The announcement last week that two Brazilian companies bought Chiquita Brands International, known for its bananas, in a deal worth $1.3 billion certainly demonstrated one thing: there’s big money in fruit.

And it’s only getting bigger.

In 2004, fruit was the fifth most popular food item consumed by Americans, according to Harry Balzer, a chief industry analyst who studies food trends for NPD Group. Today, the category is now in second place, taking over the spot once occupied by soft drinks. (Sandwiches have long been in first place.)

Americans’ growing health consciousness is partly responsible for fruit’s ascent. There is also the convenience factor. “It requires no cooking,” Balzer says “It can be part of breakfast, lunch, or dinner.”

Produce is facing some challenges, though. From an inflationary standpoint, retail prices have increased and the drought in California is threatening some supply, says Sherry Frey, senior vice president of Nielsen Perishables Group.

Still, grocery stores are devoting more space to produce, Frey says. “When you look at the entire store, one of the best growing departments is produce,” Frey says. You can chalk the growth up to healthier eating habits and a more diverse assortment of fruit offerings at stores.

So, is that increase in sales consistent across all fruit or are there certain types that are especially—ahem—ripe for growth? Nielsen Perishables tracks sales of fresh fruit at grocery stores by dollars and volume, and its statistics point to which fruit—from a business perspective—is really top banana.

