The economic plight of the Millennial is no secret.

The job market for young Americans isn’t exactly on fire: A recent Pew report showed that the unemployment rate for 25-32 year olds was higher last year than for any post-war generation. And they’re entering the job market with significant student loan debt—nearly $30,000 per borrower. All of this has led commentators to assume that the drop in Census homeownership rates to the lowest on record is due to shaky finances.

But according to analysis released Wendesday by Trulia Chief Economist Jed Kolko, the decline in Millennial homeownership is simply a product of demographic changes, specifically the fact that young people are waiting longer to marry and have children. Most often, single people have less of a need to buy a home (and less of a desire to tie themselves down with a mortgage), and are less likely to be homeowners relative to married folks. In addition to there being fewer married Millennials, the share of non-Hispanic white people in the 18-34 population—the demographic group most likely to be homeowners—has also fallen in recent years. Both of these factors, according to Kolko, have conspired to create the impression that the housing market is less healthy than it should be. Writes Kolko:

“Once we adjust for the huge demographic shifts among young adults—far fewer young adults are married or have kids than two or three decades ago—homeownership in 2013 was roughly at late-1990s levels. That means that the demographic shifts among young adults account for the entire decline in homeownership for 18-34 year-olds over the last twenty years. In other words, if the pre-bubble years of the late 1990s can be considered relatively normal, then today’s lower homeownership rate for young adults might be the new normal, thanks to demographic changes.”

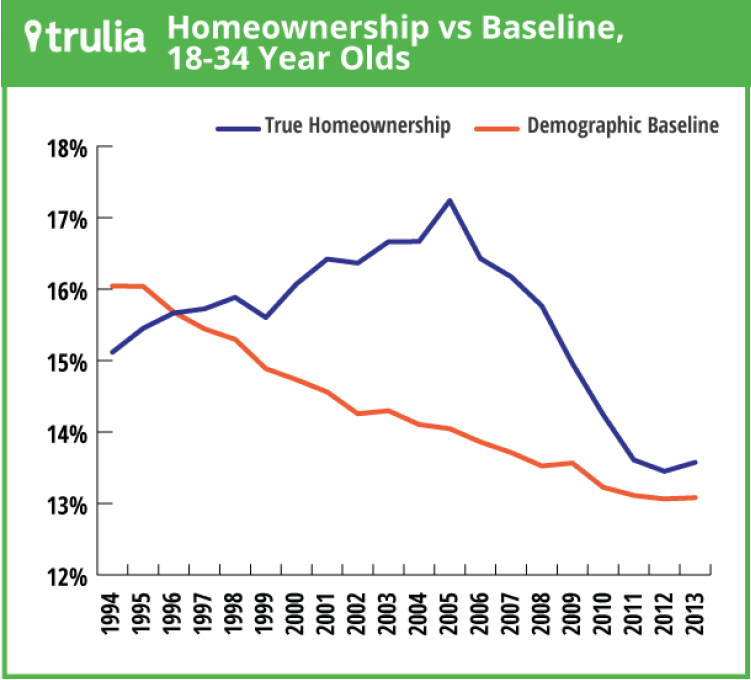

To figure out what homeownership rates would have been today had the housing bubble and recession never occurred, Kolko extrapolated what homeownership rates would have been by applying the demographic changes that actually occurred to pre-bubble trends in homeownership rates. The graph below shows both the homeownership rate (the number of owner-occupied homes divided by the 18-34 population) and where one would expect that homeownership rate to be given the demographic changes we’ve seen:

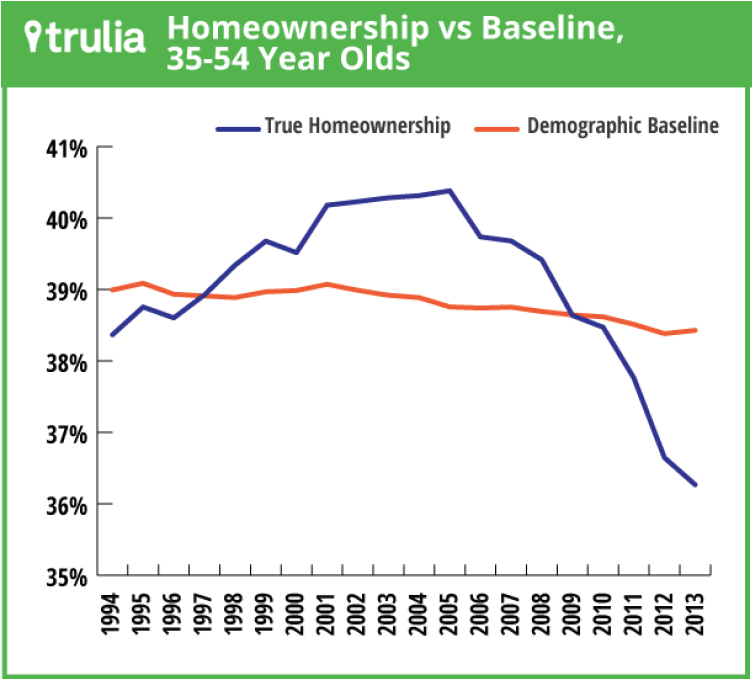

The chart shows that the actual Millennial homeownership rate is higher than what you’d expect given demographic shifts. The group that is less likely to own a home, however—the 25-54 year old age group—owns homes at a lower rate than demographic trends would suggest, as you can see in the chart below:

You can see the lingering effects of the housing bubble in these statistics. Nearly 20% of mortgagors owe more on their homes than they are worth. These homes, which are disproportionately represented by the cheaper end of the market, are actually the kind young Americans, and first-time homebuyers in general, are more likely to buy because they’re more affordable. In other words, weakness in the housing market is more likely a product of general economic weakness and the inequality of the recovery than due to the specific struggles of the young.

There is one caveat to Kolko’s analysis, however. He notes that, “some clear-cut demographic factors—like marital status and having children—are also affected by economic conditions, but the longer-term shifts pre-date the recession.” The obvious question is whether young people are getting married less frequently because of economic or cultural conditions. If it’s mainly cultural (which Kolko believes), then the drop in homeownership rates among the 25-34 age group is nothing to worry about insofar as it affects the economy; it’s just that Millennials are taking a bit longer to start families and put down roots. If the decrease in marriage rates are driven mostly for economic reasons, however, then we have reason to worry about the economic health of the generation now just coming of age.