GoDaddy Group, an Internet hosting company and domain registrar with a reputation for raunchy ads, today filed for an initial public offering, three years after being acquired by private equity firms for $2.25 billion.

The Scottsdale, Ariz.-based company listed $100 million as the amount it plans to raise, but a source familiar with the situation says that is just a placeholder, as GoDaddy has not yet reached a final determination on offering amount.

Morgan Stanley (MS), J.P. Morgan (JPM) and Citigroup (C) are listed as lead underwriters. No ticker symbol nor exchange was listed.

GoDaddy reports a $200 million net loss on $1.13 in revenue for 2013, compared to a $279 million net loss on $979 million in revenue for 2012. Its 2014 also is tracking better than 2013, based on a $51 million net loss on $320 million in revenue for the first quarter.

The company also reports having just around $133 million in cash on its books, plus $1.08 billion of long-term debt.

GoDaddy previously filed for an IPO in 2006, before later abandoning the effort over apparent valuation concerns. At the time, founder and then-CEO Bob Parsons also wrote in a blog post that he had balked at SEC ‘quiet period’ regulations. The self-described “outspoken” executive called the quiet period “suffocating” and didn’t want to give up his weekly radio show, or other planned radio and TV appearances.

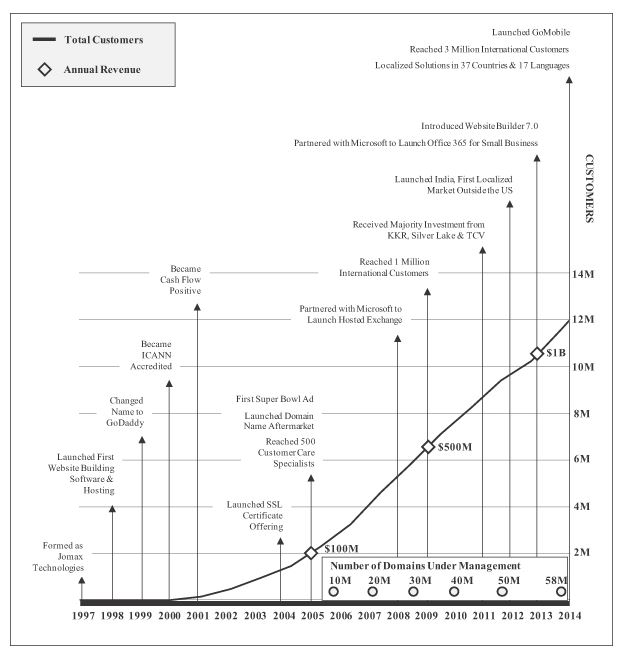

Here is a chart of the company’s history, from the IPO registration document:

Parsons moved out of the CEO role in late 2011, months after GoDaddy was sold for $2.25 billion to an investor group that included Kohlberg Kravis Roberts & Co. (KKR), Silver Lake Partners and Technology Crossover Ventures. Those firms already have gotten some return on their investment, with GoDaddy recently taking out a new $1.1 billion loan that was used, in part, to provide shareholders with a $350 million dividend.

According to its registration document, KKR and Silver Lake each own a 28% stake in GoDaddy and TCV holds 12.6%. Most of the remaining shares are held by company founder Bob Parsons.

GoDaddy will be required to pay the private equity firms an aggregate $25 million upon IPO, per the terms of a management and monitoring fee termination agreement.

With 57 million domains GoDaddy is the world’s largest domain name registrar. The company has been expanding over the past two years through a series of acquisitions, including the purchase of accounting app Outright and a deal to acquire aftermarket domain sales business Afternic. In October, the company also acquired domain hosting and website services company Media Temple, and recently opened operations in India.

Related Video: GoDaddy Files for IPO Amid Shifting Ad Strategy