Lending Club, the peer-to-peer small business lender, is ready to take itself public.

The almost 8-year-old company filed for an initial public offering worth $500 million Wednesday — a placeholder sum that’s used to calculate filing fees. The final sum the company raises could be much higher.

Lending Club had been valued at about $4 billion after a fundraising round earlier this summer.

The company is looking to raise funds amid the growing success of the peer-to-peer lending market, which includes competitors such as Prosper and Upstart. Lending Club has risen to the top of that market and is now the world’s largest online connector of borrowers and investors.

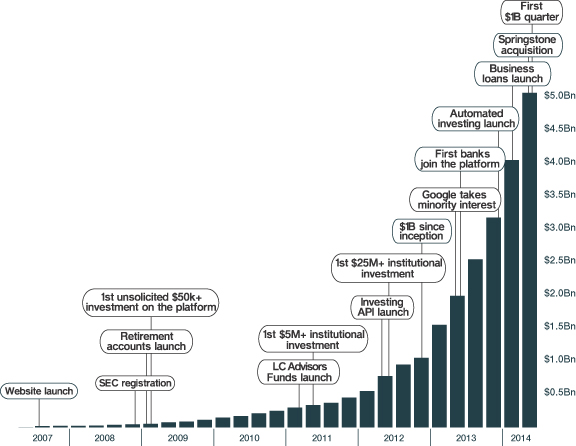

The company has originated over $5 billion in loans as of the end of June. In the six months through June 30, it originated about $1.8 billion of that total, 125% more than over the same period a year earlier, according to its filing with the Securities and Exchange Commission

The graphic below, included as part of its filing, shows Lending Club’s exponential growth in loan originations since 2007, along with key company milestones.

“We have pretty ambitious goals,” Renaud Laplanche, Lending Club’s CEO, told Fortune in March. “We want to transform the banking system into a marketplace that is more competitive, more consumer-friendly, more transparent.”

The rapid growth in loans and Laplanche’s passion to expand the company’s reach reveals why major financial luminaries have become supporters. Former U.S. Treasury Secretary Larry Summers and Morgan Stanley CEO John Mack are both on Lending Club’s board of directors.

Lending Club doesn’t make loans directly. It provides the technology and online interface to connect individuals and institutions with small-scale borrowers. It makes money by charging transaction and servicing fees.

Total net revenues for the company have grown in line with its soaring loan originations. The company brought in $98 million last year, a 190% increase over revenue in 2012. As of June this year, it had brought in $86.9 million in revenue.

The company fills a financing niche left behind by the wider banking services market. Lending Club connects small businesses that previously were served primarily by the credit card market with affordable loans, most at an average rate of 14% interest. It uses technology and algorithms to match borrowers — and their default risk — with the the right investors.

Right now the company focuses on small businesses, but “over time, we want to offer all types of credit products including auto loans, student loans and mortgages,” Laplanche said.

Those types of loans may not be that far away. Lending Club plans to use the funds from its public offering to expand into other types of borrowing, and into more areas globally, according to its SEC filing.

The company has yet to decide on a ticker or an exchange on which to list. Morgan Stanley (MS) and Goldman Sachs (GS) are managing the offering.