Three long years: That’s how long Jonathan Waghorn, a onetime Shell drilling engineer turned energy investor, has been watching with frustration as the oil and gas stocks in which he specializes have lagged the market. Over that span the S&P 500 Energy Index has underperformed the broader S&P by nearly 26 percentage points. Why? A relatively stable geopolitical scene and the shale boom in the U.S. have boosted supplies and combined to obscure what the fund manager views to be strong long-term fundamentals for the sector. “You have to be patient,” says Waghorn, 41, co-manager of Guinness Atkinson Global Energy, the top-performing fund in the sector over the past decade. “It’s always annoying when your view is ignored for a long period of time.”

Now, finally, there are signs that investors may be poised to come around to Waghorn’s way of thinking—especially given the spike in conflicts in oil-rich regions around the world. Escalating tensions between Russia and Ukraine and the rise of Islamic Sunni militants in Iraq have raised fears about future supply disruptions at a time when demand in a recovering global economy appears to be gaining momentum. Consider that the International Energy Agency estimates that Iraq will deliver 60% of OPEC’s supply growth through the end of the decade—an increasingly dubious projection. “I think that it’s fair to say, given recent events, one has to at least question the likelihood of all of that supply coming onstream,” says Poppy Allonby, portfolio manager of the BlackRock Commodity Strategies Fund.

The case for oil stocks is built on more than turmoil in the Middle East, however. “I think the world has gotten too negative on demand and too bullish on supply,” says Mike Wilson, chief investment officer of Morgan Stanley Wealth Management, which oversees $2 trillion in assets. Wilson says the energy sector has been unfairly oversold, making this a great entry point. The S&P 500 energy index currently trades at 15 times this year’s earnings, or an 11% discount to the S&P 500. “People are basically writing off energy forever, and that’s just not where we are,” says Wilson.

“The opportunities are fantastic, and we’re in the very early innings of a renaissance in the energy industry.”

—Craig Hodges, CEO of Hodges Capital

Indeed, the arrow is already pointing up for oil prices: While spot prices have dipped 8% over the past six months, futures prices for crude contracts two to five years from now have jumped as much as 11%. That not only foreshadows more expensive oil but also means oil companies are already reaping the benefits. “A lot of people don’t realize that oil companies don’t sell their oil at today’s prices. They sell it at future prices, and they’re now selling oil at better prices than they were six months ago,” says Wilson.

When the price of oil rises, producers tend to drill as much of it out of the ground as quickly as they can. Craig Hodges, who runs about $3 billion at Hodges Capital in Dallas, knows this well. So he’s moving aggressively to capitalize on the opportunity. Nearly a fifth of his Hodges Small Cap Fund—ranked No. 1 in its Morningstar category over the past five years—is now in energy stocks, a much bigger bet on the industry than he’s ever made before.

Among Hodges’s favorite picks are shale specialists Matador Resources (MTDR) and Comstock Resources (CRK), both of which have pivoted from drilling for natural gas to producing oil after natural-gas prices collapsed in the U.S. due to the flood of supply caused by the fracking revolution. Rather than worrying about an oil glut, Hodges envisions a day when the U.S. will be energy self-sufficient—and may even begin exporting oil, as the government this summer loosened its 40-year ban on crude exports. “The opportunities are fantastic, and we’re in the very early innings of a renaissance in the energy industry,” says Hodges.

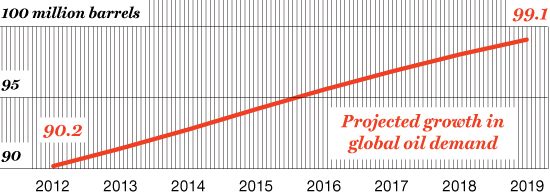

Oil production in the U.S. continues to surge. The Energy Information Administration predicts that it will surpass 8.5 million barrels per day this year, up from less than 5 million in 2008. But U.S. consumption is heating up as well. According to OPEC, demand is expected to increase in developed nations in 2015 for the first time in four years, with all the gains coming from North America. At the same time, the thirst for oil is only increasing in emerging markets like China, India, and Brazil.

Global growth is reason enough to invest in energy for Maarten Bloemen, who manages $2.5 billion for Franklin Templeton. And it helps him to look beyond price fluctuations caused by geopolitical events. When the standoff in Ukraine prompted a selloff recently in shares of Lukoil (ADR), Russia’s largest non-state-owned oil company and a significant holding of Bloemen’s, he added to his stake. Currently the stock trades at a mere four times this year’s expected earnings and pays a hefty 6% dividend yield. “We basically try to take opportunities to invest in companies when turmoil happens,” he says. Bloemen also sees value in French oil major Total (TOT). With a current-year price/earnings ratio of 10.8, it trades at a discount to peers such as Exxon Mobil and has a 5% yield.

Investors who want broader exposure to oil and gas might consider a low-cost exchange-traded fund such as Vanguard Energy (VGENX), which owns 161 U.S. stocks, or iShares Global Energy (IXC), which has a piece of 93 companies from around the world.

Waghorn, meanwhile, is zeroing in on a handful of companies in turnaround mode. Right now he likes Occidental Petroleum (OXY) and Suncor (SU), which, after years of investment in new projects, he says, are growing production and becoming more profitable. “At the moment we are far, far away from euphoria in this sector,” says Waghorn. But after a long wait, he believes happier days are finally coming soon for energy investors.

This story is from the September 22, 2014 issue of Fortune.