The housing recovery that began in 2012 came on almost as quickly and forcefully as the real estate crash that preceded it.

The combination of low interest rates, investor interest, and good, old-fashioned confidence conspired to cause a rapid and vigorous turnaround in home prices after years of tumbling or stagnant home values. But a number of key metrics suggest that the party is over, and any future home price appreciation will be slow and steady from here on out. Here are four charts showing why the housing recovery has ended:

1. Price-to-rent ratios are near their long-term average. Price-to-rent ratios are an important housing indicator that can tell you whether the housing market is overvalued. During the housing bubble, this metric skyrocketed, as speculative fever led people to believe that housing prices would always rise. But the fact that rent rates didn’t rise with purchase prices should have been a warning that the underlying demand for shelter hadn’t increased as much as the demand for owning property as an asset. As you can see, price-to-rent ratios have snuck up above their historical averages, meaning that home values are already a little pricey relative to rents in many markets.

2. Homeownership rates are also near their long-term average. In the decades leading up to the housing bubble, politicians pushed policies that would increase the homeownership rate. The theory was that homeownership gave people a vested interest in the economy and in their neighborhoods, and that would lead to greater prosperity. But giving out credit to those who didn’t have the wherewithal to afford a home was one factor that led to the failure of the subprime mortgage market. It’s likely, now that policy makers are more aware of the dangers of pushing homeownership, that those rates will remain in the 64% or 65% historical average.

3. Ratio of housing wealth to GDP has normalized. As any resident of a big city can tell you, the value of real estate is tied to the strength of the surrounding economy. The stronger the economy, the more valuable the real estate will be. The chart below shows that for the past 30 years, the value of housing wealth has hovered around 1.4 times annual GDP, except for a huge deviation from that during the housing bubble.

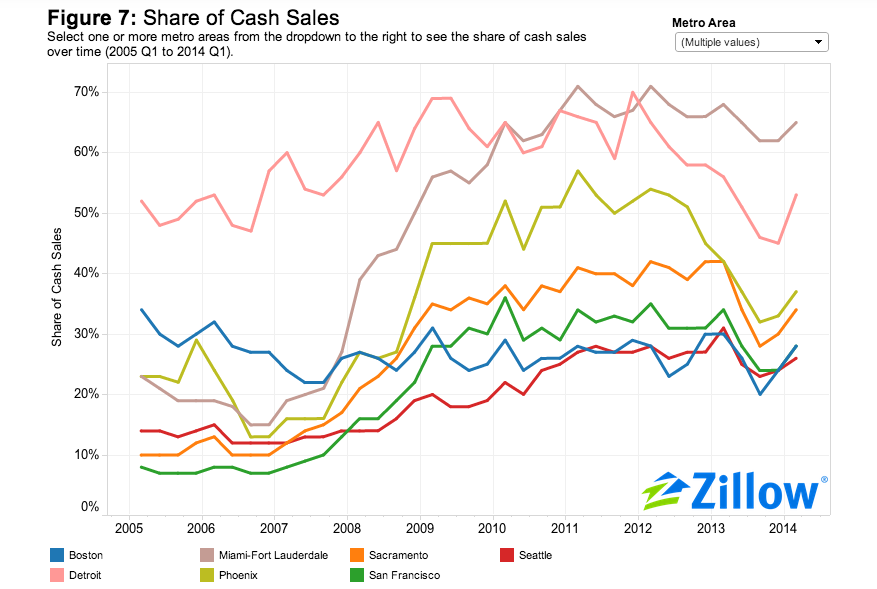

4. Paying in cash takes a tumble. Meanwhile, according to real estate data site Zillow, the share of buyers paying for homes in cash has fallen year-over-year in 102 of the 126 biggest metro areas. The fact that the number of cash buyers is declining shows that investors no longer believe that buying residential real estate will continue to provide big returns.

In the wake of the housing bubble, we should be suspect of trends in the real estate market that deviate greatly from historical norms, and if they do, it is cause for worry more than celebration. So, while home prices will continue to rise at a slow and steady pace, the days of year-over-year double digit price gains are likely over.