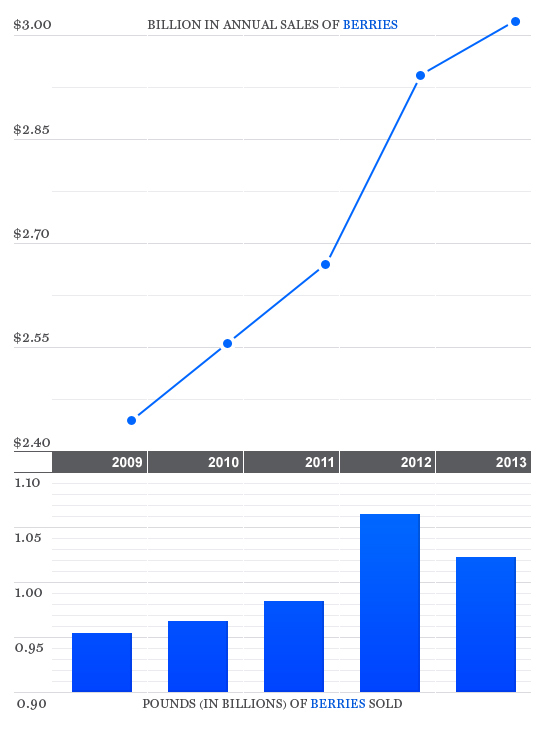

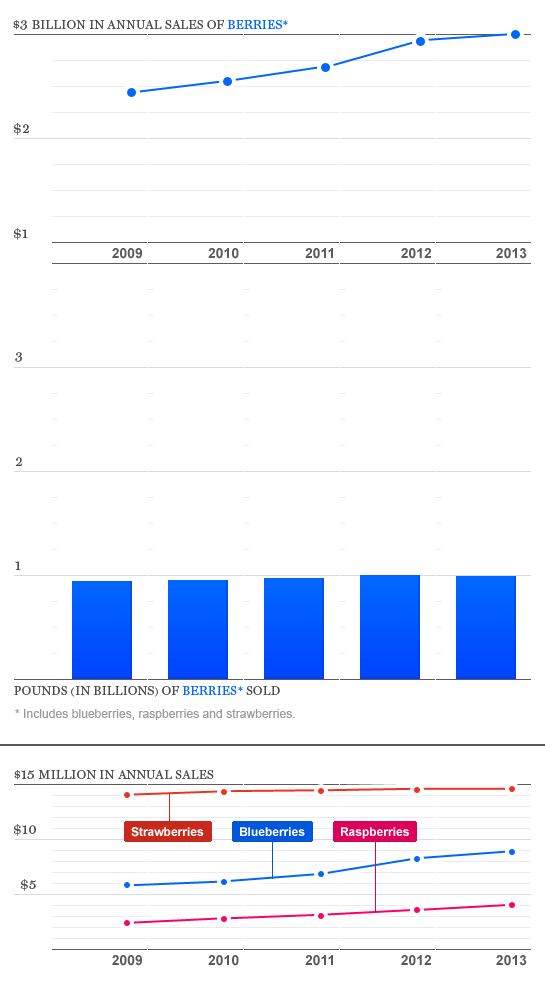

1. Berries—2013 Sales: $3.020 billion

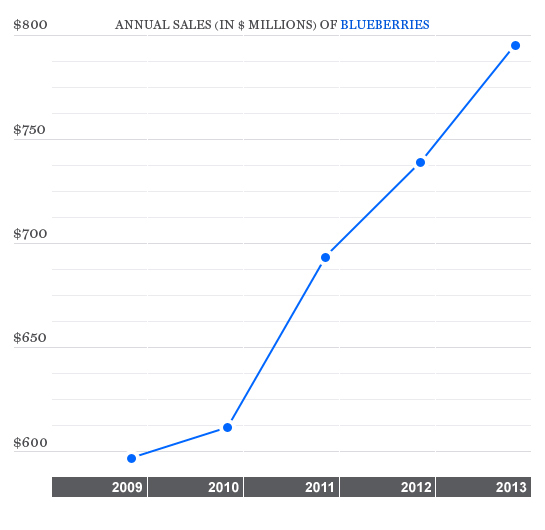

Nielsen groups all berries as one category, and with just over $3 billion in sales last year, it is the highest-grossing fruit. It captured that title thanks in part to the category’s “super food” designee: blueberries.

The fruit’s much-heralded antioxidant properties have helped increase sales, Frey says. Grocers have responded to consumer demand by selling blueberries in larger quantities. “You used to be able to only buy these small packages,” Frey says, “Now, you can buy them by the pound.”

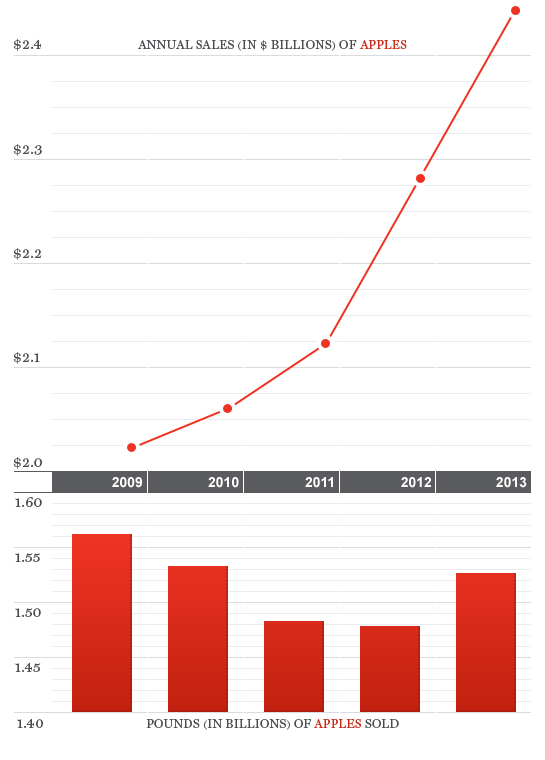

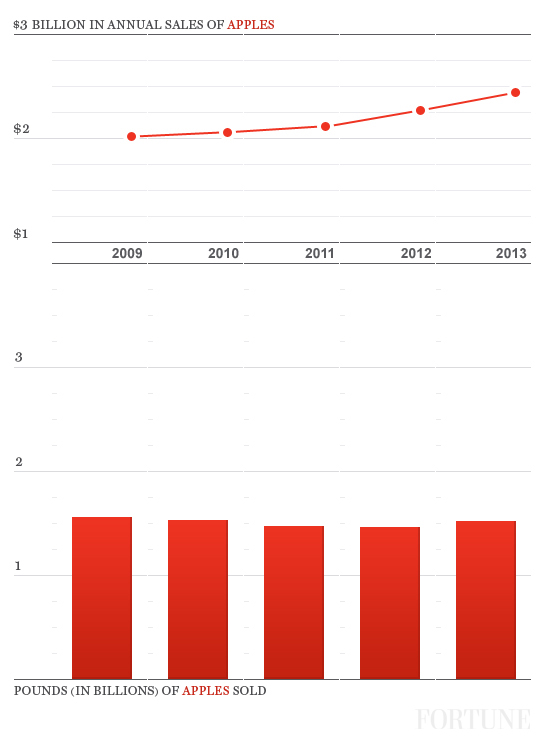

2. Apples—2013 Sales: $2.442 billion

Staple fruits like apples are often the ones that lose out when consumers sample new types of fruit, Frey says. But a new iteration of this American standby has lifted the category’s overall sales since 2009: pre-cut apples. Sales of sliced apples, which are often packaged with dip or in parfaits, are priced higher than fresh whole apples and neared $177 million in sales in 2013, an increase of 72% over the past five years.

