“There was no apparent news item in the afternoon indicative of anything dramatic for the company,” wrote Barrons’ Tiernan Ray Friday referring to Apple’s precipitous close. “Options expiration could have something to do with it, perhaps.”

There’s no “perhaps” about it. The last 60 minutes of the third Friday in March is what traders call a quadruple witching hour, when four different kinds of trading instruments expire simultaneously: stock index futures, stock index options, stock options and single stock futures.

It’s a moment when billions of dollars in high-roller bets — bets that the stock will close above or below certain pre-set “strike prices” — come due at all at once.

For high-frequency trading desks — and the algorithms that run them — it’s like the Fourth of July four times a year.

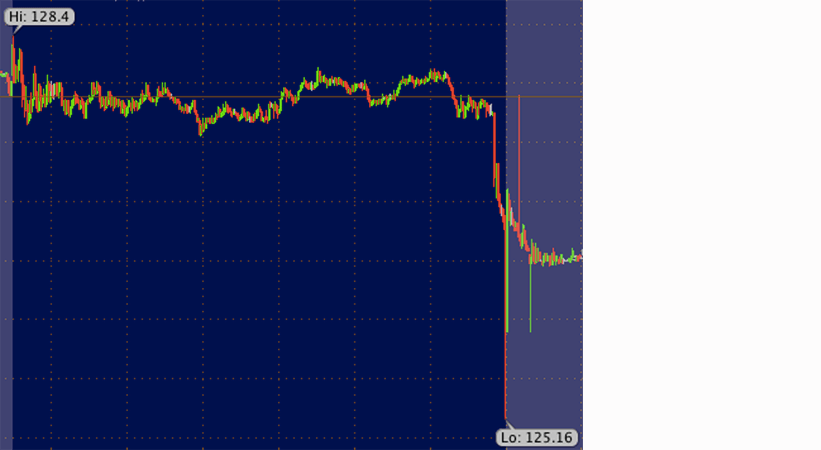

The fireworks hit for Apple on Friday in the last 60 seconds, when 13.5 million shares traded hands and the underlying stock fell off a cliff.

But the real action, says Global Equities Research’s Trip Chowdhry, was in those expiring options, the Puts purchased as a bet that the stock would fall and the Calls purchased as a bet that it would rise.

Options have long had a oversized effect on Apple, the hedge funds’ — and their algos’ — favorite trading vehicle. But this time was different. This was the first quadruple trading hour since Apple replaced AT&T in Dow Jones Industrial Average.

“The recent inclusion of Apple to the Dow index,” Chowdhry writes, “would have provided an excellent opportunity to short the Calls and long the Puts.”

In a note to clients Sunday, Chowdhry does the math. As result of Friday’s last-minute trading in Apple, he writes:

- All Call options at strike prices 126, 127 and 128 expiring this weekend totaling 210,347 contracts, equivalent of 21 million Apple shares, become worthless. This could have net a profit in the order of a hundred million to the Short Call positions.

- Further, Put options with Strike prices of 126, 127 and 128 totaling 160,729 contracts suddenly became worth $15.5 million from nothing.

.

“Such unusual stock price and volume action,” he writes, “has buttressed the loss of investor confidence in the Stock Market – isn’t the Stock Market Rigged?”

I’ve seen Chowdhry make some pretty wrong-headed calls on Apple in the past, but this time he might be right.

Follow Philip Elmer-DeWitt on Twitter at @philiped. Read his Apple (AAPL) coverage at fortune.com/ped or subscribe via his RSS feed.