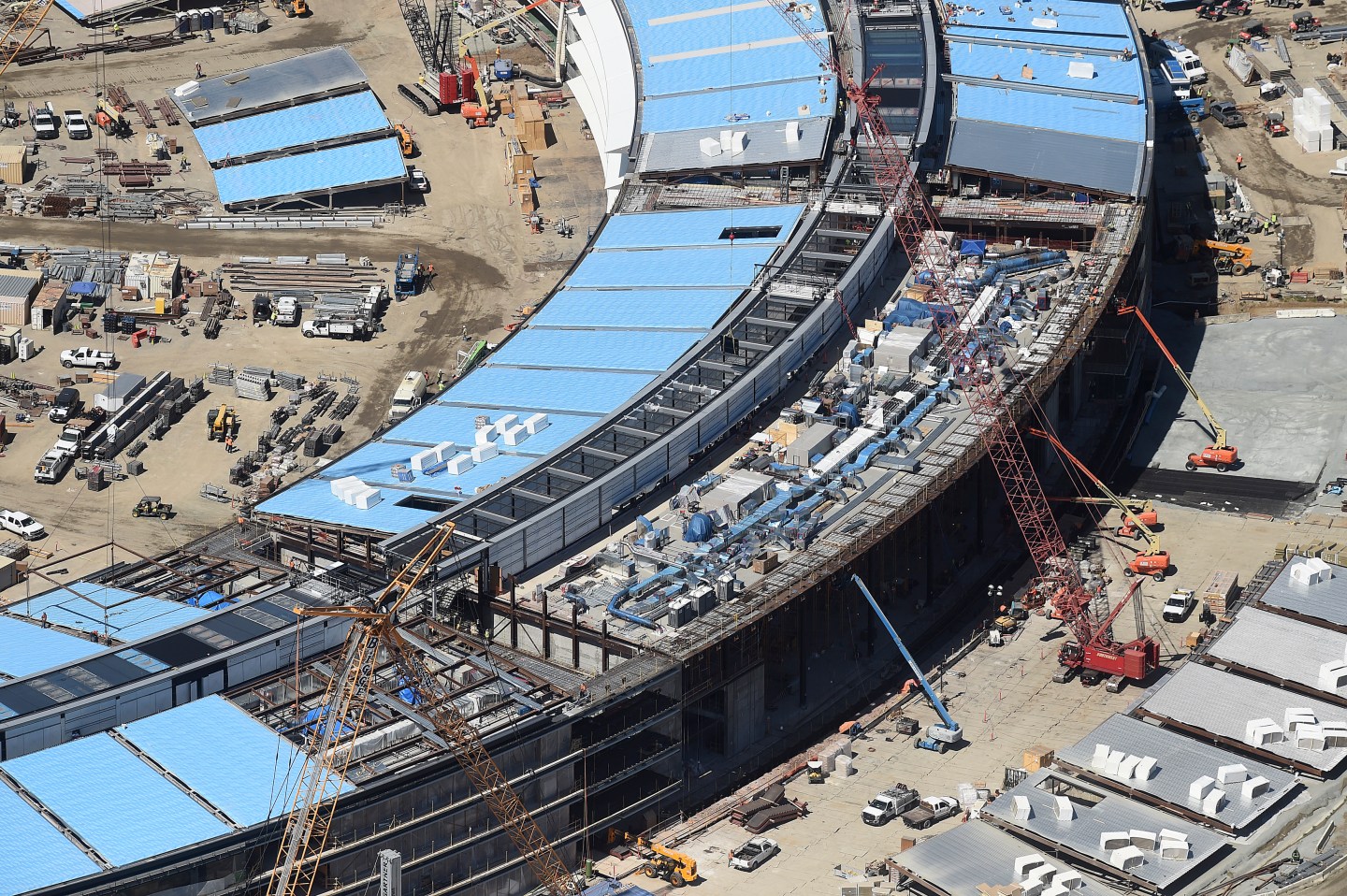

When Apple’s new massive campus, dubbed the Spaceship, opens for thousands of its employees next year in Cupertino, Calif., a small part of it will be powered by rows of big silver boxes containing fuel cells that generate energy through a chemical reaction.

