The European economy is humming again – except for Britain, where fears about the effect of the country’s exit from the European Union are taking an increasingly heavy toll on business and consumer confidence.

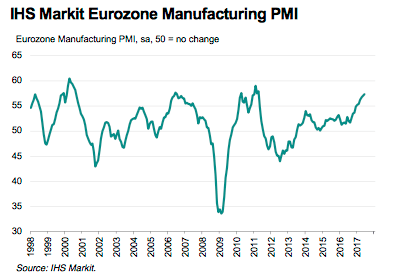

Factories in the Eurozone rounded off the first half of 2017 by ramping up at the fastest rate for over six years, according to closely-watched Purchasing Manager Indexes released Monday by the research firm IHS Markit. Meanwhile, Asia’s tech-manufacturing economies were helped by growing global demand for electronics products, it said.

June’s manufacturing PMI for the Eurozone rose to 57.4, its highest since April 2011 and up from May’s 57.0. Suggesting the bloc’s momentum will continue into the second half, new orders rose at the fastest rate since early 2011, backlogs of work increased at the fastest pace in over 13 years, raw materials were depleted and factories increased headcount at a near-record pace. The upturn was particularly strong in France and Italy, but German business confidence (as measured by the respected Ifo think-tank) hit an all-time high in June.

Read: Emmanuel Macron’s Plan to Save France—and the Euro

“There’s no sign of the impressive performance ending any time soon,” said IHS Markit’s chief business economist Chris Williamson. “Optimism about the year ahead has risen to the highest for at least five years, backlogs of orders are building up at the fastest rate for over seven years and factories are reporting near-record hiring as they struggle to deal with the upturn in demand.”

Fears that France would elect a right-wing nationalist as President promising to pull the country out of the EU’s single currency project had weighed on opinion in the first months of the year, but were dispelled by the crushing victory of the centrist and pro-EU Emmanuel Macron in May – a feat repeated by his party La Republique en Marche last month. By contrast, political uncertainty took a turn for the worse in the U.K. last month after a snap election left the country with a minority Conservative government.

Read: Everything You Need to Know About the Chaos in U.K. Government

Further signs of the strengthening economy came elsewhere, as official data showed the Eurozone’s jobless rate holding at its lowest since 2009, at 9.3% of the workforce, after a 5,000 drop in new jobless claims. A year ago, the jobless rate had stood at 10.2%.

The strengthening economy is increasingly letting factories raise prices, welcome news for policymakers at the European Central Bank who have been battling for years to get inflation back to their 2 percent target ceiling. Inflation was a stronger-than-expected 1.3 percent in June, official flash data showed on Friday, and while still below target, recent strong economic data meant ECB chief Mario Draghi last week raised the prospect of policy tightening.

But British manufacturing grew more slowly than expected as consumers faced the double-hit of accelerating inflation – caused in large part by the fall in the pound since last year’s vote to leave the EU – and by slowing wage growth. the U.K. PMI fell to 54.3 from a downwardly-revised 56.3 in May, a three-month low and below all forecasts in a Reuters poll of economists that pointed to a reading of 56.5. A reading above 50 indicates growth.

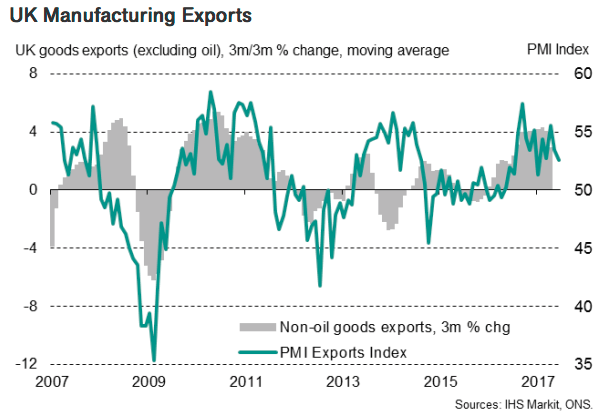

Monday’s survey suggested the supposed silver lining of a weakened pound – more competitive exports – is proving elusive and could make Bank of England officials think twice about raising interest rates. Bank of England Governor Mark Carney says he is watching to see how the economy copes with the launch of Brexit talks and whether weakness among consumers could be offset by investment and exports. Exporters had recently appeared to be cashing in from the pound’s decline – a survey by the Confederation of British Industry last month said a bigger proportion of exporters had above-average order books than at any time in the last 20 years.

(Additional reporting by Reuters)