Danaher (DHR) said on Tuesday it would buy molecular diagnostics company Cepheid in a deal valued at $4 billion, including debt, to strengthen its diagnostics business.

Danaher will pay $53 per share in cash, a premium of 54% to Cepheid’s close of $34.42 on Friday.

Danaher, which develops technology for the dental, life sciences, diagnostics, and environmental industries, said the addition of Cepheid would improve operational efficiencies and expand margins in its $5 billion diagnostics business.

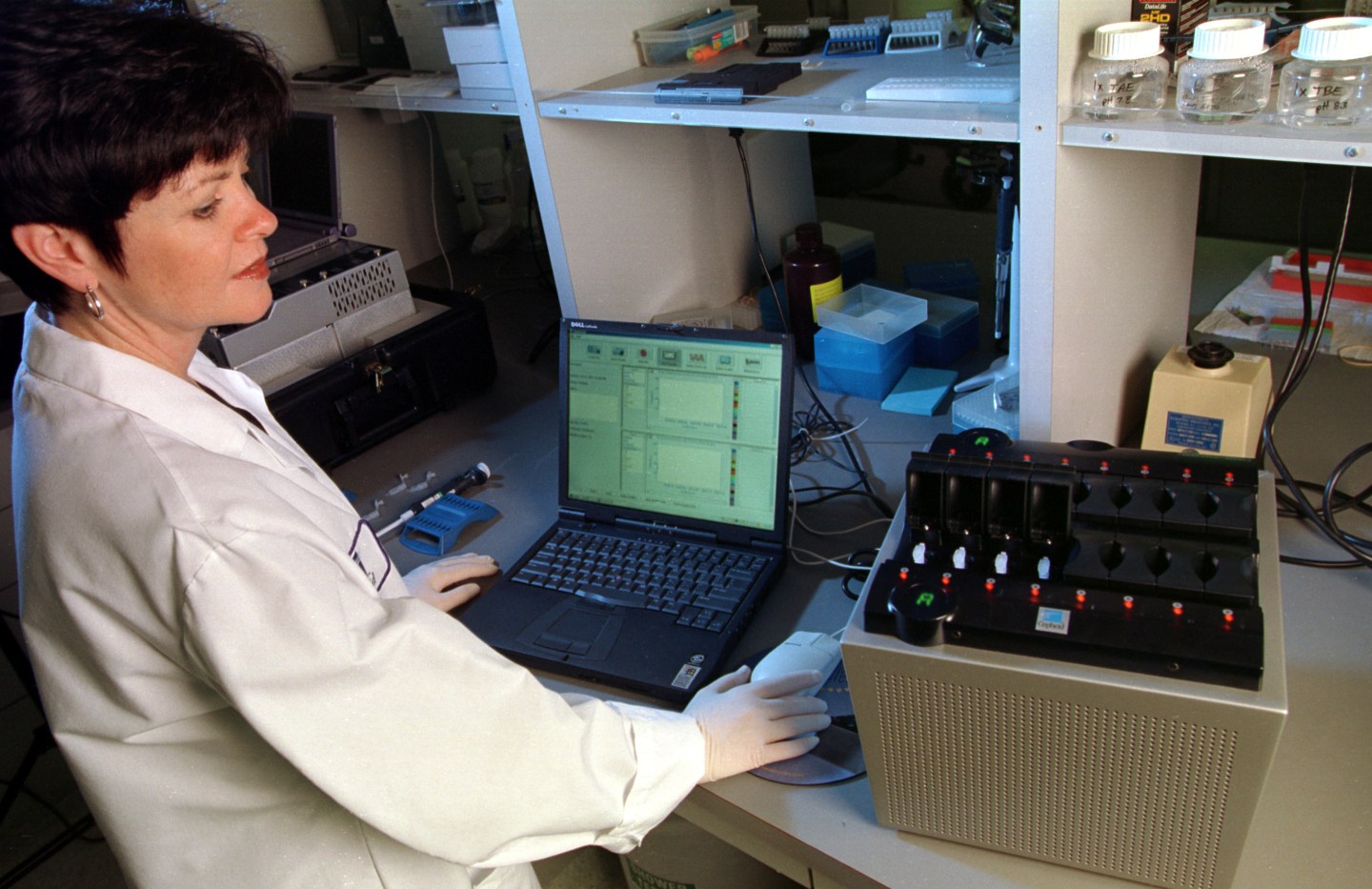

Sunnyvale, Calif.-based Cepheid develops molecular systems and tests for institutions to perform genetic testing for organisms and genetic diseases.

The company’s GeneXpert systems enable genetic testing and provide test results for critical infectious disease, sexual health and virology, among other clinical applications.

Cepheid had revenue of $539 million last year, and is expecting $618 million to $635 million in 2016.

Washington, D.C.-based Danaher, which traces its origins to the Celtic word meaning “swift flowing,” has acquired more than 400 companies since 1984.

Danaher said it expected the Cepheid acquisition to add about 5 cents to adjusted earnings per share in the first full year after the close of the deal, likely in the fourth quarter.

The equity value of the deal is $3.86 billion, based on 72.9 million outstanding Cepheid shares as of June 30.

Fenwick & West is Cepheid’s legal adviser, and Goldman Sachs (GS)its financial adviser.

Cepheid’s stock was up 52.5% at $52.50 in premarket trading, just shy of the $53 offer price.