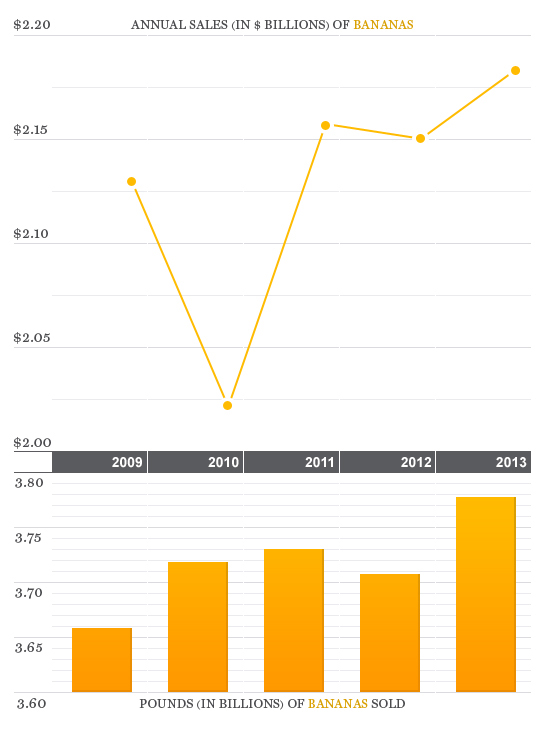

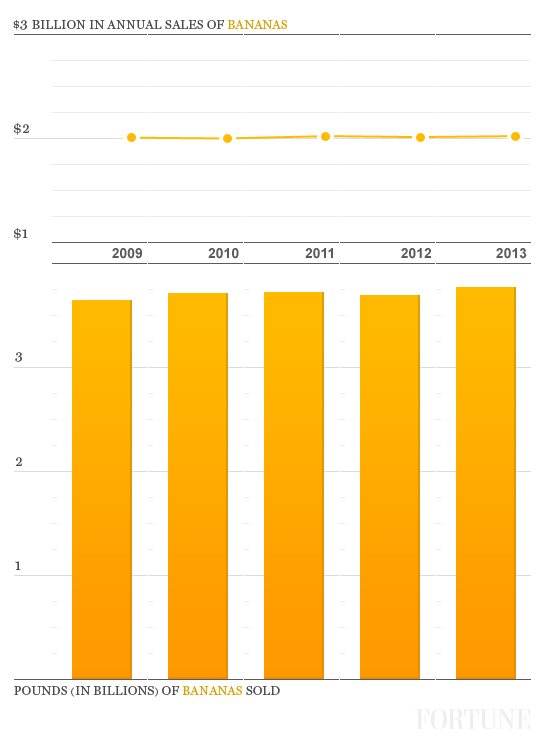

3. Bananas—2013 Sales: $2.183 billion

Banana sales are also “cannibalized” a bit when consumers experiment with new fruit, Frey says. Nielsen’s data points to relative stagnancy in dollar and volume sales of bananas, but since it only measures grocery store purchases, it doesn’t capture what Frey says is a growing source of sales: convenience stores and coffee shops, where consumer are paying a premium for the portable fruit.

