Equinox CEO Niki Leondakis sits with her eyes closed, breathing deeply, hands folded together. She bows to the teacher: Namaste. Clad head-to-toe in Lululemon and enviably fit, Leondakis looks like any other gym-goer in the crowded yoga class in downtown Manhattan. There’s no reason to suspect—and indeed no one around her does—that moments ago she was sitting in the boardroom upstairs, discussing the future of the company that operates this gym, whose industry teeters on the brink of technological disruption.

Leondakis hasn’t been Equinox CEO for very long. She took on the role a year ago after spending three decades in the hotel business, most recently as chief of Two Roads Hospitality, a boutique hotel chain based in Colorado. (Harvey Spevak previously led Equinox before ascending to executive chairman of its parent company, which now includes SoulCycle, Pure Yoga, and Blink Fitness.) In one sense, her timing couldn’t be better. Leondakis took the reins at Equinox at a time of warp-speed growth for the fitness industry. Health club memberships in the U.S. grew by 26% from 2009 to 2016, according to data from the International Health, Racquet & Sportsclub Association (IHRSA), an industry trade group. In 2016 alone, 2 million Americans joined gyms, bringing the estimated number of regular gym-goers to 57.3 million. Equinox has 92 locations and is preparing to open at least eight more in 2018, as well as its first-ever hotel—fitness is a lifestyle, after all—in early 2019.

But those cheery statistics belie the fact that a fitness industry carve-out is underway, allowing high-touch luxury brands and low-touch value brands to flourish as middle-market clubs suffer. Equinox and upscale workout studio chains like Orangetheory, Flywheel, and Rumble are expanding aggressively as bare-bones gym chains like Planet Fitness, which starts at $10 a month, rack up new memberships. Meanwhile, Town Sports International, owner of mid-market clubs in the Northeast (New York Sports Clubs, et al.), just clawed its way out of the brink of bankruptcy with a market capitalization of about a quarter of what it was a decade ago.

People are working out more than ever—and at the high end, they want an exclusive experience. So companies are turning to tech. “Technology is a route to making people even more engaged in fitness,” explains Sarah Robb O’Hagan, CEO of cycling studio chain Flywheel and Equinox’s president from 2012 to 2016. Engagement of existing customers, of course, is key. According to IHRSA, club operators spend a median of $118.65 in sales and marketing costs for each new membership account. But existing members generate a median $793.40 in annual revenue.

One way to keep customers coming back is keeping them accountable. Several fitness companies have introduced systems that gather detailed data about their customers. In the case of cycling studios, that means tracking things like speed and calories, while clients at Orangetheory, a boutique gym that offers a high-intensity workout, receive monitors to track their heart rates. People “get hooked on” results, says Orangetheory CEO Dave Long.

