Goldman Sachs yesterday published a research report arguing that private equity has been a lethargic deal-maker in 2014, but that it will soon awaken to prolong the current M&A boom. It’s titled “Where have all the LBOs gone?” Great title, albeit with a faulty premise.

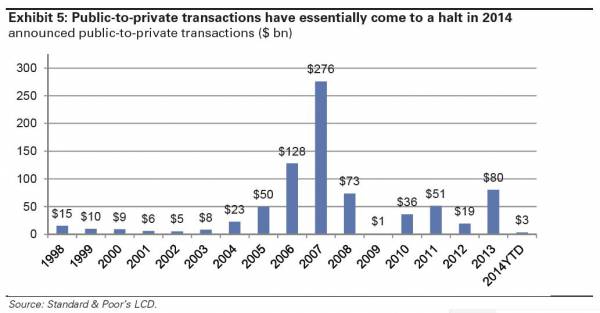

Goldman (GS) relies on data from S&P LDC that shows how there have been very few large “take-private” acquisitions so far this year. No take-privates larger than $5 billion, and just $3 billion of total announced activity:

I cannot understand how S&P compiled this data, or why Goldman chose to believe it (neither one has responded to requests for comment).

Off the top of my head, I can think of two take-privates that easily surpass the $3 billion figure: Thoma Bravo’s agreement to acquire Compuware (CPWR) and Lone Star Funds’s $1.4 billion buyout of DFC Global.

And that doesn’t even include Cerberus Capital Management’s $9.2 billion deal for Safeway, because the technical buyer was Cerberus portfolio company Albertsons. Or giant carve-outs of publicly-traded companies, like The Carlyle Group paying $4.15 billion for the Ortho–Clinical Diagnostics of Johnson & Johnson (JNJ) or Golden Gate Capital buying Red Lobster from Darden Restaurants (DRI) for $2.1 billion.

[UPDATE: S&P emails to say that the $3 billion figure was for the first-half of 2014, not year-to-date (as referred to in the Goldman Sachs report, dated Sept. 9). It adds that it views Safeway as a “platform acquisition,” rather than as a pure take-private.]

More broadly speaking, however, public-to-privates have always been a small part of the private equity business. They are opportunistic, which is why volume can go from $19 billion to $80 billion to “$3 billion” in 2014 without substantially affecting overall private equity deal volume.

The reality is that private equity is investing just as much today as it has in years past. In fact, private equity firms disbursed more capital to U.S. targets during the first-half of 2014 than in any year since 2007, and it continues to steadily increase its international deal volume. Moreover, we’re hitting record numbers of sponsor-to-sponsor transactions — most of which comes with undisclosed price tags.

What has changed, however, is that strategic buyers have finally come off the sidelines. This has made private equity a smaller piece of an expanded pie.

To be sure, some private equity firms have had to adjust. Strategic capital is cheaper than private equity capital (even at record-low interest rates), so private equity is at a competitive disadvantage in certain auction situations (including take-privates, since most listed companies hire investment banks). Moreover, private equity funds are smaller today than they were before the economic crisis, so $5 billion+ deals are harder to swallow from a portfolio exposure point-of-view (particularly given the industry’s LP-driven reticence to participate in club deals). Yes, there is a record amount of dry powder. But it is spread out, which suggests more small/mid-market deals than a sudden burst of mega-deals.

The one place I agree with Goldman Sachs is that private equity will still be there when the strategics finally pull back. Not so much when the public markets begin to retreat, since corporate boards will take a year or so before they internalize downward-revised valuations (they’re much quicker on the uptake). But rather in early 2016, when the presidential campaigns really get underway and CEOs begin complaining again about “uncertainty.”

If you want to know where all the LBOs have gone in the interim, just use Google.

Sign up for Dan’s daily email on deals & dealmakers: Get Term Sheet