Empires fall for many reasons. One of them is overreach: the lust for power often drives imperial rulers to extend their commitments beyond what their resources can support. The collapse of the Soviet Union is among the most recent illustrations of the perils of imperial overreach. During the Cold War, Moscow recklessly took on unaffordable security commitments around the world and engaged in an un-winnable arms race against a foe with a much larger economy.

Among the lessons China learned from the Soviet collapse, avoiding imperial overreach was perhaps one of the most consequential. The leaders of the Chinese Communist Party (CCP) in the early 1990s understood that they must never repeat the Soviet mistake. In the two decades since, Beijing has followed a prudent foreign policy. Although China sees the U.S. as a threat, it has resisted a full-scale arms race with the U.S. Instead of seeking parity of power, China has devoted its limited resources to niche military capabilities, designed solely to deter the U.S. from intervening in its neighborhood. Equally notable is China’s consistent resistance to the temptation of setting up puppet regimes and military bases overseas.

Unfortunately, as economic growth has boosted Chinese power and status, its leaders seem to be succumbing to the same imperial temptations that lured the rulers of the former Soviet Union into strategic imprudence. To be sure, as China still lags behind the U.S. in military capabilities, Beijing has maintained its cautious and largely defensive security posture. And in the foreseeable future, China is unlikely to risk a direct military conflict with the U.S.

But the temptations to take on the U.S. in global finance are simply too powerful to resist for Chinese leaders. With $4 trillion in foreign exchange reserves and an economy growing twice the rate as the U.S., Beijing confidently thinks that it has the wherewithal to contest American dominance in the global financial order. While it is impossible to pinpoint when and how the Chinese strategy was conceived, its two main prongs are now becoming increasingly visible.

As part of its first prong, China has led in the formation of international financial institutions that directly compete against those founded and dominated by the U.S. In the last two years, China has successfully set up the $50 billion Shanghai-based New Development Bank (NDB), the $50 billion Beijing-based Asian Infrastructure Investment Bank (AIIB), a China-financed $40-billion New Silk Road Fund, and a $100 billion dollar liquidity reserve, also largely bankrolled by China.

