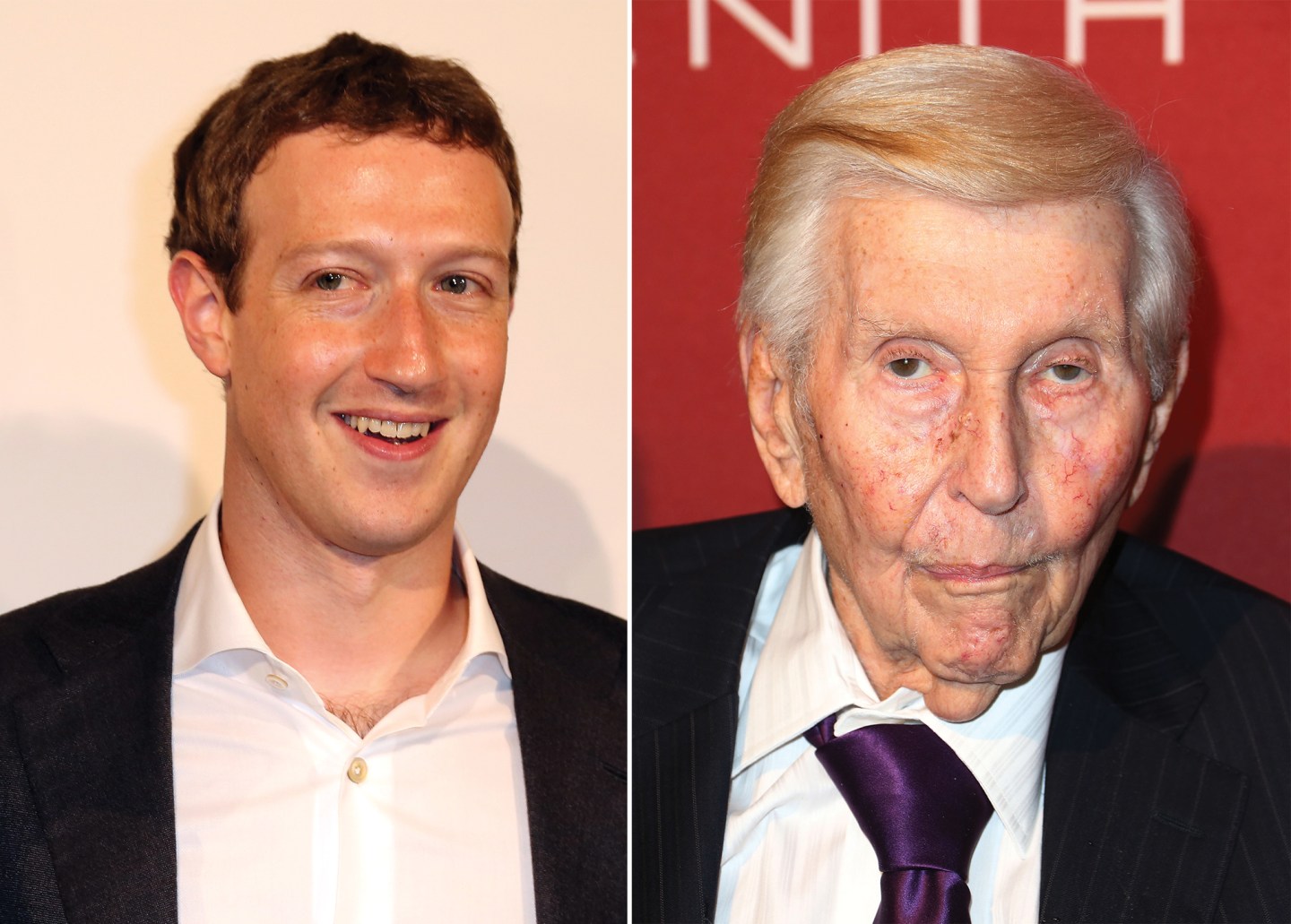

Media multi-billionaire and entrepreneur Sumner Redstone may want to take a cue from a much younger generation of business owners.

In contrast to Redstone, who’s locked in a pitched battle with his family and trustees over control of CBS and Viacom, the new generation of business owners is taking a more open approach to succession planning to ensure the smooth continuation of their companies when it’s time for them to retire or move on.

That’s one of the key takeaways from the most recent U.S. Trust survey on wealth and worth, released Monday.

Among the survey’s top findings: Younger business owners are raising money and planning to exit their businesses in ways that differ dramatically from older generations, even though many of their top concerns mirror those of the older set.

The findings may be important for any business trying to get a handle on the needs of a dynamic segment of entrepreneurs whose businesses are reshaping the economy. Some prominent—and wealthy—millennial entrepreneurs include Facebook founder Mark Zuckerberg, Stripe founders and brothers John and Patrick Collison, and Spotify founder Daniel Ek.

U.S. Trust, a private bank and unit of Bank of America, interviewed 242 high-net worth business owners with investable assets of $3 million or more, from late January to mid-February. Their responses are part of a larger annual survey of the wealthy conducted by the bank over the same time period.

Related: The Surprising Thing Strong Leaders Know That Weak Leaders Don’t

It turns out that nearly a quarter of millennials and 8% of so-called Generation X business owners have ever raised money via crowdfunding, according to the survey. By contrast, no Baby Boomers did so. Instead, older small-business owners tended to raise money using more traditional sources, including through personal or family savings, or bank loans.

And significantly more millennial business owners have benefited from angel and venture capital to build their businesses, compared to their older peers. Thirteen percent of younger business owners had access to venture funding, and 11% had angel financing, compared to 2% and 3%, respectively, of Baby Boom and older entrepreneurs. Generally speaking, Baby Boomers were born between 1946 and 1964, Gen Xers were born from the mid-sixties to the late 1970s, and millennials were born after 1982.

“We are clearly seeing…that there is an emerging trend of millennial entrepreneurs turning to VC and crowdsourcing to help finance their business,” Karen Reynolds Sharkey, national business owners strategy executive at U.S. Trust, said in an email.

Related: They Played High School Basketball Together. Now, They Lead Billion-Dollar Companies.

The generations also deal with succession planning in significantly different ways. While nearly two thirds of all business owners said they lack a formal exit strategy, 71% of Baby Boomers said they lack an exit, compared to 52 percent of younger business owners. The top reasons older business owners lacked a succession plan was fear of quitting, retiring, or dealing with end of life issues, according to the survey.

Younger entrepreneurs had widely different attitudes about their own success compared to older peers. A whopping 86% of younger business owners said their own innate talent led to their success, compared to 60% of older entrepreneurs. More than three quarters of the former also said they took advantage of unique opportunity, presented to them in the right time and place, compared to 60 percent of older owners. By contrast, 93% of older entrepreneurs attributed their success to good old-fashioned hard work and practice, compared to 81 percent of millennials and Gen Xers.

There were some similarities between the age groups, however. The top concern for millennial business owners, as for their older peers, is the outcome of the 2016 presidential elections, noted by three quarters of millennials and Gen Xers, and nearly 60% of Baby Boom and older business owners.

The various age groups also saw eye-to-eye on cyber attacks, personal income tax rates, and the cost of employee health care, and government regulations, which the majority of all business owners noted as top issues.