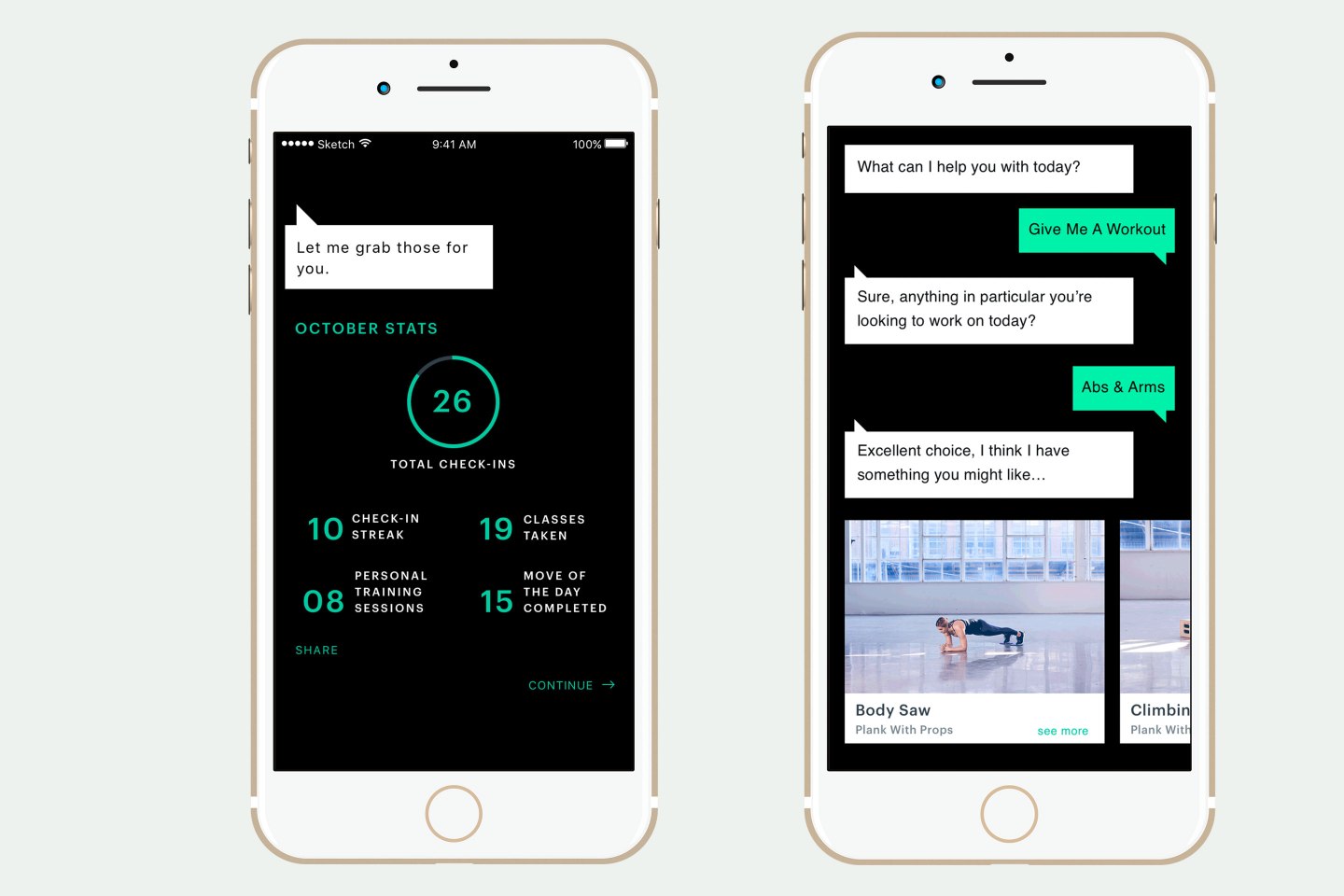

Technology is also helping fitness companies get into customers’ heads—sometimes literally. Flywheelers can “follow” each other’s performance in a Twitter-like fashion. And Equinox saw users of its “digital coach”—a bot embedded in its mobile app that “learns” from a customer’s activities and goals—check in 40% more than nonusers during a six-month pilot program. The chain has also given Halo Neuroscience headsets, which claim to neurologically “prime” the brain and help muscles adapt more quickly, to members of its Tier X personal training program.

Leondakis says she believes Equinox will soon enjoy a flourishing digital community. (Not unlike, say, the one created by Strava, a popular running and cycling app that markets itself as a social network for athletes.) Armed with the data from geolocating “beacons” installed in the chain’s facilities—there are 10 such locations to date—Equinox is able to know what kind of exerciser you are (Runner? Bench presser?) and nudge you toward certain activities.

Counterintuitively, fitness chains’ forays into digital services are helping them build analog communities. But who says you need a physical location at all? In 2012 Peloton, a pricey exercise bike company, pioneered a business model based on at-home workout experiences using live-streaming video. Competitors have since caught on. In recent months Flywheel and ClassPass launched similar platforms, attracted by profit margins that are magnitudes larger for a streamed class (which for Peloton might serve thousands of living rooms at a time) than a physical one with 50 people or fewer. Limited capital requirements, theoretically infinite scalability—it’s an attractive business to be in.

Leondakis isn’t particularly concerned about the influx of technology into the fitness business. People are still going to gyms, and it isn’t because of chatbots or fancy headphones. They come back because of the promise, as the Equinox CEO puts it, “that they can live their best lives.” As people spend more of those lives online, it only makes sense that fitness companies join them there.

A version of this article appears in the March 2018 issue of Fortune with the headline “Through Digital Pain, Gain.”

Note: This story was updated to clarify that Town Sports International never entered into bankruptcy despite serious financial troubles.