Last year was a good one for the market. But for many investors, it was far less than great.

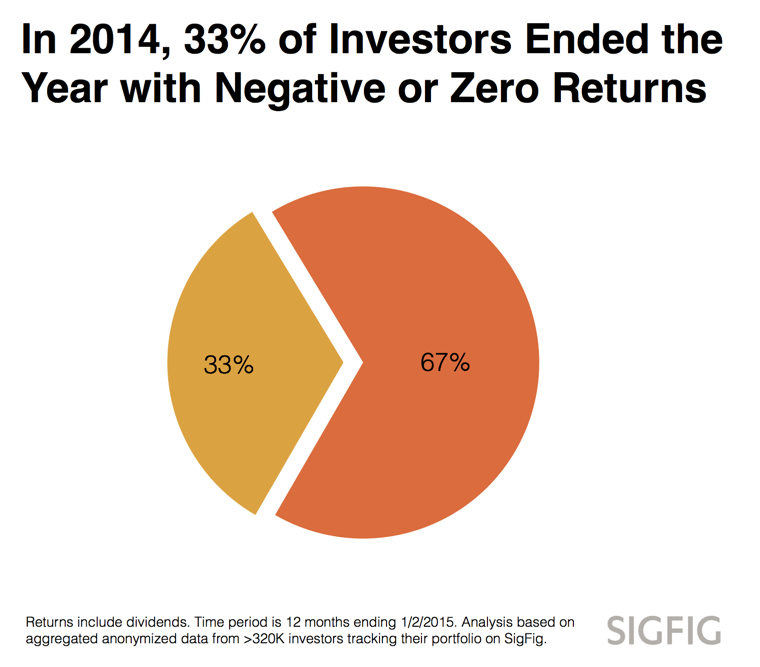

According to a study from SigFig.com, which makes a portfolio tracking app, as many as a third of all investors may have ended up either losing money or not making anything at all in the market in 2014. Meanwhile, the S&P 500 was up nearly 14% for the year.

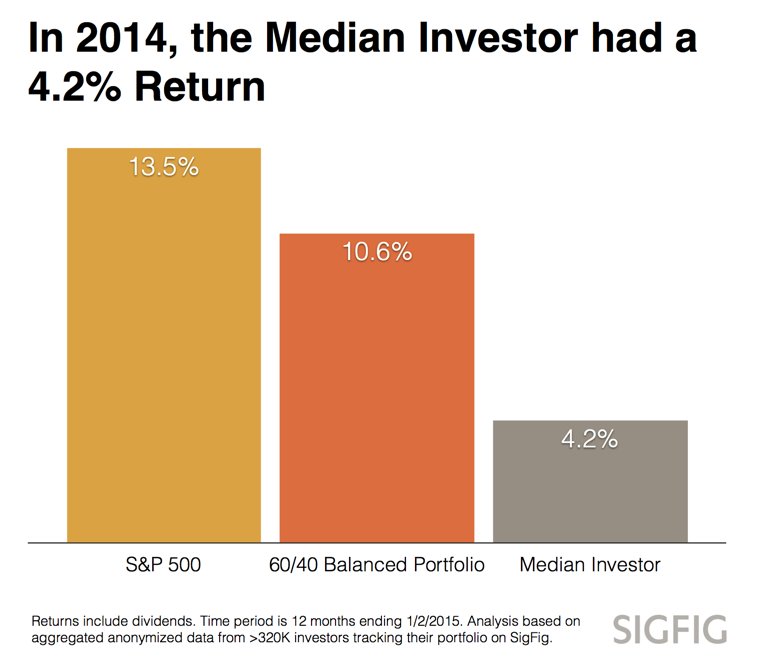

Yet most investors’ portfolios don’t seem to have experienced gains anywhere near that. SigFig’s data suggests that the average investors’ investment account rose just over 4% last year.

The study was based on the returns on the accounts of SigFig’s roughly 320,000 users. It’s not clear why SigFig’s users, and likely most investors, did worse than the market. SigFig has been around since 2011, but this is the first year it has done a study of its users’ annual returns.

The disappointing results may have to do with bonds. The SigFig data measured the returns of its users’ entire portfolios, which could include bonds and other investments, in addition to stock. Bonds didn’t do as well as stocks in 2014. Still, a 60-40 split between stocks and bonds would have produced a return of just over 10%, more than double the return of the average SigFig user.

Of SigFig users, 28% had at least 10% of their portfolios in cash. That would have also dragged down performance. Still, that was down from 33% of SigFig users in 2013. So, based on this, investors do appear to have become slightly less wary of the stock market.

Average investors often perform worse than the market because of fees and excessive trading. The S&P 500’s return does not include all the fees an actual investor would pay. Still, you wouldn’t think that fees could eat up 10 percentage points of gains. Mutual fund fees tend to hover around 1%.

So, does it all come down to excessive trading? It looks like putting your money into the S&P 500 as a whole and staying put—so-called buy and hold investing, which has gotten a bad rep lately—would have been the best strategy in 2014. Most studies show that people who trade more, particularly non-professionals, do worse.

Watch more about last year’s finance from Fortune:

You would expect someone who uses a portfolio tracking service like SigFig to be a more active investor, or at least someone who looks at their portfolio more often than most. What’s more, about 65% of the accounts that SigFig tracks are typical brokerage accounts. Only 25% were 401(k)s or other retirement accounts, where you would expect investors to do less trading. But SigFig says that, on average, its users turned over just 13% of their accounts a year. That’s not a ton of trading. Nevertheless, SigFig’s data suggests that the users who traded more did worse.

Says Terry Banet, SigFig’s chief investment officer, “Investors tend to make decisions, often emotional, that end up being bad for their bottom line. They trade too often, try to time the market, or invest in financial products that are unnecessarily expensive.”

Update: An earlier version of this story said that 30% of the investors in the study had 10% of their portfolio in cash. And that that cash position had dropped from 33% the year before. In fact the number of of the investors in the study that had 10% of their portfolios in cash in 2014 is what dropped, from 33% in 2013 to 28% in 2014.