If you’ve always wanted to know who Warren Buffett is and how he got so rich, this was the week for you!

Nearly 50 years ago, Warren Buffett and his investors took control of the textile mill company Berkshire Hathaway. You probably know what happened after that. Berkshire (BRKA) has become a hugely successful conglomerate, and Buffett’s investment vehicle. And Buffett has become the world’s third richest man.

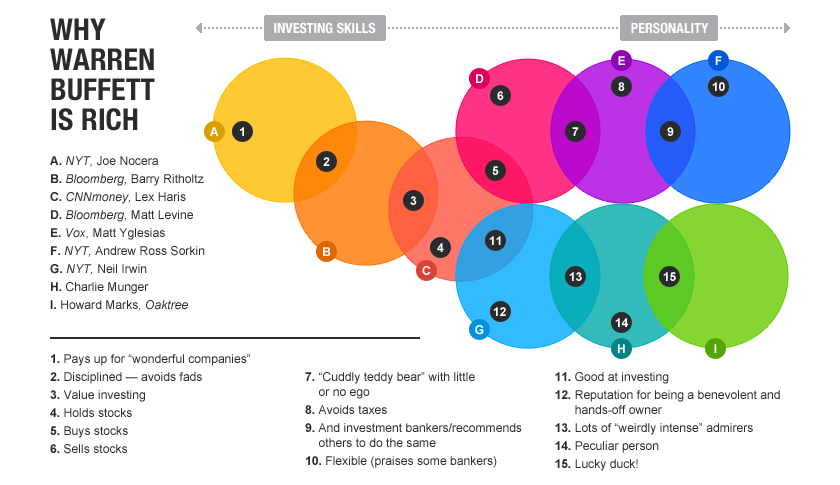

To mark the anniversary, Buffett included a special section in his annual letter to shareholders, which came out last Saturday, about his past 50 years in business. Responding to Buffett’s special section, nearly everyone on the Internet wrote a think piece on what has made Buffett the most successful investor of all time. (Well, not everyone. But many financial journalists.) In response to all those posts, I have collected all of the reasons everyone came up with and put it all in one chart.

What does my chart say? A lot! Part of the allure of Warren Buffett is that he makes what he does sound so simple. He buys good companies at fair prices, says Joe Nocera at The New York Times, and he doesn’t get taken in by the latest investing fad. The lesson to learn from Buffett is to be yourself, says Barry Ritholtz. It’s easy.

But look at the chart! There are nine bubbles, 15 potential reasons he’s so rich, and not a lot of overlap. Look at the middle of the chart. Matt Levine of Bloomberg says Buffett is successful because he buys and sells stocks. (Also because he is so “cuddly.”) Right next it: A bubble for an article from Lex Haris at CNNmoney that said that if you want to be rich like Buffett, the key thing to do is buy and hold, i.e. never sell. Buffett is successful because he is able to do a lot of stuff really well. And he’s able to do contradictory stuff, again really well.

Second, Buffett is often thought of being the best investor to ever walk the planet. But if you look at the chart, the bubbles are doubled up and much more crowded on the right side. That suggests that more of Buffett’s success—or perhaps just how his success is perceived by financial journalists—seems to be on account of his personality, not his ability to pick stocks.

If anything, the chart suggests that Buffett has been so successful because he is willing to be flexible. In his letter to shareholders, as Andrew Ross Sorkin points out, Buffett warns that Wall Street and investment bankers are always trying to get companies to do foolish things, like bad acquisitions or spin-offs, just to earn a fee. Buffett says most companies and managers would be better off ignoring investment bankers. Yet one of Buffett’s largest investments is Goldman Sachs, which is filled with bankers trying to get companies to do things so they can collect fees. That might make Buffett seem a bit hypocritical, but isn’t the world better off because Buffett is willing to point out the problems of Wall Street even if he also knows there are profits to be made?

It’s also important to learn from your mistakes. Buffett is the original activist investor. He took over Berkshire and tried to run it himself. And it was a disaster. That is likely what led him to the hands-off strategy that has made every other business that Berkshire has bought such a success. Buffett is fortunate to have experienced such fallout early enough in his career that he could bounce back.

Staying flexible, taking advantage of your good fortune, and being willing to learn from your mistakes. Like most things you can learn from Buffett, all of those items serve as pretty good life advice. And these three items will probably make you a better investor, businessperson, and perhaps even richer; though $72 billion richer is probably a stretch.

Graphic by Analee Kasudia.

Clarification: An earlier version of this story said that Warren Buffett was the world’s second richest man. In fact, by the latest rankings, he is the third.