With the world’s most valuable company — and the hedge funds’ favorite — set to report earnings after the markets close today, the eyes of Wall Street are once again on Apple.

The stock has been on a tear lately, up 26% since April 24 when the company reported stronger than expected iPhone sales, an aggressive buyback schedule and a 7-for-1 stock split.

It’s possible that bad news this afternoon could bring the momentum to a halt, but that seems increasingly unlikely.

With China Mobile (CHL) rolling out its high-speed network faster than expected, the new partnership with IBM (IBM) fresh on investors’ minds, and Apple dropping hints about how strong its fall lineup of products is going to be, it’s not going to be easy to harsh the stock’s vibe.

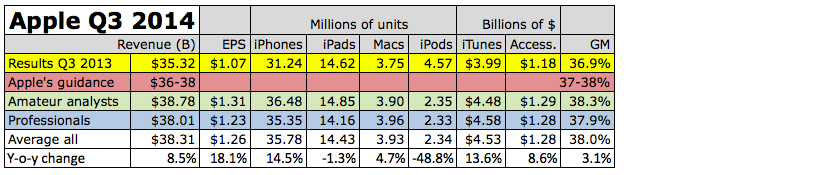

The 34 analysts polled by Fortune — 21 professionals and 13 amateurs — expect Apple to easily trump last year’s dismal June quarter. They’re calling, on average, for iPhone unit sales up 14.5%, revenues up 8.5% and earnings up 18.1% year over year.

The amateurs as usual are more bullish than the pros. They’re looking for a 23% EPS bump compared with the pros’ 15%. But even the pros concede that their estimates may be too conservative.

We’ll find out who was closest to the mark when the company reports its earnings today, roughly half an hour after the markets close. A conference call with analysts is scheduled to begin at 5 p.m. ET (2 p.m. PT).

We’ll be tuning in, and you can too. Link: Apple Financial Results Conference Call Q3 – 2014.

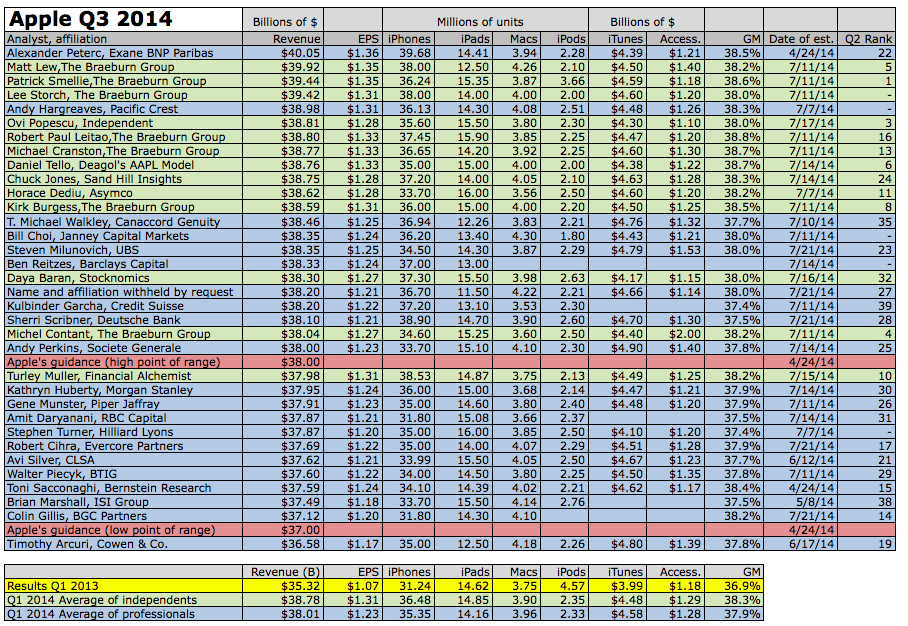

Below: The individual analyst’s estimates, with the pros in blue, the indies in green and Apple’s high and low guidance numbers in red. I’ll run my quarterly Earnings Smackdown after Tuesday’s earnings call and hope to post Q3’s ranking of best and worst analysts Wednesday morning.

Thanks one last time to Posts at Eventide‘s Robert Paul Leitao for pulling together the Braeburn Group numbers.

Follow Philip Elmer-DeWitt on Twitter at @philiped. Read his Apple (AAPL) coverage at fortune.com/ped or subscribe via his RSS feed.