice [to lawmakers] would be to [pursue policies] that keep in mind the impact on. . .productivity growth,” Yellen said.

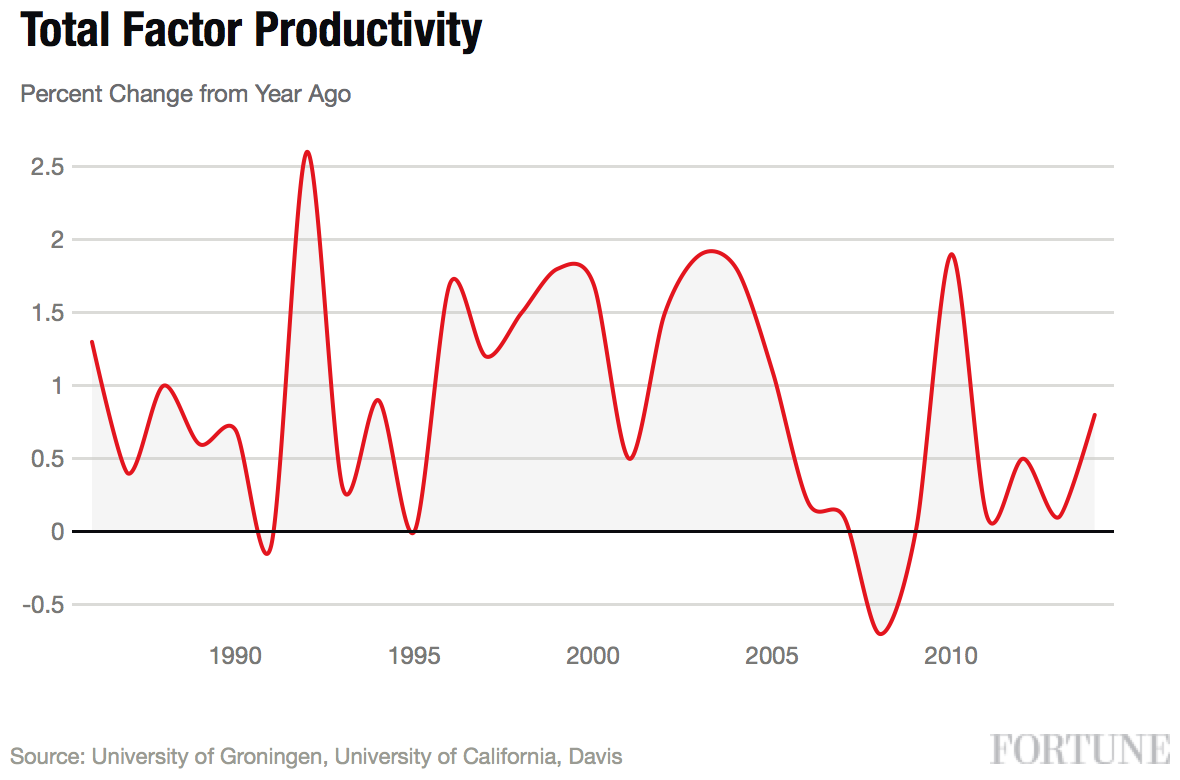

As you can see from the above chart, productivity growth began to fall off a cliff right around 2004, and despite a spike in the middle of the recession that was do to companies firing workers and getting more done with less, it has pretty much remained in the dumps since then.

Economists aren’t certain as to what is causing this decline in growth. Some believe it is the inevitable result of demographic changes and the unreliable nature of technological advance. But many right-leaning economists argue that it is the result of high business taxes and voluminous regulations.

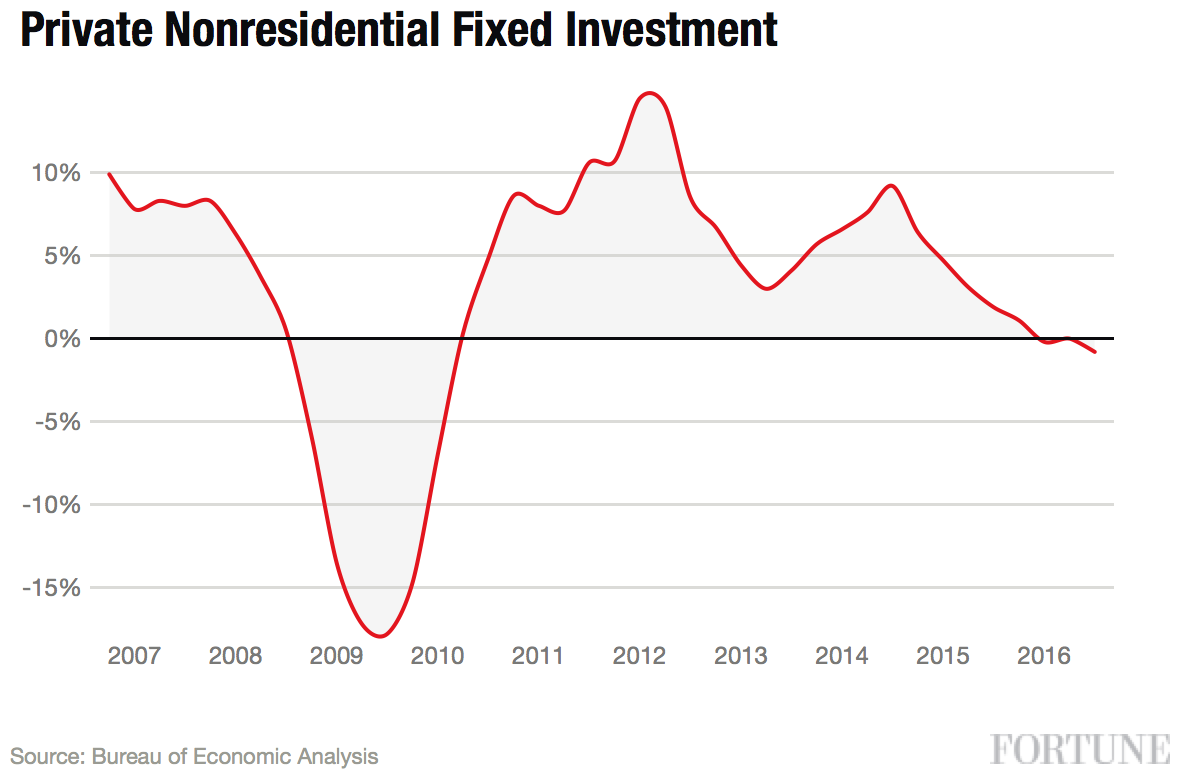

That’s because productivity growth is usually the result of businesses investing in new plants and equipment that make individual workers able to get more done per hour. So the fact that business investment has also declined significantly in recent years is not an unrelated event.

During her testimony, Yellen called the drop in business investment “disturbing,” though she argued that it isn’t the result of Fed policy. She didn’t say what she thought was causing it, but one obvious idea is taxes and regulation.

High taxes and burdensome regulation directly reduce the incentive to invest in new equipment as they reduce the profitability of those investment. Donald Trump was swept into Washington on the promise of slashing regulations and sharply reducing business taxes to 15%, which would put the U.S. at a much lower effective business tax rate than the OECD effective tax rate of 27.7%.

It’s not certain that these measures would increase business investment, but it’s certainly worth a try, as long as Washington can find a way to pay for it.