There are a lot of data points that one can use to get a sense of the venture capital markets, including the number of startup financings and the level of VC fundraising. They point to some widely known facts: Deal volume and valuations are up massively over the past seven years and non-VC money has entered the system.

But these data points are often lagging indicators. Perhaps a better barometer would be to gather data on VC perceptions in the market right now. Of course sentiment can swing wildly with new information, but I set out to take the pulse of the market as we enter 2016.

State of the Market

The full presentation & data can be downloaded on SlideShare.

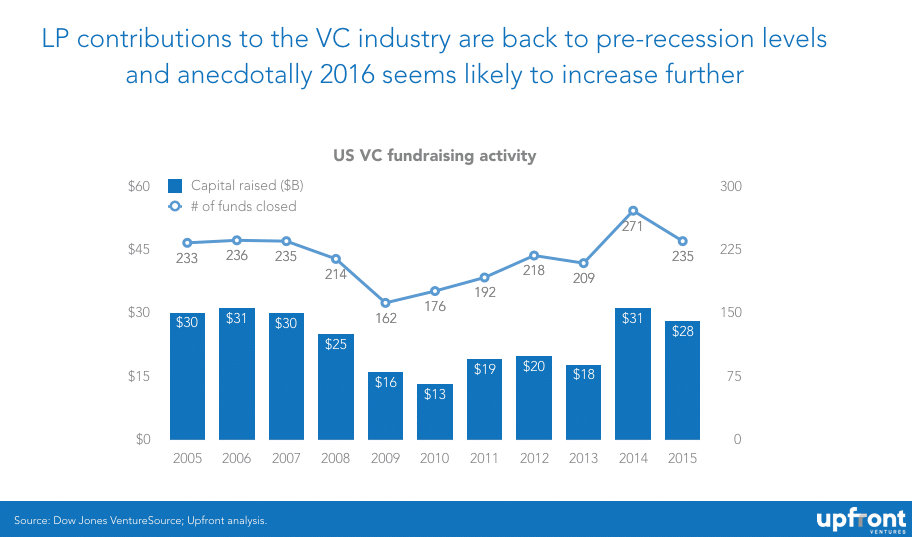

Let’s start with some basic data most people know. Limited partners (LPs) who invest in VC funds have continued to pour money into venture – with the market returning to pre-recession levels.

Don’t be fooled by the slight dip in 2015 ― the size of funds and the timing of deals in any year can skew the data set. LPs tell me that 2016 is one of their busiest calendars in years and, unless we see a unexpected downturn, expect the market size in 2016 to remain at current levels or increase.

How do I know? We surveyed 73 LP firms to get their views on the market. While the data from LPs makes it clear that they have concerns about the pace by which VC firms will invest, 82% said they expected to keep the same pace, with 8% suggesting they would increase investments. I would also point out that with corporates investing in more VC funds and Chinese money looking for stability, it’s entirely possible that brand new money enters the system.

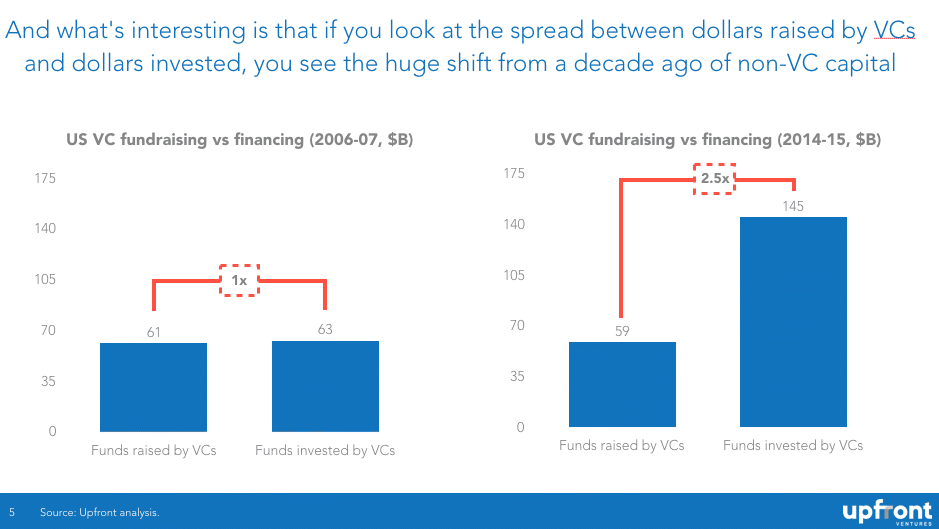

But LP dollars into VC isn’t really “the story” ― the biggest shift in the past decade is the amount of “non-VC” investment that has gone into venture-backed tech startups. Let’s start with the money slide:

Ten years ago there was about the same amount of money pouring into VC as found its way into startups. But, in the past two years, 2.5 times the dollars went into venture-backed startups as went the money that poured into VC. This isn’t an “emptying out of the VC coffers” but rather new participants pushing their chips onto the table with relatively less experience at doing so.

