THE LAST RECESSION coincided with one of history’s worst bear markets in stocks. Between its peak in October 2007 and its trough in March 2009, the S&P 500 tumbled 56%, and shareholders worldwide endured a staggering $11 trillion in lost market value.

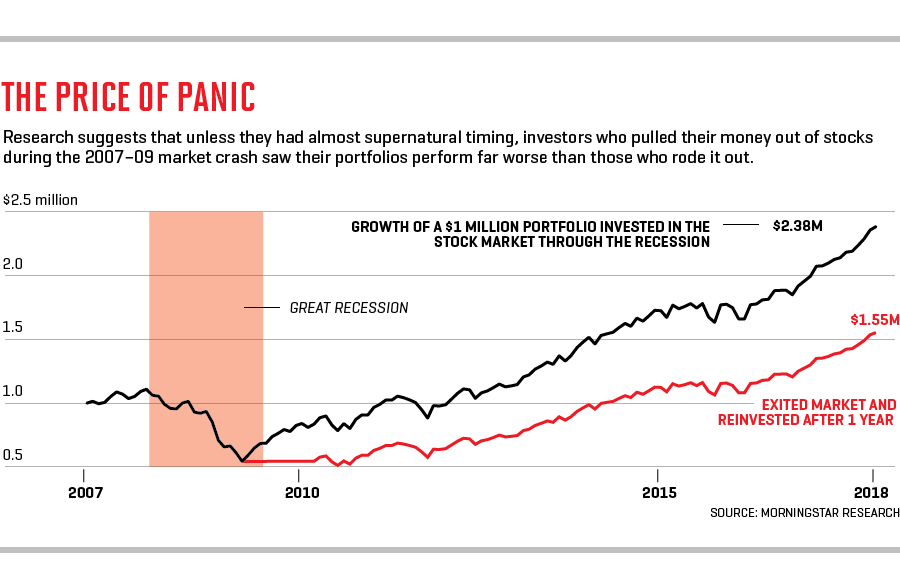

Still, as you mull the possibility of the next bear market, keep this in mind: Most investors who bailed out of stocks a decade ago regretted it later. Pulling money out of a declining market means having to decide when to jump back in to capitalize on a recovery. The number of investors who can correctly identify the beginnings and endings of bear markets can comfortably fit in a minivan, so most people flub this timing—which in turn is one big reason most individual investors underperform the markets.

A recent study from Morningstar frames the issue starkly. From 1997 through 2017, the S&P 500 returned 7.2% annually. But if you had been on the sidelines, for whatever reason, and missed the market’s 30 best days—a tiny fraction of the 5,217 trading days during that 21-year span—your stock portfolio would have lost 0.9% annually.

The bottom line: In a market that has registered three times as many up years as down years over the past century, staying invested usually pays off over time. Still, even optimists say there are adjustments worth making today that could ease the pain of a crash.

Recover Your Balance

MANY INVESTORS build portfolios around asset allocations based on their financial goals and risk tolerance—a target of, for example, 50% U.S. stocks, 25% international stocks, and 25% bonds. But because U.S. stocks have outperformed others by such big margins recently, those percentages are now out of whack for many, with American companies occupying more than their share of space. When the dollar peaks, consider selling some U.S. stocks and buying foreign ones. Even if an economic slowdown hurts markets globally, “you’ll get more bang for the buck,” says Stifel market strategist Barry Bannister.

It’s worth rebalancing within your U.S. portfolio too: The blistering performance of tech stocks, combined with significant price declines in other sectors, may mean you now own a little too much of Silicon Valley. Mike Wilson, chief U.S. equity strategist at Morgan Stanley, cites utilities, telecom, and consumer staples as industries whose stocks do well at this stage of the economic cycle.

Get Choosy About Debt

STEADILY RISING interest rates on nearly risk-free U.S. Treasuries “create serious competition for riskier securites,” says Isabelle Mateos y Lago, BlackRock’s chief multi-asset strategist. So it’s wise to reduce exposure to high-yield “junk” bonds, which pay higher interest because the issuing companies are on shakier footing, and to longer-duration bonds, whose prices can dip sharply when the economy is shaky. With even lowly money markets paying around 2%, short-term debt is “not a bad place to hang out,” says Wilson.

When To Play It Safer

THERE’S ONE GROUP of investors who should ignore the “don’t avoid stocks” rule. Kent Kramer, chief investment officer at Foster Group, recommends that people nearing retirement act soon and sell stocks, if necessary, to sock away one or two years’ worth of living expenses in money markets and short-term Treasuries, and an added five to 10 years’ worth in other bonds. You don’t want to be forced to sell equities when stock prices are falling, Kramer explains—that’s the bind that crushed many nest eggs during the Great Recession. That said, this advice doesn’t count as “market timing”: It’s a wise move even when the outlook is rosy.

—With reporting by Lucinda Shen and Ryan Derousseau

A version of this article appears in the August 1, 2018 issue of Fortune with the headline “Where To Invest When The Party Ends.”