The newest tech war in China has begun.

The opening of Tencent’s online WeBank earlier this year was attended by Premier Le Keqiang. Smartphone maker Xiaomi just announced a new money market fund that triples the yield you could get at a state-owned bank. And Alibaba Group Holdings Ltd’s (BABA) finance affiliate said yesterday it expects its online bank to open sometime in June.

Online banks are a new thing in China, and tech giants including Alibaba, Tencent Holdings Ltd (TCEHY), Baidu Inc. (BIDU) and Xiaomi have all worked to secure banking licenses in order to take on the country’s stodgy big four state-owned banks that are known for paying low rates and offering few investment options for average customers.

For Alibaba, a company that has blown through expectations at every level—driving eBay Inc. (EBAY) out of China; running the world’s largest e-commerce site; staging the world’s largest IPO—success in banking may come quickly, especially considering how ripe China’s banking industry is for some basic competition.

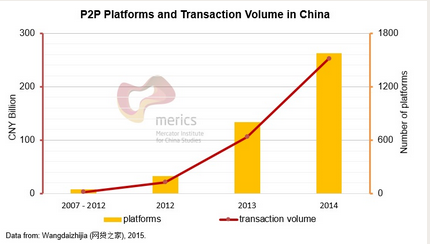

When McKinsey surveyed more than 3,000 Chinese last year, 70% said they’d be fine opening an online-only account. McKinsey also said the big four’s market share of retail banking was trending downward, dropping five percentage points from 2011 to 2014. The rise of peer-to-peer lending sites in China, of which there are now upwards of 1,000, are also indicative of the demand that exists outside the state-owned banks’ domain.

Alibaba is already known as a financial services company within China. Its money market fund Yuebao was the first time many Chinese realized they had an easy option to double the yield of their savings account. Alibaba’s Alipay has also become a part of everyday life for many Chinese, who use it to pay for cabs, transfer money to friends, and settle bills at half a million merchants. In fact a large part of the success of Taobao and Tmall, Alibaba’s e-commerce forms, hinges on the Paypal-like system that is actually owned by an Alibaba affiliate company, Ant Financial, the same affiliate behind the online bank.

All banks have to start somewhere. But the obvious criticism of Alibaba’s bank is that it is not battle tested. The Economist pointed out last year that its money market fund Yuebao started reaching for yield as soon as interest rates fell, exposing holders to far greater risk than they had experienced early on.

Moreover, China’s stock markets and investment funds experience some of the greatest volatility among large markets. Just take the Shanghai stock market, which has risen 70% over the past six months. Volatility is the bane of bankers, especially when it’s coupled with sudden asset withdrawals. Alibaba’s online bank, dominated by flighty retail investors, may quickly face markets that are easier for seasoned institutions to handle.

Separately yesterday, Alibaba’s Ant Financial and some partners announced they were constructing a new Chinese stock index. It will follow 100 online retailers across industries from household durables, to apparel to hotels and restaurants. The idea behind the new index called the CSI Taojin Big Data 100, Alibaba says, is to track the top companies in the country’s booming e-commerce sector and thereby glean insights into consumers.

While it’s true China does need to build out its offerings—currently there are only three stock indices in the country, compared to dozens in the U.S.—the Alibaba index includes some unusual inputs. For instance, the company said its index partners will analyze sales data from Alipay to update the index and add and drop companies on a monthly basis, says Ant Financial spokeswoman Miranda Shek. Alipay is the dominate online payments tool, but Tencent is quickly adding market share with its WeChat payment system. The Chinese tech world is already Balkanized because of Alibaba, Tencent, and Baidu are fighting for turf. Creating a stock index off only one company’s data extends that balkanization to the financial markets.

Moreover, the company says Alipay online sales data will be analyzed in real time to select the best performing companies for the index. Every month the index will look to switch to include the 100 top A-share companies in China. The S&P 500, by comparison, might replace 10 companies a year.

Detailed comparisons with western precedents, here as elsewhere, will of course only take you so far. China is far too busy being China for that. But fear and greed are universal forces, and the new entrants may not have too long to work out how they’ll cope with that titanic and never-ending struggle.

Watch more business news from Fortune: