The idea bounces around in the head of just about every homeowner, or at least every homeowner over 50: If I fall short on my retirement savings, maybe my home equity can help pay my bills. But a Wharton-professor-turned-mortgage-consultant is now putting a more upbeat spin on that idea: If you play your cards right, your house could produce a bigger retirement income than a lot of other investment alternatives, with a federal guarantee behind it, to boot.

The strategy, described recently by Jack Guttentag, who blogs as The Mortgage Professor, involves the federally insured reverse mortgages known as HECMs. (The acronym stands for Home Equity Conversion Mortgage.) His argument, in a nutshell: Take out a HECM as soon as you’re eligible, at age 62, and then let it earn interest so you can milk it for cash a couple of decades down the road.

Reverse mortgages let older homeowners tap their home equity for a line of credit to pay living expenses. When the homeowner dies, moves or sells the house, the balance of the outstanding loan is due to the bank. Reverse mortgages have a slightly tainted reputation in the retirement-savings world, for various reasons: Financial planners often think of them as a last resort for people with no other resources; origination fees can be high; and high-profile fraud cases involving lenders in the 1990s and 2000s made consumers justifiably skittish about them. As a result, since 1990, only about 1 million HECMs have been issued, according to the Department of Housing and Urban Development, with almost half of those originating between 2007 and 2011, when the financial crisis hammered Americans’ retirement savings.

(Click here for more articles from Time Inc.’s “Looking Forward” series.)

Guttentag’s strategic take focuses on two quirks of the federal rules governing HECMs. One is that the amount you can borrow is indexed to your age—so the earlier you take one, the bigger the line of credit you can set up. The other is that if a homeowner opens a HECM credit line, but doesn’t use it right away, it can earn interest over time, at the prevailing mortgage rate plus 1.25%. That’s much more interest than a saver would earn from, say, Treasuries—and the rate rises whenever the Federal Reserve raises rates.

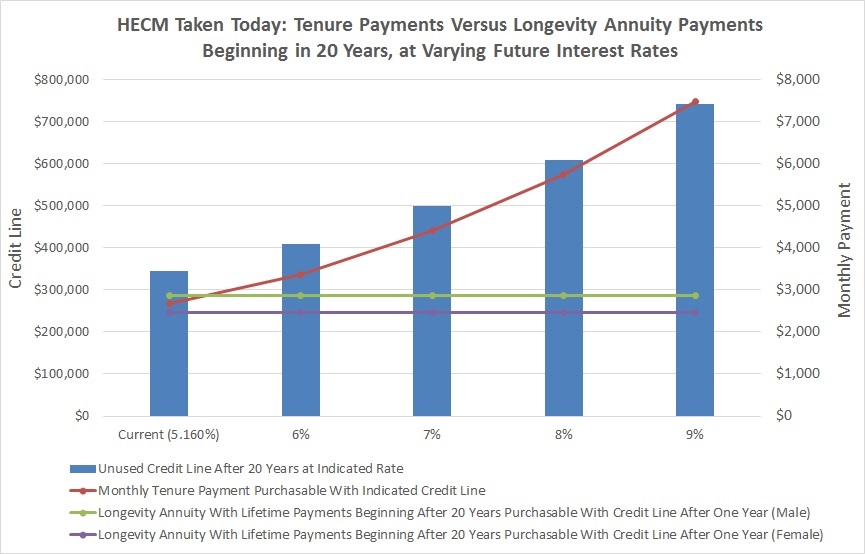

Hence Guttentag’s advice: Take out a HECM as soon as you’re eligible, at age 62, and hold off using it for as long as you can. Fifteen or twenty years down the road, when homeowners are more likely to have depleted their savings, they can convert the HECM credit line into a so-called tenure payment. And thanks to the compounded interest, he argues, that payment is likely to be much larger than what they would have gotten by putting a comparable amount of cash into an annuity–a common strategy among income-seeking retirees. Guttentag lays out some hypothetical scenarios in the chart below:

There are, of course, a bajillion caveats. When HECM borrowers leave their homes (to move into a nursing home, for example), they can no longer draw on their credit lines or tenure payments. You have to have a substantial chunk of your mortgage paid off before you can qualify for a HECM. And people in truly dire straits may not be able to qualify for them in the first place. (You can find out more about reverse mortgages in this article by our colleagues at Money.) But for other retirees, an approach like Guttentag’s could turn reverse mortgages into more of a cool-headed strategy and less of a Hail Mary pass.