Warren Buffett has long been bullish on China, and its market. But, given the nation’s recent stock market tumbles, would he still be now?

Chinese stocks have been on a roller-coaster ride lately. Shares on China’s Shanghai exchange dropped roughly 10% on Monday and Tuesday. That comes after a 14% rebound since its 25% plunge in June and early July.

But volatility has never scared away Buffett. The billionaire investor and CEO of conglomerate Berkshire Hathaway (BRKA) often says that Wall Street incorrectly equates volatility with risk. If you plan on holding a stock for the long term, Buffett says, it doesn’t matter what it does along the way. The price of a stock will eventually reflect its true value, which is hopefully higher than what you paid to buy the shares.

What Buffett is really concerned about is not overpaying in the first place. About a decade-and-a-half ago, Buffett divulged what he said was his favorite metric for determining whether the stock market was overvalued or undervalued. He wrote about it for the first time in an article in Fortune in 1999. (And here’s an update.) Buffett said he likes to compare the total value of the stock market to the output of the economy, or GDP. It’s like a price-to-earnings ratio but for the economy instead of just one stock. Buffett said he likes to buy when stocks are trading at 70%-to-80% of economic output. Anything over 133% begins to look expensive.

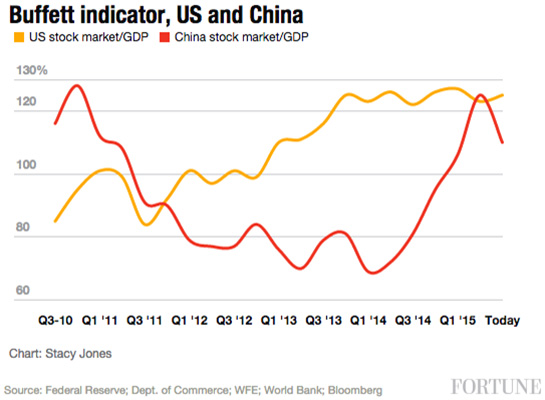

So, what does Buffett’s favorite market indicator say about Chinese stocks right now? It offers a surprisingly positive message, especially compared to what it is saying right now about the U.S. After China’s recent market drop, the total value of all Chinese stocks (I added up the value of shares on China’s two main exchanges, the Shanghai and the Shenzhen, as well as the Hong Kong’s Hang Seng market, where many mainland Chinese companies have long traded) to China’s GDP (plus Hong Kong’s) is 110%.

Many commentators have suggested that China’s market 140% rise in just a year-and-a-half (before the recent correction) was a bubble. But back in early 2014, China’s stock market was actually very cheap. At the end of March 2014, China’s total market value was just 69% of GDP. (That’s the lowest point for China in the chart above.) That’s below the territory that Buffett, who is known as a value investor, would usually says it’s time to buy.

China’s stock market value is higher now, but, the Buffett indicator suggests, perhaps not too high. The U.S. stock market trades at a value of 125% of America’s GDP. That means Chinese stocks are, at least relative to the U.S., a good buy.

There are, of course, some caveats. First of all, just because China’s stock market is cheaper than the U.S. stock market doesn’t mean Chinese shares are undervalued. Many people think the U.S. stock market is overvalued because the nation’s economic growth has been middling. China is growing fast, but it’s slowing. All of that comes into play when you are valuing a stock market.

[fortune-brightcove videoid=4348746198001]

Investors place a premium on reliability. Unlike Buffett, most investors actually don’t like volatility. So the U.S. stock market tends to trade above its GDP. Over the past five years, the U.S. stock market has traded at nearly 110% of GDP. China has traded at just over 90% of GDP. Go back even further, and it’s likely that China’s market has averaged much lower than that. So, compared to China’s market, America’s market always looks expensive.

Still, the Buffett indicator suggests that the people saying China’s stock market is still way overvalued are wrong. And Buffett’s favorite indicator matches up nicely to what he said about China back in May at Berkshire’s annual shareholder meeting, when the market was higher.

The investor predicted the Chinese stock market had another two to three years to run because the country’s population had “found a way to unlock their potential.” He made those comment right around when China’s stocks hit their all time high. They started to tumble about a month later. But none of this is likely to bother Buffett.