The stock market is so sensitive these days, all it takes is a single word to send it rising or reeling.

This week, the market will be hanging on the words of Fed Chair Janet Yellen following a meeting of the Federal Open Market Committee on Tuesday and Wednesday. The FOMC will release a statement on Wednesday at 2 p.m. outlining its latest decision on interest rates, followed by a press conference at 2:30, where Yellen will answer questions from the press.

It’s not expected that the Fed will announce a change in policy on Wednesday, but market watchers will be paying close attention to the central bank’s language, specifically whether the FOMC decides to drop the word “patient” from its statements regarding an interest rate hike. In the past, the Fed has said it will be “patient” in its efforts to begin the process of “normalization”—meaning that it is in no rush to start raising rates steadily from the near-zero levels they are at right now.

All signs point to Yellen and company dropping “patient” from its announcement and replacing it with more flexible language that would open the door for a rate hike as soon as April, but more likely in June. If this does happen, expect the market to take it poorly and as a sign that we’ve started on the path toward permanently higher interest rates.

But even if we lose the word “patient,” as is expected, there are still a lot of unknowns going into the summer. Here are the three big questions that investors need to solve if they want to avoid being burned by the central bank:

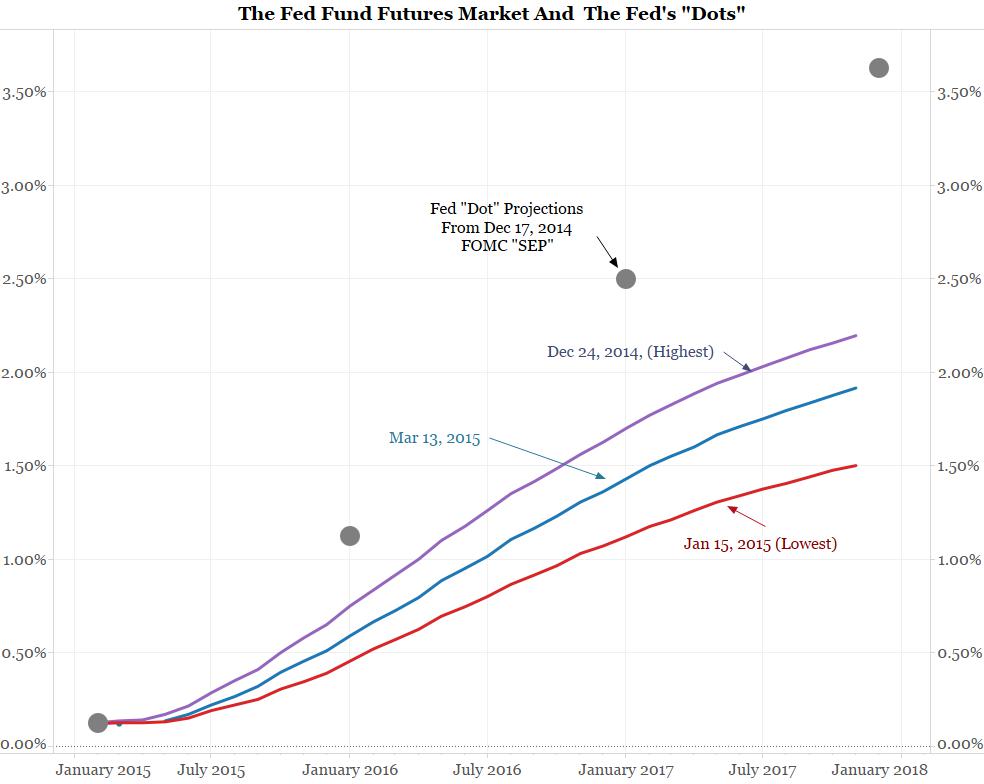

1. Does a June rate hike mean we’re headed for post-crisis Fed policy? According to a survey of Fed Governors released after December’s meetings, the Fed thinks rates are heading higher than the market does. Take this chart from Bianco Research, which shows the average FOMC member’s estimate of the future path of interest rates versus the market’s:

The FOMC members believe that once the central bank starts to raise rates, we’ll be on a conventional path towards rate normalization. But the market isn’t so sure. It’s probably looking at weak growth abroad, a stronger dollar, and mixed economic data (outside of strong jobs numbers) as reasons that the Fed won’t be able achieve policy normalization any time soon.

2. How dependent is the Fed on data after all? Janet Yellen has been at pains to convince the market that the Fed is not committed to any sort of timeline regarding rate hikes, and that the central bank’s decision is wholly dependent on real-time data. But a lot of the data Yellen should be looking at—from the current rate of inflation, to inflation expectations, to initial estimates of first quarter economic growth—show an economy that isn’t markedly different from what it was a year or two ago. Meanwhile, if the Fed does end up raising rates later this year, that would actually line up with what the central bank had been saying back in 2012, back before it had abandoned its timeline for data-dependent guidance. That’s leading some analysts to argue that the Fed is going to raise rates even if the data doesn’t back up the decision.

The one big difference, of course, is the employment situation. The past year has seen better job growth than at any point since the late 1990s. And if you control for the growth of the labor market, job creation has been stronger than at any point since the 1950s. This leads us to our final question:

3. How tight is the labor market? The only strong rationale for raising rates this summer is that job growth has been so strong and the unemployment rate has fallen so quickly that inflation is just around the corner. Proponents of raising rates argue that inflation is a lagging indicator that rears its head after it’s too late to do anything about preventing it, short of forcing the economy into recession.

At the same time, there are millions of Americans who have been unemployed for 27 weeks or longer. The so-called “long-term unemployed” make up more than 30% of the total unemployed, a far higher share than even during past recessions. Meanwhile, the labor force participation rate has decreased dramatically, showing that many Americans have left the labor force altogether.

This is a phenomenon that can’t be wholly explained by the aging of the labor force. If the Fed signals a rate increase in June, it’s basically saying that it has given up on these workers coming back to the labor force anytime soon.