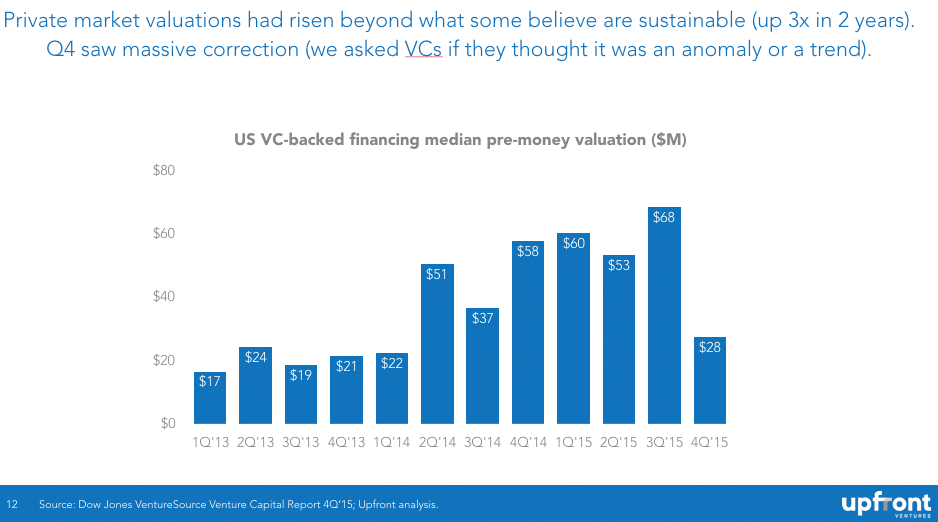

The result? Median pre-money valuations skyrocketed ― shooting up 3x in just three years as investors competed to christen imaginary animals with imaginary valuations. And then, seemingly all at once, the market felt constipated.

Sentiment of the Market

So what happened?

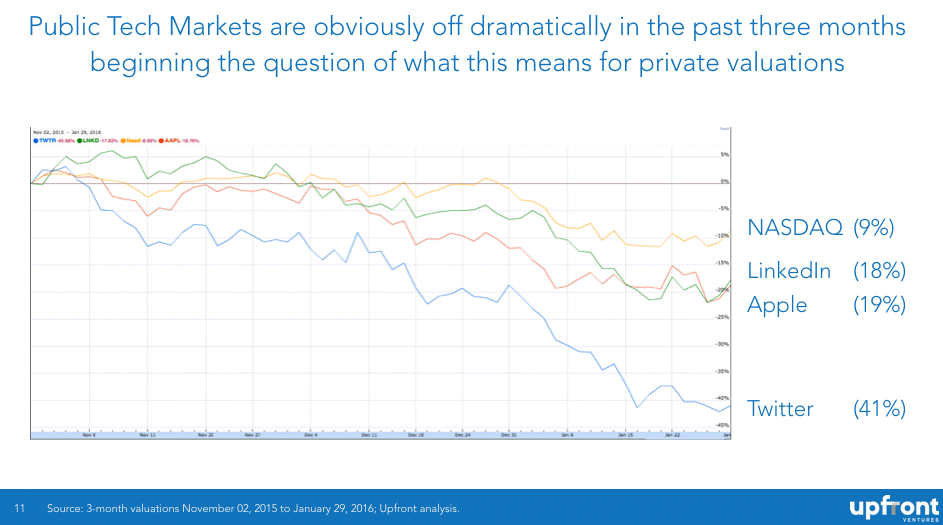

As I’ve argued for ages there has to be a correlation between public tech stock valuations and private market valuations. Of course this doesn’t mean private market valuations will follow the same P/E or P/S ratios, since the expectation is for much higher growth rates in private companies. But the correlation became completely untethered in the past 3 years.

So why the slow down all of a sudden? Leaving aside China, oil prices, Syrian refugees, a presidential election and all of the things that might feed into general market fear – this chart is telling

Frankly, it’s really hard to write checks at later-stage valuations when you know you’ll have to exit into the public markets or sell to a public-market company, and the stocks are declining precipitously.

But again, this may still be lagging indicators or the canary in the coal mine. When we surveyed more than 150 VC firms for what they were seeing in the market, the data were pretty clear.

