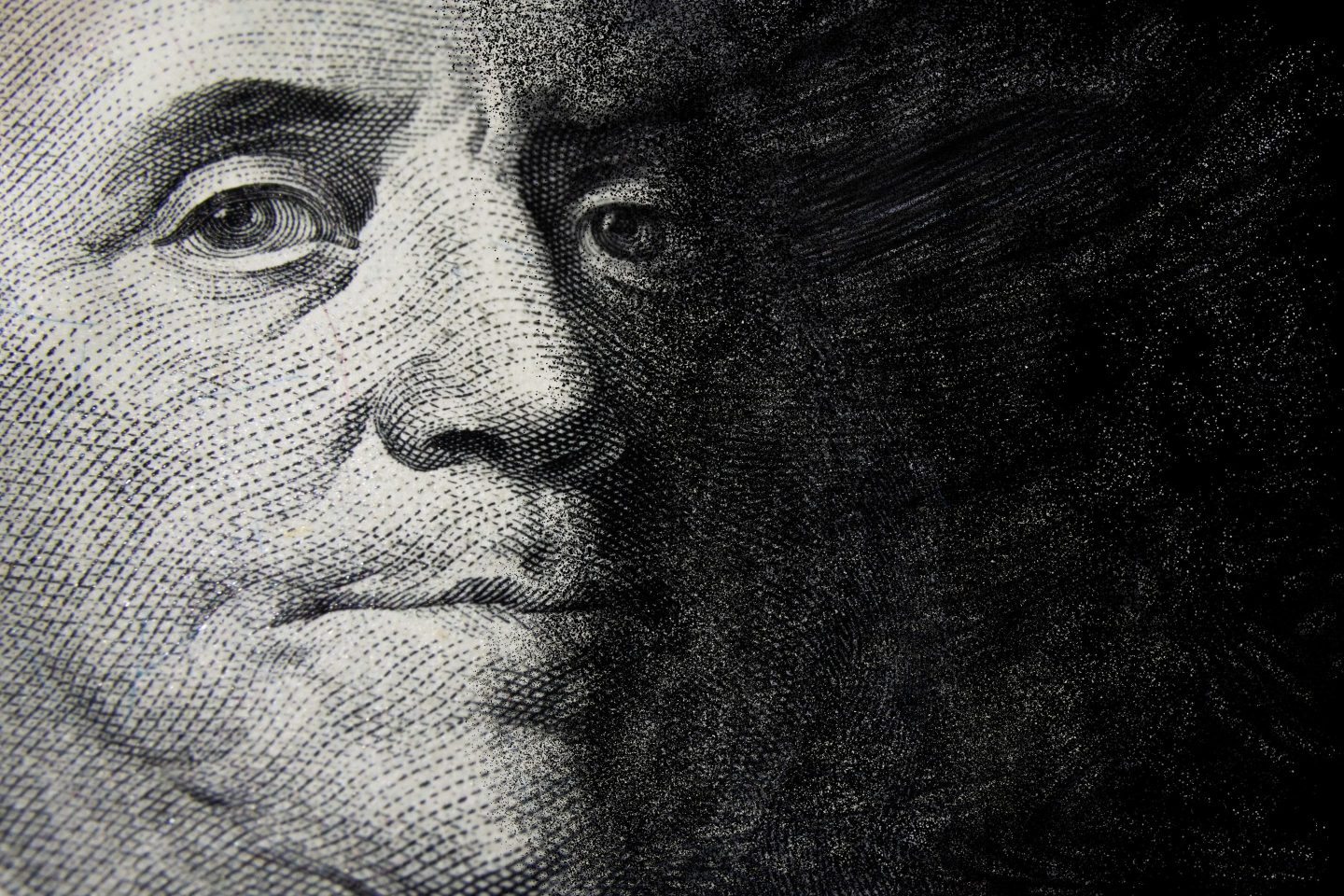

Crypto diehards tell anyone who will listen to put their faith in Bitcoin instead of currency printed by the U.S. government. For years, this was a fringe position, but lately it’s getting support from some unlikely quarters—including from a longtime currency analyst at Deutsche Bank who told MarketWatch that the rise of crypto is part of a “revolt” against the greenback.

The alleged revolt came about as a response to the profligacy of the U.S. government, which, according to detractors, has undermined the dollar with years of “quantitative easing,“ near-zero interest rates, and rampant stimulus. This has led both consumers and foreign governments to look to alternatives.

“The money printing, with its overt seigniorage extraction and inflation repercussions, has only further encouraged those in the developing world that want to establish a multipolar currency system more in keeping with their growing share of global GDP,” the Deutsche analyst noted.

