George Soros is preparing to make a bundle on a coming financial disaster.

Soros, who has returned to trading after a long hiatus, has sold some of his stocks in his $30 billion portfolio and moved a good chunk of that portfolio into gold. Soros Fund Management has been moving some of its money into gold and the shares of gold mining companies for a little while. But according to the WSJ, Soros has essentially come out of retirement to oversee the trade because he thinks there are a lot of profits to be made.

Among Soros’ concerns are China, massive world deflation, and the end of the EU. In January, at the annual World Economic Forum in Davos, Soros compared what was happening in financial markets to what happened in 2008. “We are repeating 2008,” he said.

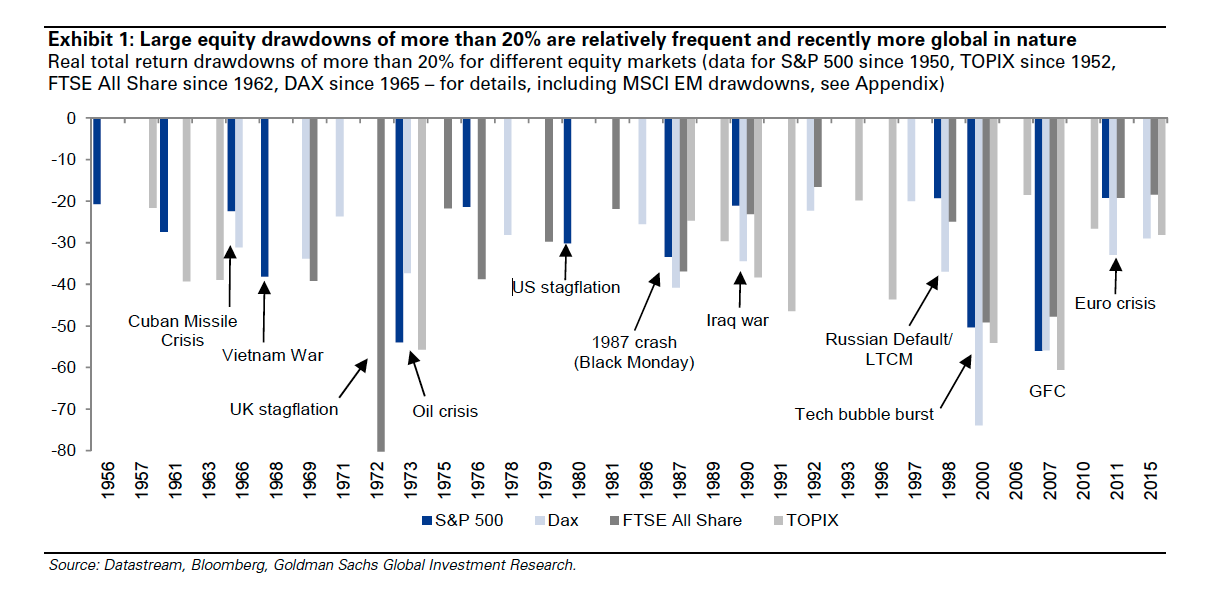

On Wednesday, Goldman Sachs also sounded an alarm about the market. In a report titled “Equity Drawdowns and Diversification Desperation,” Goldman strategist Christian Mueller-Glissmann included a chart of the biggest market drops over the past 60 years. (Drawdown is Wall Street speak for market drop.) Mueller-Glissman seemed to be advising clients that another big drop could be coming.

Soros has been sounding pretty bearish for a while. Recently, he’s been wrong. The stock market has risen by nearly 6% in the past three months, after dropping at the end of last year. And the market remains near all-time highs.

Before last week’s jobs report, a number of market commentators expressed confidence in the U.S. economy, and some were growing worried about inflation. Many still think that the Federal Reserve will likely raise interest rates at its next meeting.

It’s not clear how large Soros’ bet on gold has become. Soros’ firm owns just over $380 million worth of shares in Barrack Gold (ABX), according to first quarter data, which was the funds largest so-called long position, meaning Soros was hoping the value of the shares would rise. Soros had $123 million in an exchange traded fund that rises, and falls, with the value of gold. Soros’ largest position was a $430 million bet, or short position made by buying put options, that stocks would fall.

And it’s a weird bet. There is a lot of evidence to suggest that the market is overvalued. But gold, which has been rising recently, is probably overpriced as well. Just because stocks fall doesn’t mean gold will rise. Gold rises in times of real calamity, like during a financial crisis. And there aren’t a lot of people who think that could happen now. If the Fed continues to increase interest rates, as Janet Yellen has said it would do, that is likely to hurt gold prices as well.

Soros says that trouble in China could cause massive deflation around the world. He also thinks it is possible that the growing refugee crisis in Europe will lead to the collapse of the Euro. That would trigger a massive recession in Europe and cause significant political unrest.

“The world is running into something that it doesn’t know how to handle,” Soros said in January.