E. Gerald Corrigan has gotten used to big change during his career in government and on Wall Street.

There were drastic interest rate policy changes when he was at the Federal Reserve. There was a transformation in the way Goldman Sachs Group (GS) operates and is perceived by the public during his time as a partner there.

Now, at age 75, Corrigan will make a change of his own, with plans to retire from the Wall Street bank.

Goldman announced on Tuesday that Corrigan, known as Jerry, will be leaving in June. A managing director in the office of Chief Executive Lloyd Blankfein, Corrigan does not have a formal title because he does a lot of everything around the company.

He meets with important clients, is chairman of Goldman’s two deposit-gathering banks in New York and London, which are key to the broader company’s future growth plans, and co-chairs committees on risk and trading partners. And perhaps most important for Goldman, Corrigan shared oversight of a committee that reviewed the bank’s behavior during the financial crisis.

That panel, the Business Standards Committee, jumped into action after the U.S. Securities and Exchange Commission accused Goldman of duping clients. But before the committee was able to complete its review, Goldman’s reputation was further tarnished after a disgruntled employee quit and wrote a book about bad behavior he said he witnessed at the bank, including coworkers’ referring to customers as “muppets.”

By the time the Business Standards Committee revealed its conclusions in 2013 — chiefly that Goldman should remember to put clients first — they were old news. But Corrigan says it was a massive internal undertaking for him and his co-head, J. Michael Evans, a former executive who is now a board member.

“When we were up against the wall in 2010, Lloyd wanted to get something going” with an internal review of Goldman’s behavior and culture, Corrigan told Reuters in an interview on Tuesday. “He left it to us to figure out how to do it.”

Corrigan joined Goldman Sachs in 1994 as a managing director and became a partner two years later. But he’s never really had one concrete role or title.

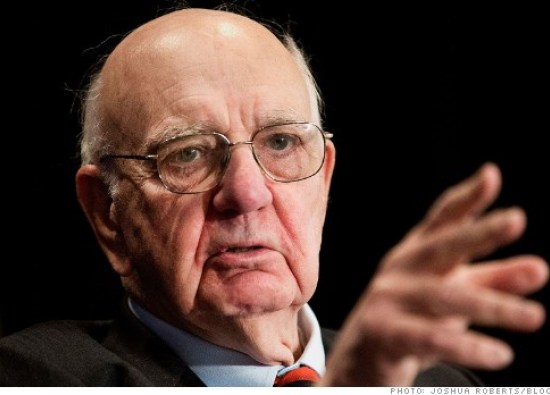

Tall and pale, with a ruddy face and full head of white hair, Corrigan refers often to his Irish heritage. He says the frequent trips from his home in Boston to Goldman’s office in New York — or to events and client meetings in other cities — have started to wear on him. Still, he starts work at 6 a.m. and ends late in the evening

Corrigan is known internally as one of just a few senior executives who spotted problems before the financial crisis erupted in the fall of 2008, as part of an internal group that manages risk among trading counterparties. He’s also noticed problems in other countries, and has written — in longhand, because he’s not fond of computers — at least 150 speeches and testimonies to present in countries ranging from the U.K. to China, according to a printed list he showed Reuters.

Before Goldman, Corrigan spent 25 years at the Federal Reserve, including as a special assistant to former chairman Paul Volcker, who became a close personal friend.

Volcker, during his reign at the Fed, drastically changed monetary policy by raising interest rates dramatically and allowing rates to move more freely in the market. The decisions were controversial, but Volcker is credited with saving the U.S. economy from crippling inflation.

His work required cooperation among Fed officials who had very different views, and Corrigan described himself as a point person who helped Volcker achieve consensus.

Corrigan’s relationship with Volcker has its irony, since Volcker’s eponymous rule restricting U.S. banks from trading for profit using their own capital has caused Goldman Sachs more problems than any other regulated Wall Street bank.

Yet Corrigan doesn’t seem to have any issue with their relationship, recounting fishing trips and hours-long visits to Volcker’s office to catch up on life, as well as a war room he drew up at the Fed in the 1980s, at Volcker’s command, to deal with some rogue traders on Wall Street.

Their friendship has in some ways put Corrigan in an awkward position, though he won’t publicly share his view of the Volcker rule — or any other policy set by regulatory friends, much less acting Fed members.

“Paul and I have been close friends for many years. I was his troubleshooter for awhile, and we got into some pretty lively situations.”