There is data to support this narrative. MarketWatch notes that the greenback accounted for around 70% of other nations’ foreign reserves in the 1990s, but that this figure is closer to 58% today. Meanwhile, the U.S. dollar has been the worst-performing G-10 currency over the past month, spurring increased chatter about “de-dollarization” and likely helping drive Bitcoin back to $30,000 despite regulatory headwinds.

This is not great news. The all-powerful dollar has helped the U.S. maintain superpower status for decades, including by letting Uncle Sam borrow on the cheap. The rise of alternative currencies—including gold, Bitcoin, and the yuan—can only diminish its influence, and there is a looming risk that could accelerate this trend.

I’m referring to the impending debt ceiling crisis, which could see Republicans tank America’s creditworthiness while engaging in a needless political stunt. Recall this is what happened in 2011 when GOP hardliners decided to flirt with financial catastrophe by temporarily refusing to raise the ceiling—which is a technical measure Congress must invoke to pay for preexisting obligations—and causing U.S. debt to be downgraded. While both parties are to blame for the untenable state of the country’s finances, Republicans are the only ones who have used the debt ceiling as a form of hostage taking.

I would like to think the GOP has learned its lesson from the 2011 debacle, for which it paid a political price, but I’m not optimistic—after all, this is a party that has seen fit to elevate insane people like Marjorie Taylor Greene to leadership roles. If it decides to go the kamikaze route during the current debt ceiling standoff, it will deliver another major hit to the dollar’s credibility—and a further boost to Bitcoin.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Bitcoin is up 72% this year, leading some analysts to suggest Crypto Winter may be over. (Fortune)

Venture funding for crypto firms in Q1 dropped a massive 82% year over year, though certain segments—notably blockchain infrastructure—fared better. (Crunchbase)

Disgraced Terra founder Do Kwon was charged with fraud in Montenegro, where he is being detained after trying to leave the country for Dubai using a forged Costa Rican passport. (WSJ)

A new Securities and Exchange Commission bulletin tells investment advisers that, when discussing crypto, they must ensure their clients understand the products and the risky nature of the industry. (CoinDesk)

Tom Brady, who is being sued for promoting FTX, told a Miami audience he’s still enthused about crypto and running Autograph, his sports-related NFT startup. (The Block)

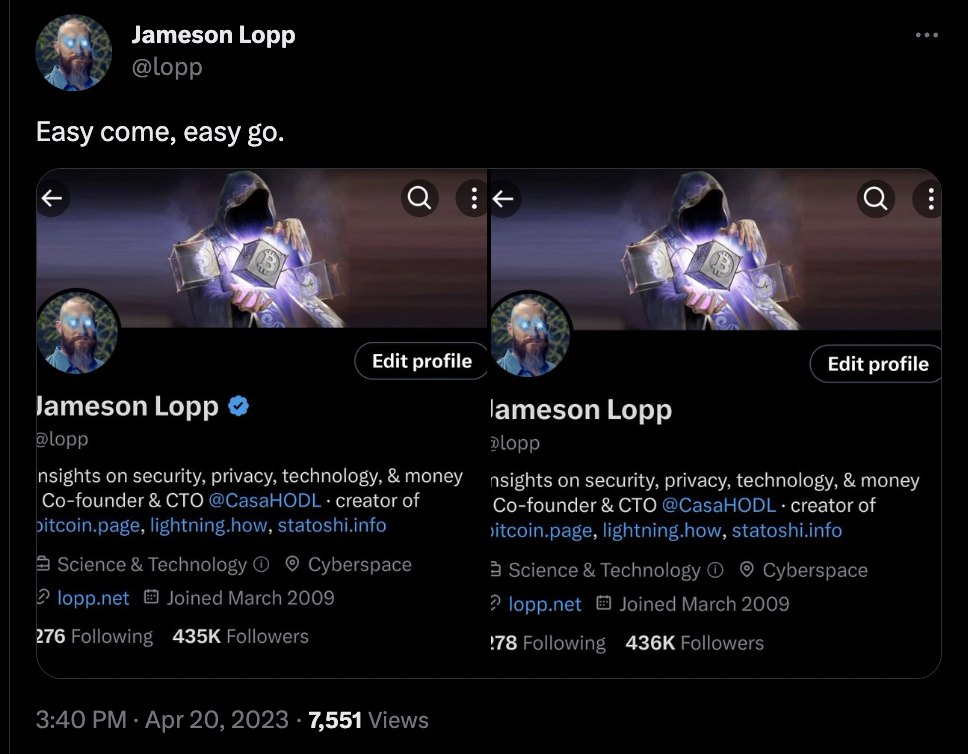

MEME O’ THE MOMENT

Crypto crowd unfazed by Musk’s blue check stripping:

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.