The Federal Reserve is to launch a major review into whether it is too close to the banks it supervises, after a recent spate of criticism alleging that it is still in thrall to Wall Street’s giants.

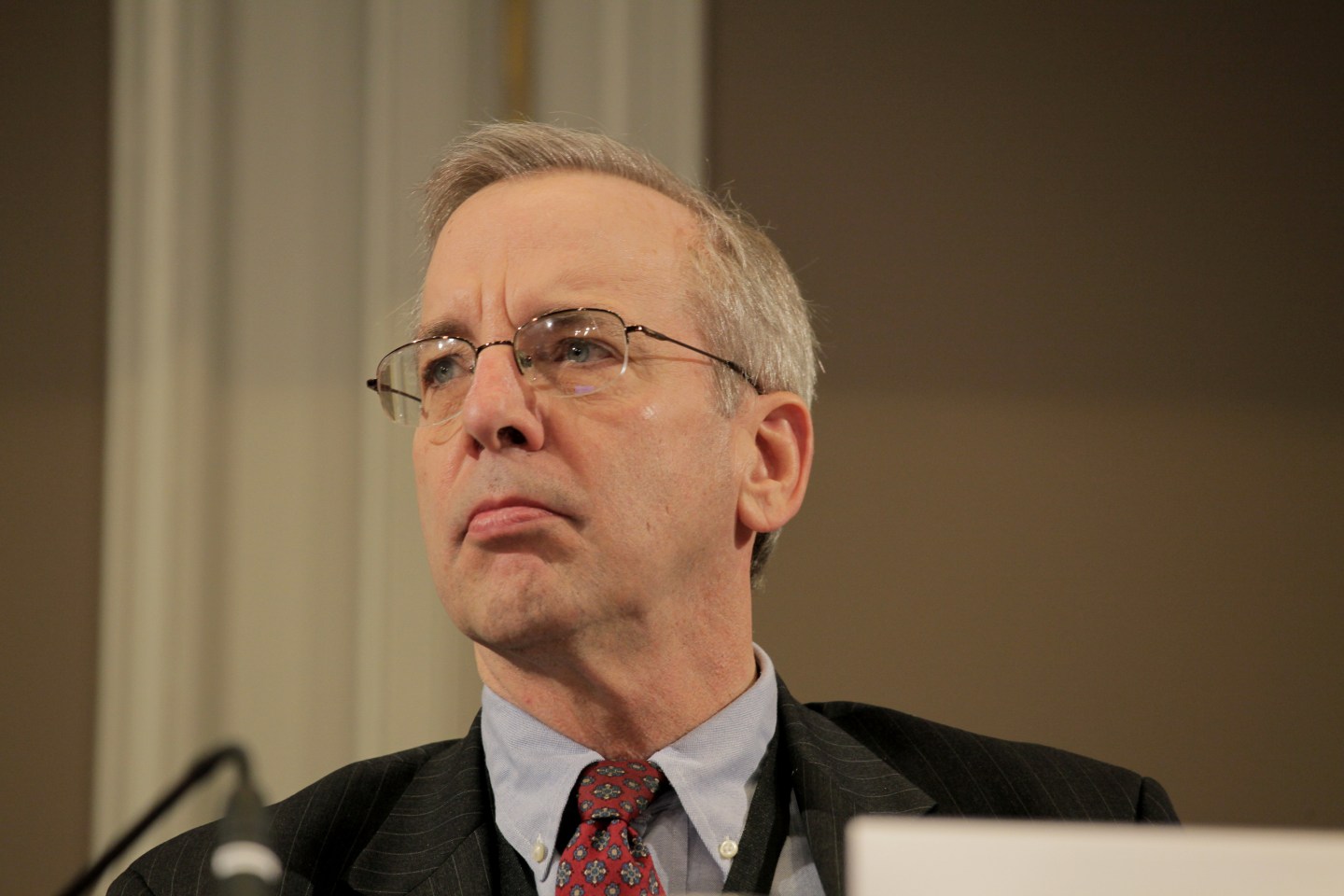

William Dudley, who heads the New York Fed and is consequently responsible for supervising most of the country’s largest banks, will tell a Senate committee later today that a new review into its supervisory practises will look specifically at the issue of ‘regulatory capture’–the idea that a supervisor tasked with upholding the public interest ends up under the influence of the companies it is supposed to be monitoring.

According to remarks prepared in advance and published on the NY Fed’s website, Dudley will say the review is expected to last “several months”.

He’ll be facing a tough audience. Senators Elizabeth Warren and Joe Manchin, two Democrats on the committee, wrote in the Wall Street Journal earlier this week that the Fed still seems “more worried about protecting Wall Street than protecting Main Street” and should appoint people with no links to Wall Street to the two vacant seats on its board.

Dudley’s announcement comes after a difficult few weeks for the Fed, sparked by a report by ProPublica which alleged senior staff had silenced concerns raised by junior colleagues supervising major institutions. Carmen Segarra, who had worked as a Fed examiner embedded at Goldman Sachs, had been fired in 2012 after refusing to retract a view that its internal policy on conflicts-of- interest was inadequate. Segarra later failed in an attempt to sue the New York Fed over her termination.

Separately, the Fed’s inspector-general said in October that it had missed opportunities to stop JP Morgan Chase & C0 ‘s (JPM) disastrous ‘London whale’ fiasco, which ended up costing the bank $6 billion.

Such cases have illustrated how conduct by individuals and institutions is at least as important to ensuring the safety of the financial system as raising the levels of capital that banks are required to hold.

Segarra’s case was controversial not least because she and many other examiners had been hired in the wake of an earlier report by retired Columbia University professor David Beim. Beim had concluded that the NY Fed was too eager to act by consensus, a culture that led to it softening down its criticisms and sanctions of banks that were breaking the rules.

“Building consensus can result in whittling down of issues or smoothing exam findings,” Beim had said. “Compromise often results in less forceful language and demands on the banks involved.”

Dudley’s testimony will spell out the many changes that the Fed has made to supervising banks since the 2008 crisis, which many argue was encouraged by lax oversight. These include sending more senior staff to the ‘front line’ at individual banks, and rotating examiners after three to five years to stop them getting too comfortable with the objects of their scrutiny.