Ordinary Americans are being deprived of the opportunity to reap financial rewards from investing in promising young technology companies. Not by regulation or a lack of cash, but by the companies themselves. These startups are staying private longer, achieving more of their exponential growth for the benefit of a tiny shareholder base.

All this comes in the midst of a national debate about income inequality—one that’s particularly fervent in the San Francisco Bay Area, where high-paying tech jobs are causing apartment rents and home prices to skyrocket, forcing many longtime residents to seek new zip codes.

It wasn’t always this way. Think back to when four-year-old Amazon went public in 1997. It raised just $48 million, pricing its stock at $16 a share. The initial market cap was around $382 million. Today the company is valued at about $159 billion, with its stock trading at $354 a share (there have been several stock splits). Or consider when seven-year-old Google went public in 2005 at $85 a share at a $23 billion market cap. Today it trades at $580 a share (the stock split earlier this year), with a $390 billion market cap. In either case, an early bet of a couple hundred dollars would have turned into tens of thousands of dollars.

Had those companies been founded these days, it’s highly unlikely that either one of them would have gone public yet. When Amazon and Google were just starting out, the capital success flow chart was clear: Try to raise some seed money from rich friends, raise venture capital, and then go public (even after post-Enron rules made things a bit tougher in 2002).

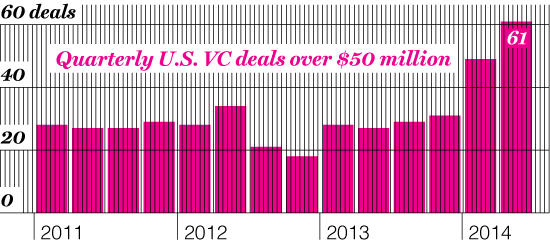

Today’s hot startups are living in a brave new world of big capital. Hedge funds, banks, mutual funds, and sovereign wealth funds are now big players in the pre-IPO space. For example, Fidelity Investments recently led a $1.4 billion “venture capital” round for five-year-old car-service company Uber at a valuation of more than $18 billion (for reference, Hertz is valued at less than $13 billion). Last summer, Uber was worth only $3.5 billion. How much value could a public Uber have created for a much wider swath of individual investors in the same amount of time? How many people might have had an easier time paying the rent in San Francisco? Or in Boise?

For the hedge funds and mutual funds, these pre-IPO in- vestments make sense: Get a lower price for shares they would buy eventually at the IPO, plus secure tacit promises of better allocations in the public offering. For founders, it’s about control—and holding on to it longer.

The reality, however, is that the entrepreneurs may be wrong. For starters, most of a company’s culture is really created during its first few years of existence. Second, founding CEOs can set up dual-class stock structures that would allow them to retain a remarkable amount of company control, even post-IPO. Third, once the most famous advocate of the “keep control” mantra, Facebook founder and CEO Mark Zuckerberg has since admitted that he may have been wrong. Speaking last fall at a conference, he said, “In retrospect, I was too afraid about going public…I’ve been very outspoken about staying private for as long as possible. I don’t think it’s that necessary to do that.”

To be clear, no CEO should take his company public before he thinks it is ready. After all, it’s difficult to zealously oversee something that you believe to be a giant strategic mistake. At the same time, however, CEOs also should recognize that going public can be more than just a financing event for the company or a way to begin cashing out early employees. It also can be a civic good—not a socialistic free ride, of course, but a symbiotic shareholder relationship that ultimately helps the company by enriching its surrounding community and country. Go public. For the public.

This story is from the August 11, 2014 issue of Fortune.