They may not be running too big to fail firms, but the CEOs of many small biopharmaceutical companies are being paid like they are unquestionably indispensable, In fact, many are making more than Wall Street’s chief executives and the CEOs of their much larger pharmaceutical peers.

In fact, these executives are being paid more than the CEOs of much larger counterparts in a lot of other industries. Only one of these biopharma companies is part of the Fortune 500—Baxter International—and Baxter’s CEO is not the highest paid.

The CEO of Regeneron Pharmaceuticals earned $36.3 million in 2013, putting him at No. 13 in this year’s NYT/Equilar CEO pay survey. The CEO of Celgene, Robert Hugin, brought in $21 million that year, coming in at at No. 52. The highest paid big pharma CEO was Lamberto Andreotti of Bristol-Myers Squibb at No. 53, who earned $20.8 million in 2013.

Bristol-Myers brought in $16.4 billion in revenue in 2013, compared to $6.5 billion at Celgene, and $2.1 billion for Regeneron. So, what’s going on?

An examination of eight biopharma company CEO salaries shows that many are paid like entrepreneurs, or rather like a hybrid of entrepreneurs and blue chip company CEOs, giving these executives the best of both worlds.

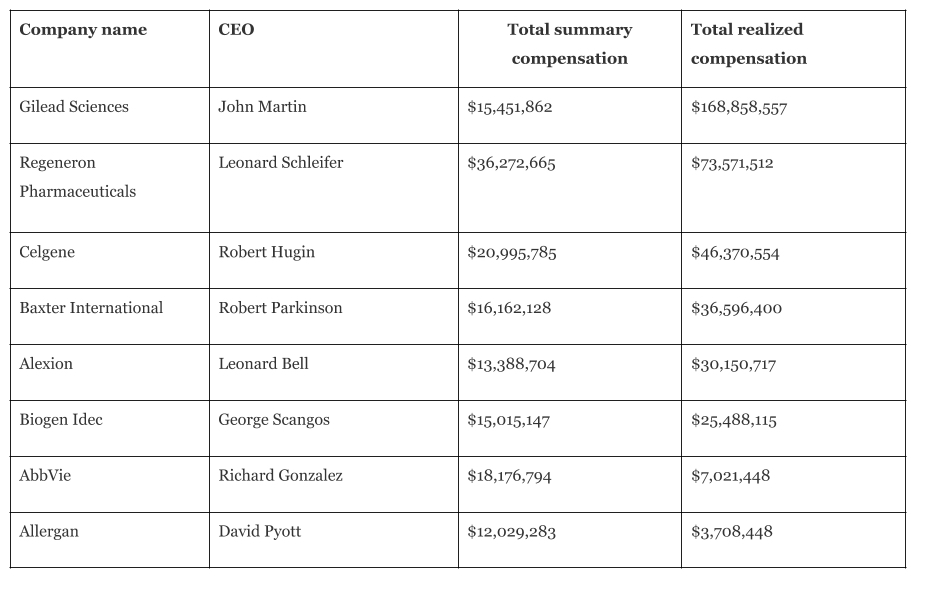

Most of these CEOs were paid a base salary of $1.5 million, not a typical rate for an entrepreneur. Add in stock option grants, other stock awards, and cash bonuses and most received annual compensation of around $15 million a year (see table below). Take out the estimated value of equity awards and add in the realized value of equity pay—actual stock option profits and vested stock awards—and the compensation of most of these CEOs more than double.

For the highest paid CEO in this group, John Martin at Gilead Sciences, the biggest portion of pay came from the $159 million in option profits he made in 2013, the latest year for which figures are available. While Gilead’s stock is up more than 350% in the last five years, that level of growth is dwarfed by the share price increase at Regeneron of more than 2,000% in the same period. This more than accounted for Regeneron CEO Leonard Schleifer’s $70 million in stock option profits, representing 96% of his total realized pay. Disregarding the stock price increase, almost 40% of shareholders voted against Regeneron’s compensation plan, indicating that they were not impressed with Schleifer’s pay package.

The two lowest paid CEOs in the group are both mired in merger difficulties. AbbVie’s terminated merger with Shire will cost the company $1.6 billion in breakup fees, which will damage the firm’s performance this year. Allergan managed to fight off a hostile bid from William Ackman’s Pershing Square and Valeant Pharmaceuticals by offering itself for sale to Actavis. Celgene’s stock price rose by 320% in the last five years, giving CEO Robert Hugin $35 million in option profits last year. Similarly at Baxter International, CEO Robert Parkinson made option profits of $28 million. At Alexion, CEO Leonard Bell made $22 million in stock option profits, benefiting from a stock price rise of 700% in the last five years. In contrast, most of Biogen CEO George Scangos’ realized pay came from performance stock, $20 million in 2013.

The lowest paid CEO in this group—David Pyott at Botox-maker Allergan—didn’t exercise stock options in 2013, despite a 250% increase in the company’s share price over the last five years. Once the merger with Actavis goes through, however, Pyott could make a lot of money on outstanding options. At a sale price of $219 per share, that is two, three, four, and five times the price of all of Pyott’s stock options. Indeed, Pyott will be sitting on almost half a billion dollars worth of stock options once the sale goes through.

The consistent use of stock options as a pay tool is puzzling in this industry, although it is working out well for the CEOs. Biopharmaceutical company performance—and the market’s perception of it—is all about new drugs. Shouldn’t all these CEOs have their performance measured against their drug development pipeline and research and development progress?

At Gilead Sciences, Celgene, Alexion, Biogen, and Allergan, annual performance is partly based on the development of new drugs, but not over the long term. You could argue that the market’s opinion of the potential for growth from new drugs translates into stock price growth, so rewarding CEOs with stock options is a good idea. Unfortunately, the market’s insights are neither consistent nor precise. Stock options are something of a blunt instrument over the long term, and since long-term investors are interested in seeing the development of a pipeline of new drugs for the foreseeable future, it would be better to test these CEOs against that measure.