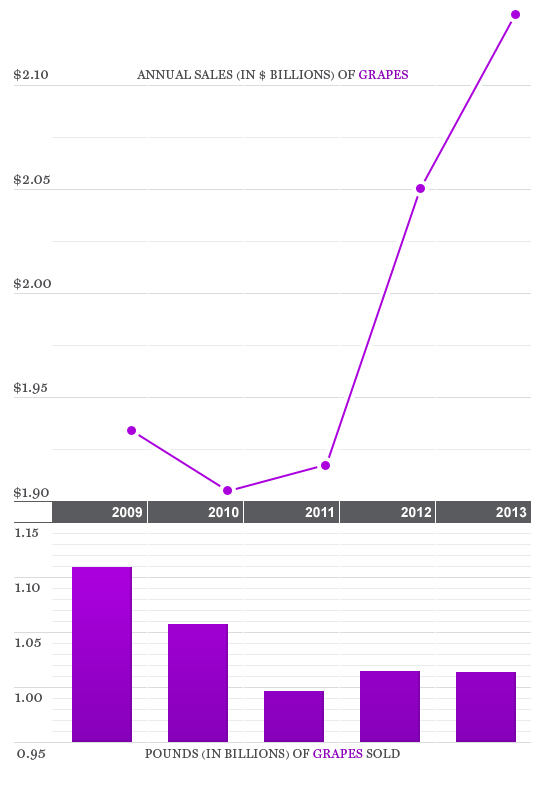

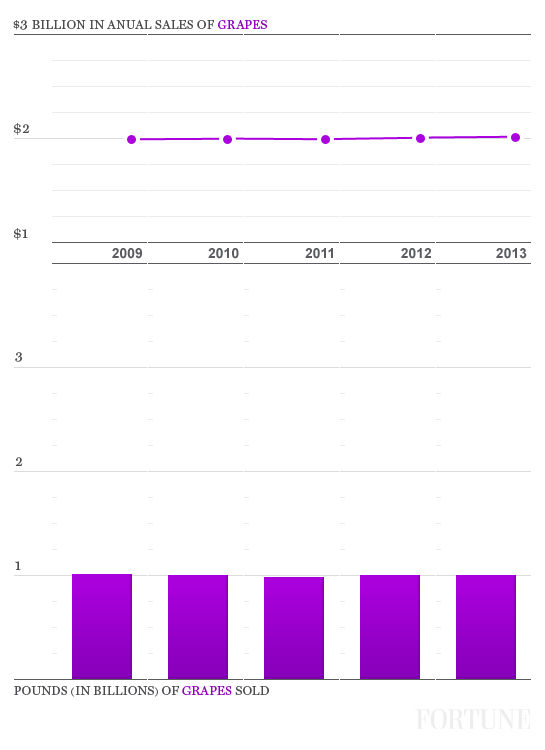

4. Grapes—2013 Sales: $2.135 billion

The drought in California has posed a challenge to the sector, as increased prices have stunted volume growth. But there’s good news, too: innovation related to flavor and seeds—of lack thereof—has increased the assortment of grapes available to consumers. Changes in packaging—like housing grapes in plastic clamshells instead of cellophane—have helped to ensure that the easily squished fruit makes it through the distribution process and your next full-cart shopping trip, Frey says.