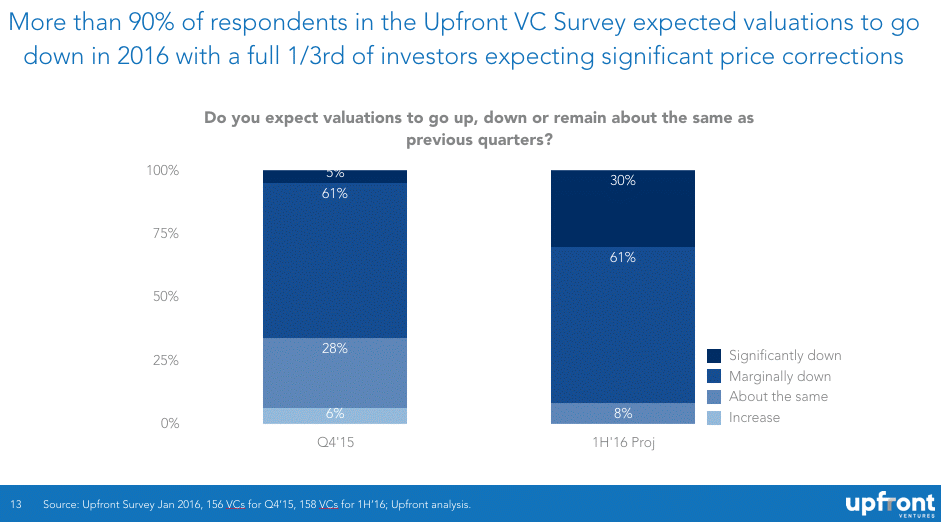

61% of VCs said valuations were “marginally down” in Q4 2015, but 91% expect price decreases in the next two quarters. The anecdotal sentiment I hear from early-stage investors trying to get companies financed is that they’re encouraging founders to be “flexible” or “realistic,” with the sentiment shifting from “scale as fast as you can” to “lower burn and make sure you have 18-24 months of cash.”

In fact, 62% of VCs surveyed ― across a wide variety of stages and geographies ― said their portfolios were starting to cut costs.

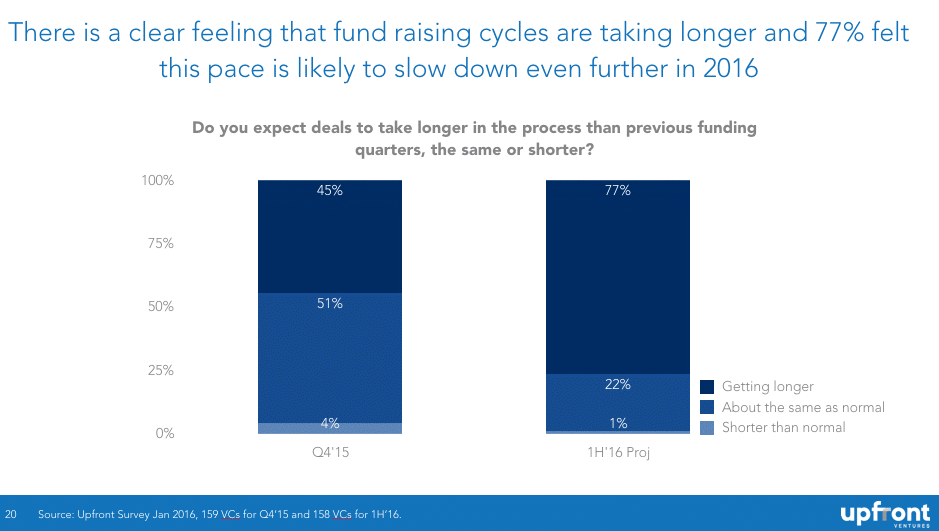

Also note that 45% of investors in Q4 2015 said it was taking longer to get deals funded. And the outlook for 2016 shows 77% of VCs expect it to take even longer in the months ahead.

Some Likely Conclusions

Well, we all know that Jon Snow probably isn’t really dead, but one thing you can count on …

I just don’t know whether it will be super cold or El Niño or something altogether different. But it’s certainly not sunny ahead.

What to expect in the next 24 months? It’s only a guess, but mine would be:

- Increased loss ratios

- Most flat rounds

- More down rounds

- More structured rounds

- Relatively harder to raise capital

- VCs marking-to-market showing some movements south

In short, a slight clearing out of some older, weaker branches washed out by the storm. And while we should never celebrate this, we all know the cycle of renewal clears the way for new seedlings, growth and a more realistic cohort of first-time entrepreneurs who know to be careful about every incremental dollar of spend.

Mark Suster (@msuster) is a partner with Los Angeles-based venture capital firm Upfront Ventures.