So much for those China chills. On Monday, bitcoin appeared to be shaking off investors’ anxiety about a cryptocurrency crackdown by the Chinese government, and posting big gains.

As of mid-morning Eastern Time, the price of bitcoin had soared over 10 percent in the last 24 hours and crossed above the $4,000 mark for the first time in nearly a week.

This is a big reversal of fortune after a terrible week for the digital currency in which the CEO of J.P. Morgan (JPM) slammed bitcoin as “a fraud” and the Chinese government ordered cryptocurrency exchanges to cease trading.

Get Data Sheet, Fortune’s technology newsletter.

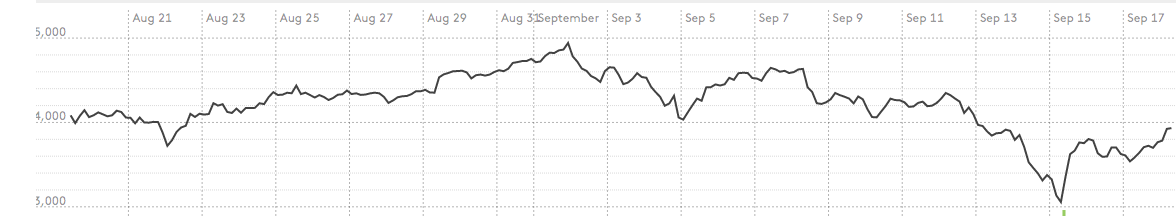

The spate of bad news led the price of bitcoin to nosedive to near the $3,000 mark—a nearly 40% drop from early September when it briefly crossed into $5,000 territory.

Here’s what the recent ride has looked like, according to data from the Winkelvoss index, which averages the price of several bitcoin exchanges:

It’s hard to say for sure what explains bitcoin’s latest resurgence but the best guess may be an underlying confidence in the crypto currency’s resiliency. While a crackdown by China might have once seemed to be an existential threat, it appears traders are for now betting that bitcoin will survive this as it has so many previous perils:

The harder nation states crack down, the more coins smart money will buy. pic.twitter.com/QDZvDk9jT8

— Jameson Lopp (@lopp) September 18, 2017

Others pointed to a recent analysis that supports a popular narrative that bitcoin has become a permanent asset class in its own right, one that will jockey with precious metals and may even become a reserve currency for central banks:

https://twitter.com/jerrybrito/status/909781585121218560

This optimism may be well-founded. Nonetheless, bitcoin still has a ways to recover from last week’s smackdown—despite the recent rally, the currency is still around 20% below its recent highs. (P.S. If you’re bearish on the whole thing: here’s our handy guide to shorting bitcoin).

This is part of Fortune’s new initiative, The Ledger, a trusted news source at the intersection of tech and finance. For more on The Ledger, click here.