China National Petroleum Corp. is expected to take the lead on a $5 billion project to develop Iran’s share of the world’s biggest gas deposit, taking over from France’s Total SA, which halted operations after U.S. President Donald Trump reimposed sanctions on the Islamic Republic.

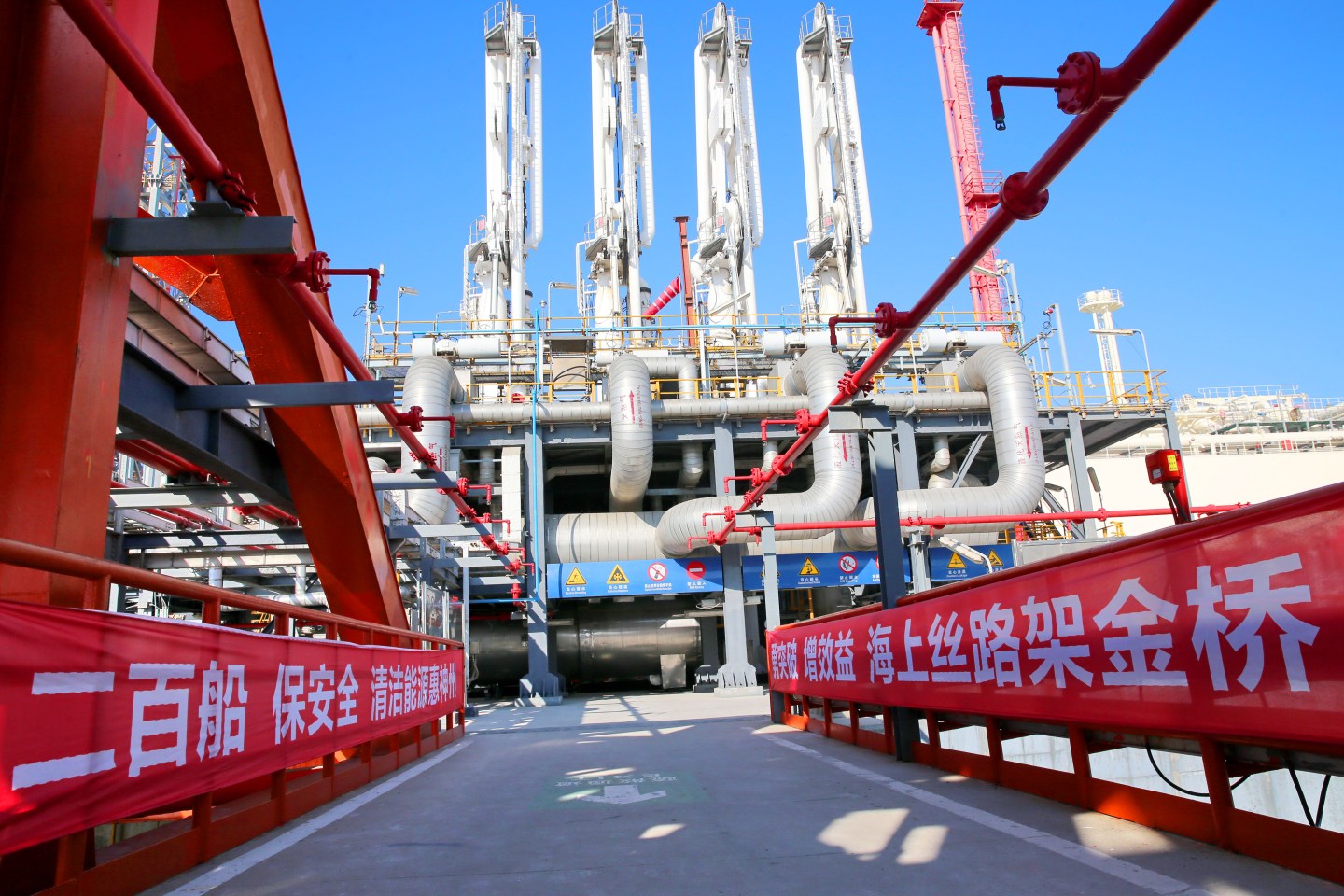

State-owned CNPC, which had joined an original consortium involving Total and Iran’s Petropars Ltd. in 2016 to develop Phase 11 of the South Pars Gas field in the Persian Gulf, would increase its stake in the project from the current 30 percent. Total had originally agreed to take a 50.1 percent stake in the development.

CNCP will become the lead operating partner in the project, the state-run Islamic Republic News Agency said, citing Mohammad Mostafavi, head of investments and business at the National Iranian Oil Company. Terms of the contract have not yet officially changed, though, according to Shana, the oil ministry’s official news site.

Total, which finalized its agreement with Iran in July 2017, had already spent some 40 million euros ($45.7 million) on the project when Trump announced in May that the U.S. would exit the 2015 nuclear deal, formally known as the Joint Comprehensive Plan of Action, and reimpose sanctions on Tehran lifted after the accord was signed.

The first round of U.S. sanctions was put back into place this week, with more to come in November, greatly complicating efforts by companies that rushed into Iran after the 2015 nuclear accord was signed by Iran, the U.S. and five other countries plus the European Union.

Under the deal, Iran agreed to take steps to limit its nuclear program, and to submit to verification by the International Atomic Energy Agency in return for economic sanctions relief.

Scores of European companies, including Total, have withdrawn their operations and investments from the oil-rich Persian Gulf country since the U.S. reversal. Trump marked the return of sanctions with a tweet on Aug. 7: “Anyone doing business with Iran will NOT be doing business with the United States.”

Iran, which holds the world’s largest gas reserves, shares South Pars, also known as the North Dome field, with neighboring Qatar.

Total, had previously withdrawn from South Pars in 2009 because of sanctions. It planned an initial investment of $1 billion for Phase 11, with the aim of eventually producing 2 billion cubic feet a day, or 400,000 barrels of oil equivalent a day including condensate, the company said in a statement in July 2017. At the time, Total said the contract had a 20-year duration.

CNPC has been active in Iran since 2004, operating in oil, gas and oil-field services, according to the company’s website. In 2006 it was awarded a three-year contract to provide offshore well-logging and other services at South Pars.