Bill Gross of Janus Capital Group is not happy with Janet Yellen and the Federal Reserve.

In his latest Investment Outlook, the famed bond trader is calling the Fed’s policy of keeping short-term interest rates near zero, “a savers’ nightmare.” He even went so far as to describe the condition of the American saver as akin to getting stuck “on a revolving spit, being slowly cooked alive while central bankers focus,” solely on inflation and unemployment.

What central bankers should be focusing on is encouraging investment, according to Gross. The bond king thinks that near-zero interest rates does just the opposite, however. He writes:

Zero bound interest rates destroy the savings function of capitalism, which is a necessary and in fact synchronous component of investment. Why that is true is not immediately apparent. If companies can borrow close to zero, why wouldn’t they invest the proceeds in the real economy? The evidence of recent years is that they have not. Instead they have plowed trillions into the financial economy as they buy back their own stock with a seemingly safe tax advantaged arbitrage. But more importantly, zero destroys existing business models such as life insurance company balance sheets and pension funds, which in turn are expected to use the proceeds to pay benefits for an aging boomer society.

This is not the first time Bill Gross, or other Fed critics, have argued that the Fed should raise rates in order to help out savers. And while many workers nearing retirement have been hurt by the poor return on bonds, Gross doesn’t address what the overall condition of the economy means for interest rates and investment decisions. Gross says that instead of encouraging investment, low rates have just led companies to issue debt and buyback stock — actions that might raise their stock prices but will do little to affect the real economy.

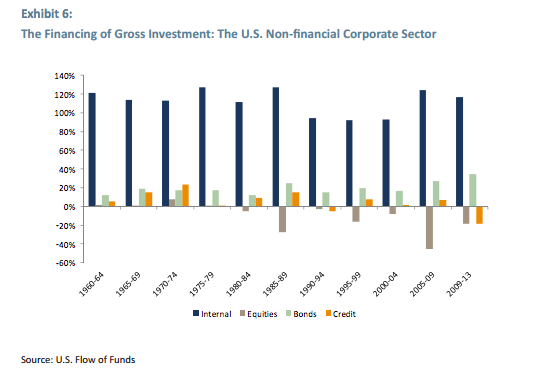

But Gross is ignoring the evidence that firm behavior isn’t actually influenced heavily by Fed policy. A company invests when it sees an opportunity to make a profit, and doesn’t when there is no profit to be had, regardless of where interest rates are. The following chart from GMO’s James Montier shows this fact clearly:

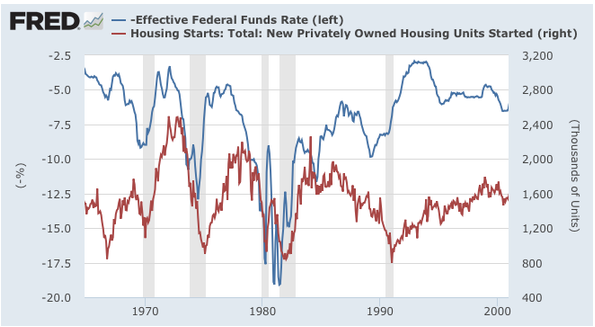

As you can see, the vast majority of investment is done with internal funds, not debt. The mechanism through with the Fed does affect the real economy, however, is through the housing market. When interest rates are low, home builders tend to build more houses because they become a lot cheaper for the average American to buy. This leads to greater employment for American workers and wealth-building opportunities for new homeowners:

Meanwhile, Gross is ignoring the many signals that low interest rates are a natural outcome of a slow-growing global economy. Take for instance the fact that on Tuesday, a $15 billion sale of US Treasuries attracted record demand even though they paid an interest rate of precisely zero. According to the Wall Street Journal, the auction “drew bids of $9.47 for each dollar of bonds on offer, surpassing the previous high from a December 2011 Treasury bill sale.” That’s despite the fact, that when you take inflation into account, investors in these assets are losing money.

How do you explain this behavior other than the fact that there just aren’t that many productive uses for money these days? The Fed must set interest rates somewhere, and Bill Gross has yet to explain how higher interest rates will lead to more investment, or a stronger economy.