No one can say for sure just how bad China’s economic situation has become, but analysts in the United States have been taking comfort in the fact that U.S. trade to China, and the Pacific Rim in general, constitutes a small sliver of U.S. GDP.

And while the emerging world makes up a much bigger share of the global economy than it did a generation ago, the U.S. economy is still the largest in the world. When capital flees riskier economies like Brazil or Turkey, the U.S. is where it will run to.

There’s one problem. These arguments ignore the fact that economists don’t agree on what, exactly, causes recessions. True, the Asian financial crisis of 1998 didn’t lead to slower growth in the U.S. But that doesn’t mean that a recession in the emerging world will fail to drag us down this time.

David Levy, economist and chairman of The Jerome Levy Forecasting Center, has been predicting that China would suffer an economic crisis and he believes that turmoil in emerging markets can take down the U.S. economy. Levy subscribes to what he calls “the profits perspective,” which examines global profits rather than country-specific GDP for indications of economic turmoil. How can global profits help predict recessions? Profits are the main factor that guides economic activity: when profits are high, businesses will invest and hire workers, and lenders will extend credit. When profits are low, the opposite occurs.

As it turns out, the largest contributor to global profits is net investment. When firms invest in capital equipment or when an individual invests in residential real estate, this is an act of wealth creation that does not require an immediate expense, in accounting terms. On a global scale, then, when investment is rising, we should also see profits rise and the global economy expand. But when we start to see investment stagnate or decline, we should expect profits to fall, putting recessionary conditions right around the corner.

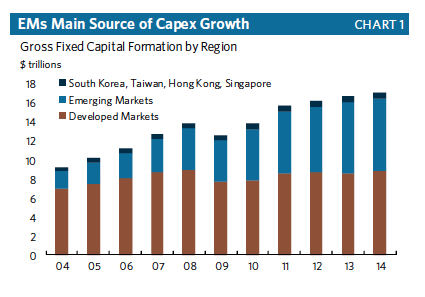

As you can see from the following chart, the emerging world is now the source of roughly half of the world’s capital expenditures, while investment in the developed world remains below its pre-crisis levels:

With formerly high-flying emerging economies like Brazil and Russia already in recession, and data out of China continuing to suggest that it is entering a significant slowdown, there’s plenty of reason to believe that the developing world will no longer be able to power global economic growth. As Levy writes:

[Emerging market] net investment has been the world economy’s greatest profit source in recent years—and now it is decelerating. EM investment in manufacturing, mining, and certain types of transportation has badly overshot utilization, creating serious overcapacity and associated financial strains . . .

[Developed market] investment isn’t providing much lift either. Cyclically, investment is mature in the United States; there is no great pent-up demand, no prohibitively high interest rates to be slashed, and no prospect that an economic acceleration will enhance business expectations overnight. The euro area might arguably have some pent-up demand after two recessions in seven years, but growth prospects remain severely limited, and euro banks remain largely zombies with little appetite for risk.

Viewed through the lens of global profits, then, it doesn’t matter if U.S. firms are economically dependent on exports to Asia. It matters much more where global profits will come from in an era of contracting investment.