Advent International, a $32 billion private equity firm with offices in a dozen countries, is not including a preferred return (i.e., hurdle) on its eighth flagship fund, as first reported this morning by peHUB‘s Chris Witkowsky.

For the uninitiated, hurdles are a rate of return that private equity funds must meet before fund managers can begin collecting their cut of investment profits (i.e., carried interest).

I’ve since confirmed Advent’s plans with market sources, and also learned that the firm will not be changing either its carried interest structure (20%) nor the GP-beneficial quirk whereby its 1.5% management fee does not step down over time (a feature that in the past has, effectively, delayed the hurdle from being cleared). On the other hand, Advent has removed a clause whereby it could charge limited partners upwards of 75 million euros for ‘business services,’ fees usually related to Advent putting its operating partners into portfolio companies (few of which were actually charged on Advent’s last flagship fund).

To be clear, there is some decent philosophical motive for eliminating the hurdle. Such structures were originally established to essentially mirror interest rates, so that LPs had incentives to invest in high-risk private equity funds. But with interest rates at effectively zero, an 8% hurdle (which is where past Advent funds sat) is no longer tethered to that rationale.

But, in practice, all of that is gobbledygook. If hurdles were really about interest rates, then they would be structured via some sort of “floating” mechanism. Instead, this is about Advent protecting its own downside while removing related protections from its LPs.

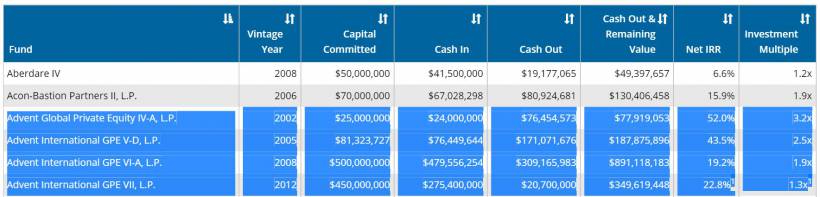

To be clear, I have no reason to believe that Advent won’t easily surpass 8% returns on its new fund. Even though its performance has slipped pretty consistently over the past several funds, it’s still well more than double that threshold. For example, here is some data through year-end 2014 from the California Public Employees’ Retirement System (CalPERS):

Advent, however, appears to be taking out an explicit insurance policy against either not meeting the hurdle, or perhaps finding itself near the hurdle in five to seven years and wanting to avoid the dangerous impulse to swing for the fences in order to clear it.

Remember, this isn’t a firm that has never had a hurdle — like Warburg Pincus or Hellman & Friedman — deciding to maintain its historical structure (upon which all of its compensation is built). It’s a veteran firm making an intentional change.

My best guess is that most LPs will grumble loudly and then still pony up, particularly in light of how many of them are trying to make bigger bets on fewer managers. But if Advent does indeed stumble going forward, it will have deservedly lost some goodwill the next time around.

Advent declined comment, citing U.S. securities laws surrounding fundraising activity. The firm is seeking to raise $12 billion for its new flagship fund, compared to the $10.8 billion it raised for Fund VII back in 2012.

Get Term Sheet, our daily newsletter on deals & deal-makers.