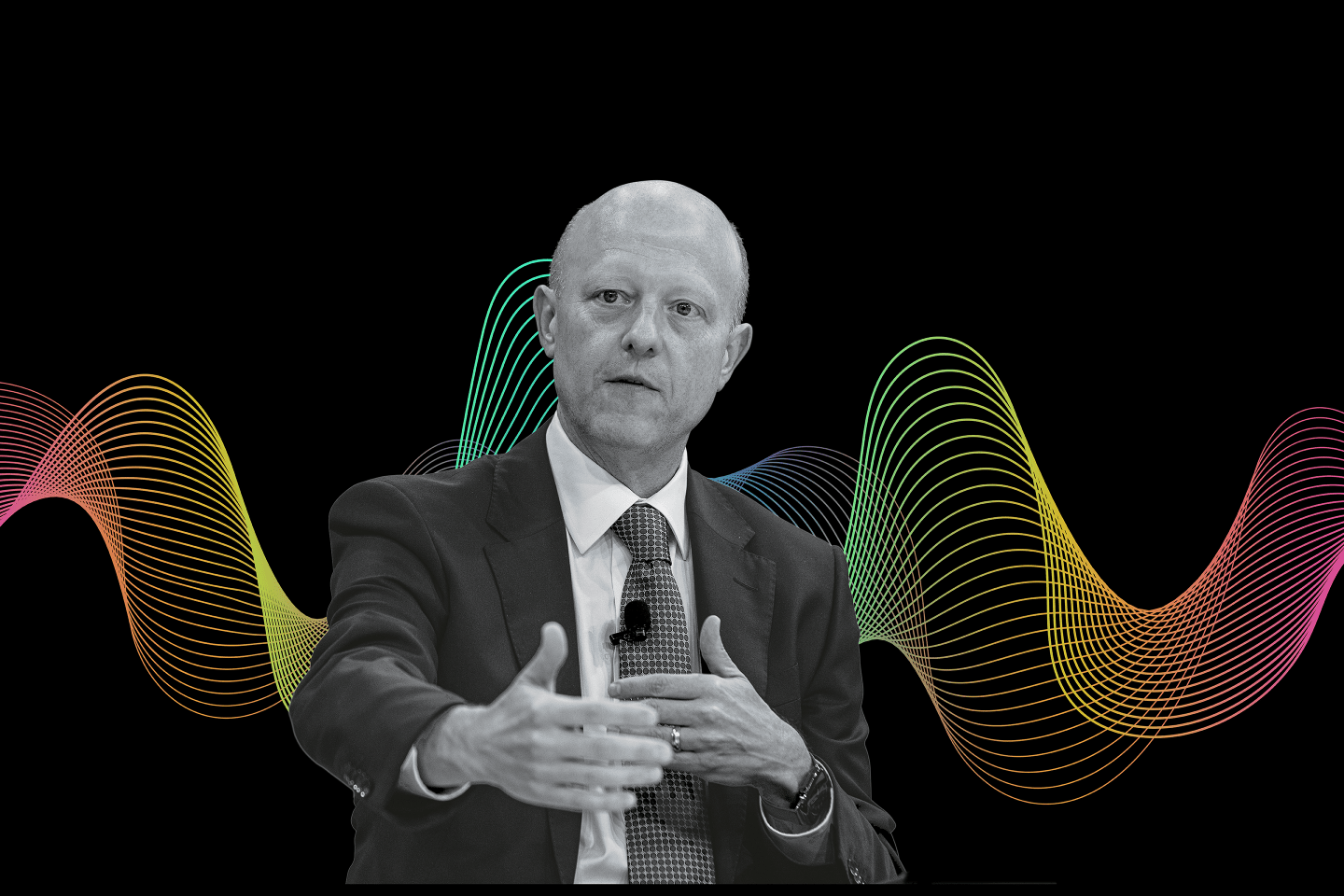

Jeffrey Gundlach, the widely followed investor who runs DoubleLine Capital, foresees a “global growth scare” between now and the end of the summer, triggered by a presidential nomination of Donald Trump.

“That is where I see the vulnerabilities,” Gundlach said in a telephone interview on Monday. Trump’s protectionist policies could mean negative global growth, Gundlach warned. “As he gets the nomination, the markets and investors are going to worry about it more. You will see a downgrading of global growth based on geopolitical risks. You must factor this into your risk-management.”

Trump has blamed currency devaluations around the world for hurting the U.S. economy and costing American jobs, and has called for a tougher U.S. stance on trade.

“We just sit back and do nothing,” Trump said earlier this month. “That’s getting to be very dangerous as far as I’m concerned.” A more effective economic move than devaluations would be charging a tax on products made abroad and sold in the United States, particularly those from China, Trump said.

Gundlach, who oversees $93 billion at Los Angeles-based DoubleLine Capital, said it isn’t premature to think about a Trump nomination. “You have to entertain the hypothetical.”

Phone calls and emails to Trump’s spokeswoman were not returned.

For its part, stock markets, which moved into positive territory after the U.S. Federal Reserve’s dovish move last week, will continue to track oil prices, Gundlach said, who was prescient in his call for $40 per barrel.

“I think oil will have a hard time moving up to $45,” Gundlach said. The risk-reward proposition is “so bad right now because you had this easy rally” in risk markets, Gundlach said. He added: “No way I would buy junk bonds at this level.”

Gundlach also criticized Fed officials for changing their stance on interest rates. “They’ve been flip-flopping like crazy over the past few months,” he said.

Just three days after the Fed held interest rates and cautioned “global economic and financial developments continue to pose risks,” Atlanta Fed President Dennis Lockhart said on Monday that the United States may be in line for an interest rate hike as soon as April given “sufficient momentum” in U.S. growth.

Gundlach said it’s become obvious Fed officials are seeking guidance from markets.

“If it is going to be about the markets, they should just come out and say, ‘If the S&P hits 2,100 we will tighten—and if it goes to 1,900 we will ease,” Gundlach said.