The energy technology was developed and manufactured just a few miles away from Apple’s one-mile wide, still unfinished campus by the 15 year-old Silicon Valley company called Bloom Energy, Fortune has learned. Neither Apple nor Bloom Energy would comment on the Cupertino fuel cell project.

The substantial project, at 4 megawatts, is a big deal for Bloom Energy, a company that’s seen major hype, a bevvy of critics, and a steady list of customers. Apple’s adoption of the energy technology is also an important endorsement of fuel cell technology, which has slowly gained some traction with a handful of global brands as an alternative to companies simply plugging their buildings into the power grid.

Fuel cells produce energy by running fuel like natural gas or methane, and oxygen across rows of reactive materials. The process creates a chemical reaction that generates electricity.

The excitement around fuel cells is that they can create electricity directly next to the buildings where it’s needed. That is in stark contrast to how energy has traditionally been produced far away at a coal or gas plant and then delivered long distances over power lines.

During transmission and distribution, up to 15% of the electricity can be lost. Producing power on site, therefore, can be more efficient under the right circumstances. On site power can also add an element of security for operations that really need ongoing power if the greater power grid goes down.

In addition, fuel cells can emit fewer greenhouse gases compared to grid power. Bloom Energy’s fuel cells can use natural gas, which pollutes less than burning coal, along with even “biogas” which comes from collecting methane from decomposing organic matter like on a hog or cattle farm, a waste water treatment plant, or a landfill.

Bloom Energy—which emerged publicly six years ago but was founded in 2001—generated big headlines and excitement early on for its technology that now provides local power for a smattering of global Internet giants and big box retailers. It also drew attention for its loosely discussed goal to sell a low cost version of its fuel cell to power homes one day.

The company is backed by over $1 billion dollars from investors including some of the world’s most well-known venture capitalists. The company’s board includes former Secretary of State Colin Powell, AOL founder Steve Case and Kleiner Perkins Caufield & Byers partner John Doerr.

But in the past couple of years the notoriously tight-lipped company, has seen some of its bloom fade. A planned initial public offering never materialized, meaning that its early investors likely lost money. For years the company has relied on a California state subsidy, drawing ire from critics and competitors. More recently, that limited subsidy has started shifting to batteries instead of fuel cells.

In addition, industry-watchers have questioned just how green Bloom’s power really is compared to energy from the power grid. Particularly if the power plant down the road also uses natural gas, and biogas can be incredibly difficult to procure.

And forget that pipe dream of the residential fuel cell sold to regular people. It’s not even a topic of discussion anymore.

However, after 15 years of technology development and sales, Bloom Energy has survived and has continued to attract some of the world’s biggest brands to buy into its energy technology. Customers, many in California, are continuing to buy energy from the company’s new and improved fuel cells to power buildings and data centers.

Bloom Energy now says it has fuel cells at more than 300 sites, with 200 megawatts of energy capacity. That’s about the equivalent of one gigawatt of solar, given the sun only shines during the day, says Bloom Energy’s vice president of marketing and customer experience, Asim Hussain. In comparison one large coal or gas plant can generate about one gigawatt of power around the clock.

Over the past year, Bloom Energy has started selling a more efficient, more power dense, and more compact version of its fuel cell, dubbed the Energy Server 5.0, or the fifth version of its fuel cell. Hussain says the new fuel cell is 65% efficient, which is a significant increase from the 48% efficiency of its first fuel cell. It’s also almost double the power density—how much power can be produced per volume—of the previous version.

Apple, after installing early versions of Bloom’s fuel cells at its data center in North Carolina several years ago, is now using Bloom Energy’s more efficient fuel cells at its soon-to-open space age campus. The new project is smaller—less than half the size of the one in North Carolina—but it will help Apple create a microgrid, and run on local power if it disconnects from the greater power grid.

