China’s stock market rout hit a new phase over the weekend, as officials began acting on their convictions that algorithmic traders are responsible in part for the crash that has sent shares downward by 30% in the last month and a half after stocks rose by 140% in the preceding year.

On Monday, the Shanghai composite index fell by a relatively gentle 1%.

Citadel, the massive hedge fund and quantitative trading company controlled by Ken Griffin and advised by former Federal Reserve Board chairman Ben Bernanke, had one of its accounts suspended from trading by Chinese regulators, the Wall Street Journal reported.

The news comes two weeks after a high-ranking government official blamed foreign forces for torpedoing China stocks, invoking George Soros’s supposed role of shorting currencies in the Asian financial crisis of 1997 as proof that Westerners wreck havoc in Asian markets. The Citadel fund was one of 34 accounts frozen by regulators who are investigating whether algorithmic traders offer bids then retract them to influence prices– a process that has also come under scrutiny in the U.S. A spokesman for Citadel said, “We can confirm that while an account managed by Guosen Futures Ltd. on behalf of Citadel (Shanghai) Trading Ltd., has had its trading on the Shenzhen Exchange suspended, we continue to otherwise operate normally from our offices, and we continue to comply with all local laws and regulations.”

Analysts have viewed the investigation skeptically. A better explanation for the recent stock market decline is that leveraged traders have sold stocks to meet margin calls, causing panic and more selling.

Monday also brought more evidence that Chinese officials should be looking at home for explanations of stocks’ continued decline.

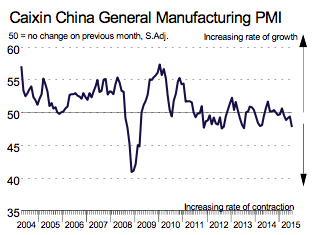

New manufacturing data shows that the Chinese economy is failing to recover after multiple interest rate cuts and fiscal spending programs. The Caixin China Manufacturing Purchasing Manager’s Index (formerly HSBC’s PMI) fell to 47.8, which indicates economic contraction. It’s worse than the flash reading that was released last week. Industrial output fell to the weakest level since November 2011. “The official PMI was also weaker than expected for the month of July, suggesting that the manufacturing sector may again be losing momentum,” wrote HSBC economists Julia Wang and Qu Hongbin today in Hong Kong.

What the PMI measure suggests is that the Chinese economy isn’t falling off a cliff, but it is not rebounding strongly, either, after months of supportive monetary and fiscal measures. The HSBC economists join a majority of analysts predicting more government support measures as a result of disappointing manufacturing data.

According to the National Bureau for Statistics, the economy grew 7% from a year earlier in the second quarter, in line with the government’s target for this year. Analysts have expressed doubt about the reliability of that estimate, given that a broad range of other indicators pointed to a sharper slowdown.