As Carly Fiorina has moved up in the polls, so too has the debate about her business career.

Fiorina says that she took over Hewlett-Packard (HPQ) at a tough time. She says the acquisition of rival computer maker Compaq that she led saved HP from oblivion and that, over the same time period, she did better than rival executives at other companies. “I led Hewlett-Packard through a very tough time, the worst technology recession in 25 years,” Fiorina said last week during the Republican primary debate.

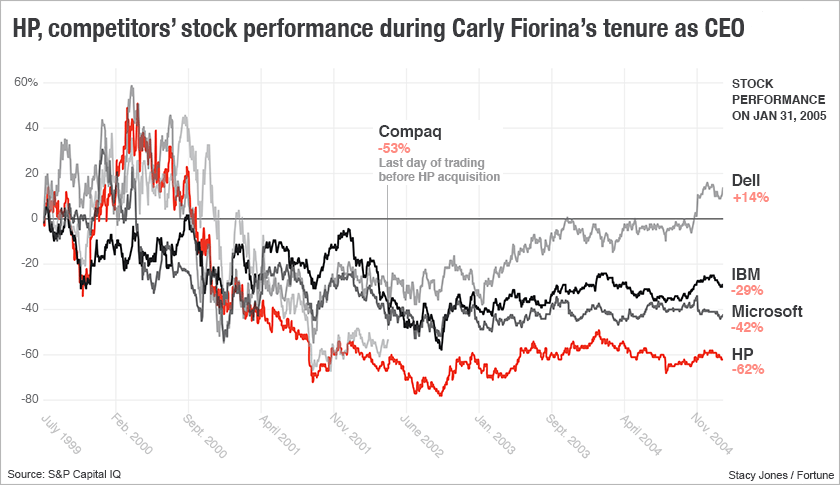

There’s no denying that. The question is whether Fiorina did the best job with what she was handed or whether she made matters worse. There are a number of ways to answer that question. At the time, the market gave Fiorina’s run as CEO a thumbs down. From right before she started as CEO of Hewlett-Packard in July 1999 to right before she left in February 2005, HP’s stock fell over 60%. That was a worse performance than any of its rivals.

Of course, HP may have been in worse shape than its rivals when Fiorina came in. What’s more, as Justin Fox at Bloomberg View points out, if you look at the five years after Fiorina left HP, shares of the company did really well. Surely, some of the credit of that has to go to Fiorina and her acquisition of Compaq, which at the time she left looked like a dud. Mark Hurd, HP’s next CEO, probably deserves some credit as well.

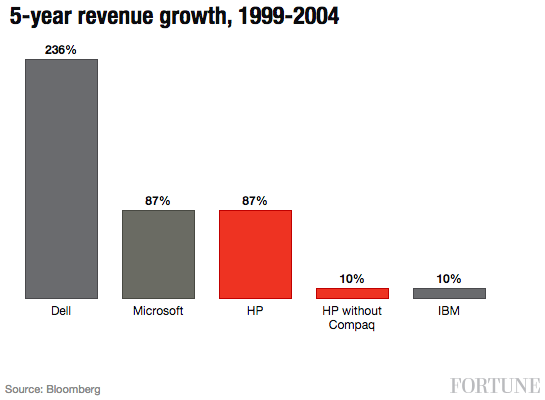

Fiorina has repeatedly used the fact that HP’s revenue doubled (it really only nearly doubled) as proof that she was an extremely successful CEO. But that revenue growth wasn’t actually all that remarkable compared to what her rivals were doing at the time. Microsoft’s revenue grew at a similar rate. And Dell’s far outpaced HP. What’s more, Fiorina is counting Compaq, a company HP acquired, as part of her sales growth record. Exclude that and HP’s organic sales growth under Fiorina is a paltry 10% over five years. Again, that matches IBM, which Fiorina seems to have viewed as a model for what she wanted HP to become. Perhaps she chose the wrong model.

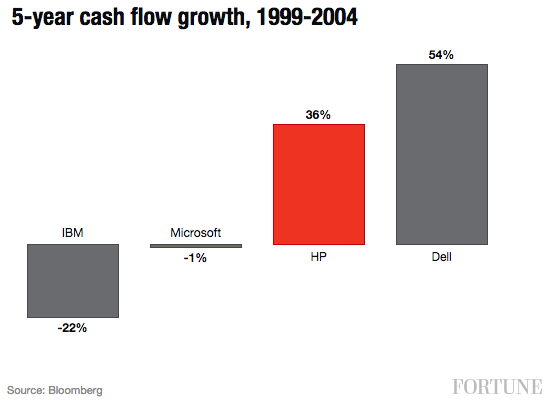

Fiorina says that HP’s cash flow quadrupled when she was CEO. That’s not quite right. True, HP did a lot better than its rivals in improving cash flow under Fiorina’s tenure. But even on that measure, she was well outpaced by Dell. No word on whether Michael Dell is considering running for president.

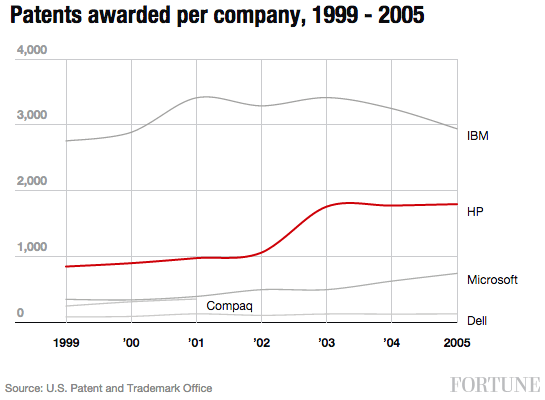

Fiorina has said that she made HP more innovative. And she has pointed to the number of patents filed by HP as proof. And voters likely desire a president who can help make the U.S. more innovative.

Again, her track record is mixed. When Fiorina took over as CEO, the number of patents HP was filing was significantly lower than IBM. By the time she had left, HP was filing nearly twice as many patents as when she began. But the doubling came in one big burst, and shortly after the company bought Compaq, and then leveled off. So again, that growth could be the result of the acquisition. The number of patents Microsoft was filing, on the other hand, continued to grow and, within a few years after Fiorina left, overtook HP. Microsoft now far out paces Hewlett-Packard on this front. And HP never rose to the level of IBM in terms of innovation. So, once again, it’s hard to know how much credit Fiorina deserves.

In the end, here’s the best assessment of Fiorina’s tenure at HP you can make based on the evidence: she wasn’t a horrible CEO, but she wasn’t a great one either.

Graphics in the story are by Stacy Jones.