Retail giant Home Depot, too, has been installing Bloom Energy’s new fuel cells behind some of its buildings. On a visit to the Home Depot store in Westbury, N.Y., an hour outside Manhattan, earlier this year, I checked out the shining, compact row of boxy Bloom Energy’s fuel cells outside. There’s only eight refrigerator-sized boxes at the site, but they provide much of the energy needed to run the store around the clock.

By the end 2016, Home Depot plans to power 10% of its stores, at 200 locations, with fuel cells from Bloom Energy. The move is part of a plan for Home Depot to invest in batteries, solar panels, and other ways to be more creative about cleaner, cheaper and more efficient power. It’s also part of a strategic plan for the retail giant to be greener.

Home Depot’s vice president of operations, Chris Berg, told Fortune that Bloom Energy’s fuel cells can lower Home Depot’s energy costs in states like California and New York where electricity rates are high and additional incentives are available for cleaner power options. The technology also helps the company demonstrate sustainability, which can help retain and inspire employees.

Home Depot is an example of a new customer for Bloom Energy that is benefiting from its latest technology. Earlier customers that have used Bloom’s older technology include a who’s who of the tech industry and retail brands like Google (GOOGL), Adobe (ADBE), Verizon (VZ), eBay (EBAY), Walmart (WMT) and AT&T (T).

In Home Depot’s case, it’s mostly deploying Bloom’s technology in states where subsidies can provide additional extra support. Many of Bloom’s customers are operating in the same way and installing the devices in California only.

Since Bloom Energy was founded, it’s focused on lowering its costs and boosting the efficiency of its technology. When the company debuted in 2010, an investor told me that it was looking to lower overall costs of making its fuel cells by 60% to 70%.

But it’s unclear if the fuel cells are now low cost enough on their own to compete with other forms of clean and distributed power, like solar panels, or even just grid power. Bloom Energy declined to comment on the specific costs of the fuel cells, but Hussain said that “the overall total cost of ownership is coming down and we are becoming more competitive.”

The core issue with fuel cells—that every fuel cell maker has faced for decades—is that the costs have long been high to build and maintain them. The stacks inside the fuel cell box, which are lined with reactive materials, need to be replaced periodically.

If a fuel cell company must replace those stacks frequently over the years, the overall costs of energy can be high. If a company like Bloom can design the stacks to last longer, and make replacements more infrequent, the overall cost of energy can come down.

It’s these type of costs that have plagued most fuel cell makers. For years, energy industry media site Greentech Media has kept a recurring tally of the world’s profitable fuel cell makers, with three blank spaces for number one, two and three.

Hussain wouldn’t comment on Bloom’s financials, but said “we are progressing and scaling well and still experiencing fast growth.”

Bloom has suggested that’s it’s been close to profitability at various points thanks to its regular sales. This Reuters article, which focused on a large drop in Bloom’s valuation for an early investor, quotes an anonymous longtime investor in Bloom as saying the company is “within striking distance” of profitability.

But Bloom has also historically told its investors that it would become profitable at various points, like in the second half of 2013, as reported by Fortune’s Dan Primack. Early investors in Bloom Energy are likely not so enamored with the company’s slow progress on profitability.

However, beyond venture capital returns, Bloom has survived thus far, and has sold a substantial amount of its fuel cells. So what now?

Will the company end up being like solar panel maker SunPower, which took many years of hardship to become the energy generating powerhouse it is today? Or will Bloom eventually run out of runway, if its costs remain too high for too long?

Remember, the energy business is hard. SunPower even had to sell a major chunk of itself to oil giant Total when times were hard in 2011. Will Bloom end up as a division of a much larger energy company?

When Apple’s Campus 2 switches on its power sources next year, Bloom’s fuel cells will play an important role to help Apple create a “microgrid,” enabling Apple to disconnect from the greater power grid when needed. At the same time, solar panels and batteries will play an even bigger role than fuel cells for Apple’s Campus 2 microgrid.

But that Apple is a repeat customer for Bloom Energy is actually pretty important. Apple kicked the tires on Bloom Energy’s fuel cells at one of the largest fuel cell installations in the U.S. at 10 megawatts in North Carolina. Now the third largest company in the U.S., by revenue, has returned to buy more.