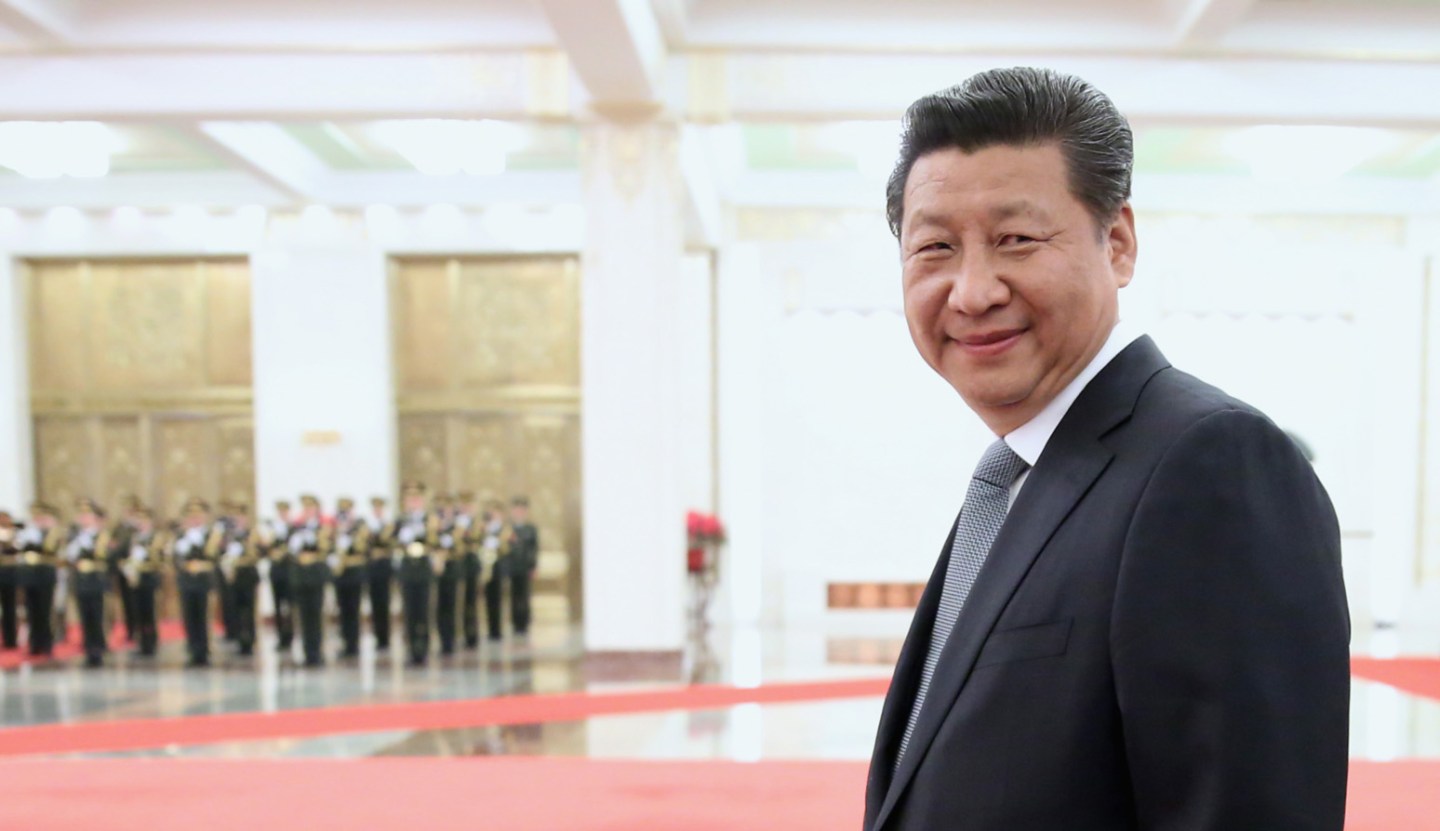

The second prong: China has put together massive bilateral aid packages for strategic allies and resource-rich developing countries designed to strengthen its economic ties to these nations. The latest manifestation on this front is the $46 billion energy and infrastructure deal China announced for Pakistan. And when President Xi Jinping visited Latin America in July 2014, he signed contracts worth roughly $70 billion.

On the surface, China’s strategy of competing with the U.S. in global finance and investment seems both prudent and shrewd. With a large chunk of its foreign exchange reserves invested in low-yielding American Treasuries and other securities, allocating hundreds of billions of dollars of its forex-reserves into alternative assets (overseas infrastructure and natural resources) may diversify risk and generate better returns. In addition, money diplomacy is more potent than gunboat diplomacy in peeling off American allies; just witness the recent rush of nearly all America’s longtime allies into Beijing’s arms as the AIIB is about to close its doors to new members.

However, China’s strategy is as flawed as it is unsustainable. Taking on large global financial commitments, as China has recently done, entails significant risk. Running a startup multilateral development institution presents complex technical and political challenges for which China has little experience or demonstrated competence. Investments in infrastructure and natural resource projects in developing countries can be endangered due to ethnic conflict, terrorism, and political instability. China’s most recent setback in Sri Lanka, where a change of government threatens billions of dollars in Chinese investments in infrastructure, is just one example of the fallout that can come from such activities. In Pakistan’s failing state, huge Chinese investments might fare even worse.

Beijing has also overestimated China’s financial capacity. Despite China’s rapid growth, the U.S. economy, with a GDP of $17.4 trillion in 2014, is still two-thirds larger than the Chinese economy ($10.4 trillion). More importantly, as history shows, constructing an alternative global financial order requires uncontested economic hegemony and resources. When the U.S. designed the post-World War II global financial system (the so-called Bretton Woods system) in 1944, the American economy made up half of the world’s GDP. Since China accounts for 13.4% of the world’s GDP, it is questionable whether it has sufficient resources to underwrite an alternative system.

In its imperial overreach, Beijing’s is diverting precious resources away from its home front. With a collapsing real estate bubble, mountains of bad loans in the financial system, massive manufacturing overcapacity, an aging population, and catastrophic environmental degradation, China ought to be spending its money at home to shore up its economy, instead of chasing elusive prestige abroad.

Minxin Pei is the Tom and Margot Pritzker ’72 Professor of Government at Claremont McKenna College and a non-resident senior fellow of the German Marshall Fund of the United States