Here we go again. After a long stretch in which the price of bitcoin held stable, the world’s most famous digital currency is on the move again—and this time it’s heading straight up.

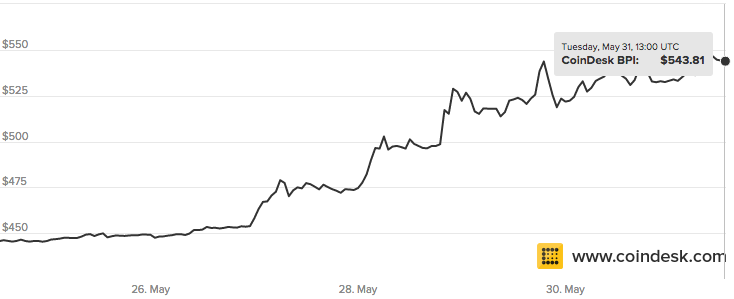

On Tuesday, bitcoin was nosing towards $550 per unit, which is even higher than August 2014, when bitcoin prices reached almost $533. The recent move also ends a six-month period of relative tranquility in which prices mostly hovered between $350 and $450.

https://twitter.com/twobitidiot/status/737109090934095872

It’s also a remarkable improvement from a year ago when the currency was in the gutter. On June 1, 2015, one could buy a bitcoin for $226. To get the flavor the recent uptick, here is a screenshot from Coindesk’s price index, showing prices in the last week:

So what’s behind the recent surge? It’s hard to say for certain since the workings of bitcoin are often inscrutable to outsiders, while those who are in the know typically have an agenda to push the price up or down. That said, here are three explanations for the current price jump.

Reason 1: Mining bitcoin is about to get more expensive

Recall that bitcoin is “mined” by people with specialized computers that solve cryptographic puzzles. (This process also serves to provide a record of bitcoin transactions.) In return for solving the puzzle, the miners receive 25 bitcoins.

The nature of bitcoin is deflationary, however, meaning that fewer bitcoins are mined as time goes on. Critically, at some point in the near future, the reward for miners will drop from 25 bitcoins to 12.5 bitcoins. (See this Bitcoin magazine article for more).

It’s unclear how this price cut, which will take place when bitcoin block 420,000 is mined (probably in the coming weeks), will affect the price of in the market. But several news reports claim the recent surge in the price may be driven in part by the impending stress on the mining supply.

Reason 2: Hype over a new digital currency is reigniting interest in bitcoin

Tech types have been buzzing about the emergence of Ethereum, a new blockchain technology that is winning big support from banks and venture capitalists. You can read a good explainer here, but the short version is that many think Ethereum is faster and more reliable than bitcoin, and could even supplant it as the pre-eminent digital currency.

The emergence of a rival currency might, of course, seem bad for bitcoin. A Quartz article asks, however, if a price surge for ethereum might instead serve to rub of on bitcoin. But so far, there is little evidence that the price of the two currencies is strongly correlated.

Get Data Sheet, Fortune’s technology newsletter.

Reason 3: China, China, China

This seems the most convincing explanation for the bitcoin surge. According to the Wall Street Journal:

Huobi and OKCoin, two Chinese exchanges, now collectively account for some 92% of global trading in bitcoin. The surge in bitcoin buying this weekend could be the latest sign of how Chinese investors are moving money between asset classes quickly in search of high returns.

Goings-on in China have driven bitcoin volatility in the past, and it stands to reason that this is what’s going on again.

Meanwhile, comments on Reddit and Twitter from those in the know not only point to a Chinese investor effect, but also raise the possibility that the effect won’t last. This will occur if the bitcoin buying just turns out to be a way-station on the way to other assets:

This.

My concern is that big chunk of BTC buys is a short-term exit from CNY before dumping it for USD/GBP later. pic.twitter.com/OL3UmuUSoZ

— Oleg Andreev (@oleganza) May 30, 2016

So is the current price surge a sign that virtual currency is catching on at last? Or is this just another example of bitcoin’s famous volatility in which greedy outsiders rush in to get rich, only to get burned when the price collapses again weeks or months later? We’ll see soon enough.