If President Obama had been able to better address Americans’ widespread and persistent economic anxiety, Donald Trump might not be celebrating his inauguration today. But anyone with enough money to invest in the stock market had plenty to celebrate under the outgoing president: U.S. stocks rose an average of 12% a year during Obama’s two terms, according to S&P Global.

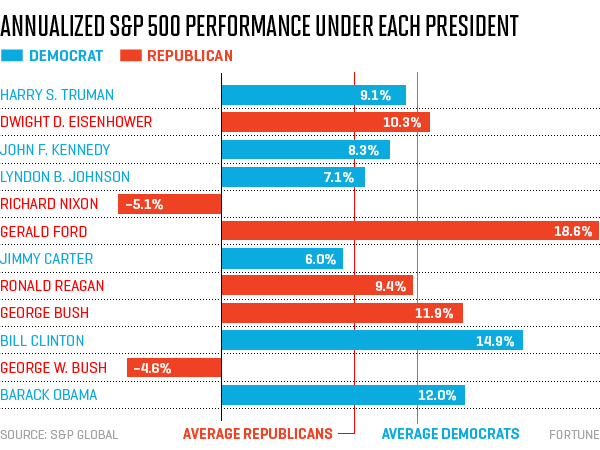

That ranks Obama 3rd among the 12 men who have served as president since World War II, based on the performance of the S&P 500. Only Bill Clinton (under whom stocks rose 14.9% a year over 8 years) and the late Gerald Ford (18.6% annualized during his 29 months in office) presided over better markets. For more detail, see the chart below.

The 44th President had the advantage of starting from a grim stock-market low point: When Obama took office, on Jan. 20, 2009, stock investors were still in full lemming mode, fleeing from stocks in reaction to the bursting of the housing bubble and the realization that Wall Street balance sheets were pretty much termite-ridden, thanks to risky lending and financial engineering. But stocks touched bottom on March 6, 2009, and have been trending upward ever since.

Stock performance under Obama also benefited, ironically enough, from the so-called Trump Bump. In the 10-plus weeks since Election Day, Obama’s last days as president, the S&P 500 has risen 6.2%, as the prospect of lower taxes and fewer regulations revived lame-duck animal spirits among stock investors. Overall, the market rose 166.3% between Obama’s first day in office and the close of trading Thursday, his last day.

What comes next? Historically, stocks have done better on average under Democratic presidents than Republican ones. On the other hand, a quick glance at the statistics suggests that investors should be excited to have a Republican president heading a Republican-led Congress: The S&P 500 has gained 15.1% a year under those circumstances.

There’s a catch, however: As Money’s Taylor Tepper recently pointed out, there have only been six years since World War II where Washington had unified Republican government. Four-and-a-half of those years occurred under George W. Bush, when stocks had a nice run…until the financial crisis, which essentially wiped out several years of gains.