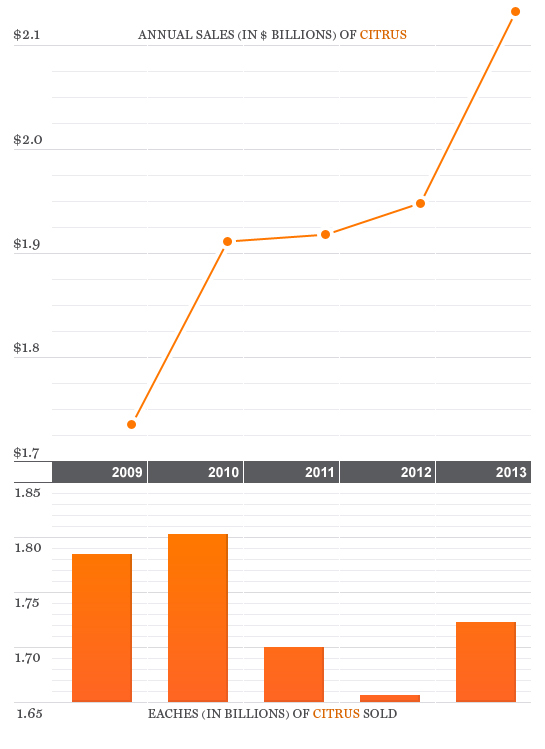

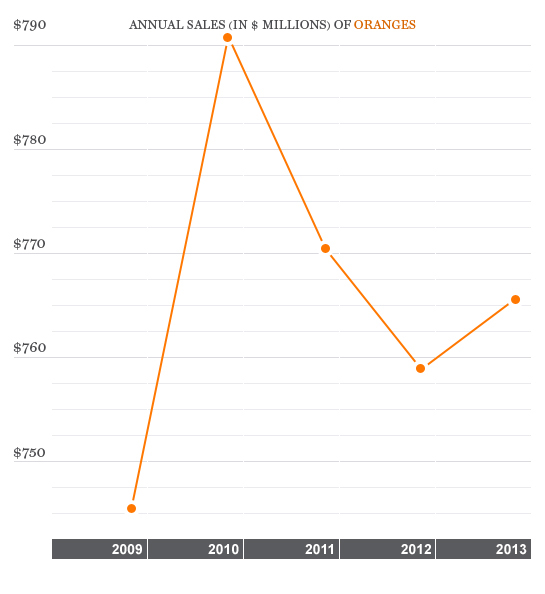

5. Citrus—2013 Sales: $2.133 billion

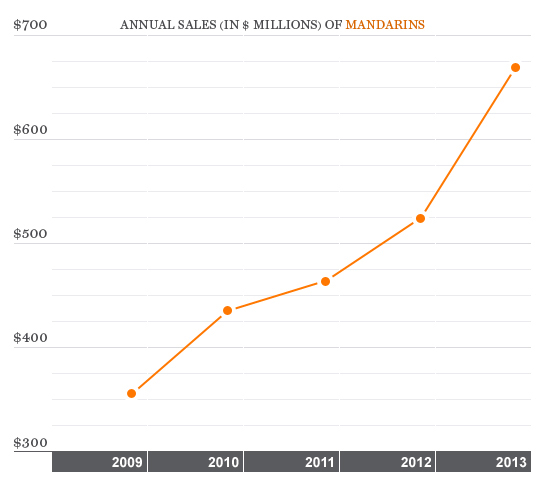

Citrus is undergoing what Frey refers to as “shape shifting,” as new items replace the category’s long-standing favorite as the driver of sales growth. In other words: hello mandarin, goodbye orange. (Note: Citrus sales are measured in “eaches,” which refer to individual pieces of fruit.)

As consumers clamor for convenience, they have begun to ditch the bulky, stubborn orange for more compact, seedless, easy to peel mandarins—think of Cuties that are marketed toward kids. Mandarins have experienced an 89% increase in dollar sales from 2009 to 2013.

Charts by Analee Kasudia

Editor’s note: A previous version of this story included a quote from Nielsen’s Sherry Frey that claimed that specialty fruit’s share of all U.S. fruit sales grew from 2% to 15% between 2009 and the present. Nielsen has corrected its calculation. Specialty fruit sales’ share has remained at 2% of all fruit sales, but that specialty fruit sales as a whole have grown by 38%.

Berries

Nielsen groups all—strawberries, raspberries, blackberries, blueberries, even currants—as one category and with $3 billion in sales last year it is by far the highest-grossing fruit. It's easily maintained that title thanks to its "super food" component: blueberries. The fruit’s much heralded antioxidant properties have helped increase sales, Frey says. Grocers have responded to consumer demand by selling blueberries in larger quantities. “You used to be able to only buy these small packages,” Frey says, “Now you can buy them by the pound.”

Apples

Staple fruits like apples are often the ones that lose out when consumers sample new types of fruit, Frey says, which may explain the slight decline in apple sales volume. But a new iteration of this American standby has lifted the category’s overall sales since 2009: pre-cut apples. Sales of sliced apples that are often packaged with caramel dip or in parfait and are priced higher than fresh whole apples neared $177 million last year, an increase of 72% over the past five years.

Bananas

Bananas is another category that gets “cannibalized” a bit when consumer experiment with new fruit, Frey says. Nielsen’s data points to stagnancy in dollar and volume sales of bananas, but since it only measures grocery store purchases it doesn’t capture what Frey says is a growing source of sales: convenient stores and coffee shops, where consumer are paying a premium for the portable fruit.

Grapes

The supply of everyone’s favorite pluckable fruit is being harmed by the drought in California, but it’s become more appealing to consumers thanks to innovative packaging, Frey says. The first department that shopper usually enters in a grocery store is produce, meaning the rest of the trip is spent trying to keep fruits and veggies from getting smooshed. This doesn’t bode well for grapes with their thin skin and even thinner cellophane wrapping. No one likes a sour grape, but a soggy, bruised one might be even worse. Enter the plastic clamshell. The industry has evolved packaging so grapes make it through the distribution process and your next shopping trip, Frey says.