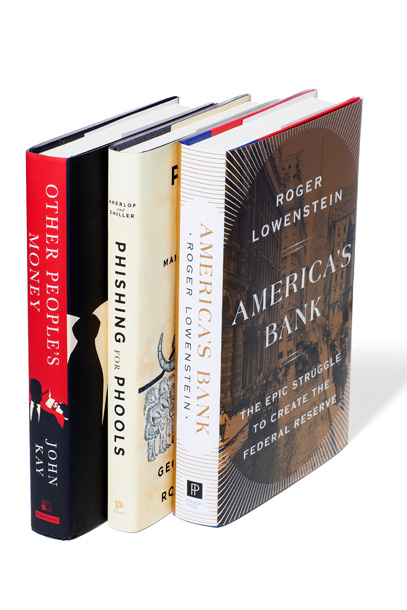

Other People’s Money

By John Kay

Kay doesn’t care what the markets think. “Any notion that traders have interesting insights into the formation of economic policy is quickly dispelled by the slightest contact with them,” the U.K. economist writes in a typically droll paragraph in his devastating new book about the world financial system. The problem, Kay says, is that the industry represents a huge segment of the world economy, and yet its actual contributions to it are impossible to discern, thanks to a mind-boggling complexity that fosters instability and too often ignores the actual customers (you know, those “other people”). The solution, he argues, is not increased regulation, already too voluminous, but a rethinking of the entire financial order. With a flair for metaphor, Kay’s occasionally academic prose is well worth the time. Wall Street, it’s safe to say, will not like it.

Phishing for Phools

By George A. Akerlof and Robert J. Shiller

The protagonist in the latest book from Nobel Prize-winning economists Akerlof and Shiller is a fundamentally good, endlessly engaging idea-generating machine. The character is also a treacherous and, at times, cruel huckster—the evidence of which grows with each passing page. This flawed hero is the free-market economy, and in this slim, readable volume, the authors make it come frighteningly alive. Building on rather traditional economic theory and behavioral finance, Akerlof and Shiller show how the same market forces that create opportunity also provide an opening (and incentive) for duplicity and fraud. And, it seems, most of us are only too willing to bite at the myriad schemes and bad deals being phished to us—from overhyped stocks to dangerous drugs to slippery politicians. No question, Phishing for Phools is a radical book. It may also be a radically important one.

America’s Bank: The Epic Struggle To Create the Federal Reserve

By Roger Lowenstein

We’re all Fed watchers today, nervously eyeing Janet Yellen & Co. as they manipulate interest rates to shepherd the economy. So it’s bracing to be reminded that before 1913 the U.S. didn’t have a Federal Reserve—or a unified banking system or even a uniform currency—and that consequently America was a global laggard, subject to constant economic panics that crippled businesses and farms. Depicting the effort to create a central bank, Fortune contributor Lowenstein tells a gripping tale with a trove of vivid characters and period details; you can almost see the handlebar mustaches and smell the oyster stuffing. And the broader cultural conflicts he describes—-distrust of centralized authority, tension between Main Street and Wall Street—are just as relevant now as they were in the era of Taft, Teddy, and Woodrow Wilson.

A version of this article appears in the October 1, 2015 issue of Fortune magazine.