The Proshares Large Cap Core Plus Fund uses borrowed money—leverage—to load up on stocks recommended by its algorithm. Nearly 20% of its portfolio is devoted to shorting, using more leverage to bet that stocks will fall. It also invests in swaps, a type of derivative that its marketing materials acknowledge can be volatile.

These are sophisticated strategies, straight from a hedge fund playbook. But Core Plus is an exchange-traded fund, managing $450 million and growing fast. And its popularity points to a broader trend: the rise of the anything-but-simple ETF.

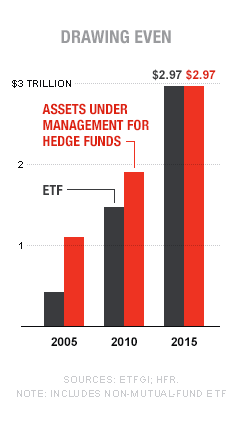

This summer saw a milestone. As of July 1, there was more money invested in ETFs than in hedge funds, though by a tiny margin. Some commentators hailed this as a sign that investors had embraced humbler, sound strategies. ETFs, after all, originated as a cheap way to buy diversified baskets of stocks that track common benchmarks.

But ETFs also attract traders who want to chase the hot money—and some of today’s fastest-growing funds cater to these clients’ esoteric needs. ETFs now track assets that most investors once had no access to, like commercial property and currency-hedged portfolios. Many use leverage and derivatives to amplify returns: Direxion Daily CSI 300 China A Share Bull 2x Shares, for example, offers two times the return of China’s CSI 300 index.

Ben Johnson, director of global ETF research at Morningstar, notes that 80% of ETF inflows still go into basic indexlike funds. But products that blur the line between ETFs and hedge funds also attract huge sums. There is now $400 billion in ETFs branded as “smart beta,” marketing-speak for funds that try to beat, rather than match, their benchmarks.

Mazin Jadallah is one of the new ETF wizards. His company, AlphaClone, uses an algorithm to mimic the picks of top hedge funds; its ETF has beaten the market since it launched in 2012. “Institutional investors can now get much of what they used to get from hedge funds from ETFs but at a much lower cost,” says Jadallah. With annual expenses of 0.95%, AlphaClone’s ETF is cheaper than most hedge funds—though it’s roughly 10 times as expensive as basic ETFs from BlackRock (BLK) and Vanguard.

Prolonged market turmoil could expose how risky some ETFs are. The August tumble was exaggerated in a number of ETFs: Direxion’s CSI 300 ETF, for example, was down more than 70% at one point. And complex funds could create problems even for those who don’t own them. Regulators have long worried that big bets by hedge funds could make markets riskier. ETFs now raise similar concerns. Some critics have warned that ETFs that focus on hard-to-trade assets like high-yield debt and bank loans could create a systemic crisis if investors try to sell en masse.

The good news: Since the first ETFs started trading, mutual fund investing has become far cheaper. Including ETFs, the average fund now charges 0.6% a year, down from around 1% in 1993. But the idea that ETFs would make markets simpler or less risky overall remains wishful thinking.

A version of this article appears in the September 15, 2015 issue of Fortune magazine with the headline “Hedge funds in disguise.”