Unless you’re in the business of video production, you likely haven’t heard of Pond5. The company’s new $61 million Series A round of venture funding, led by Accel Partners with participation from Stripes Group, will likely change that.

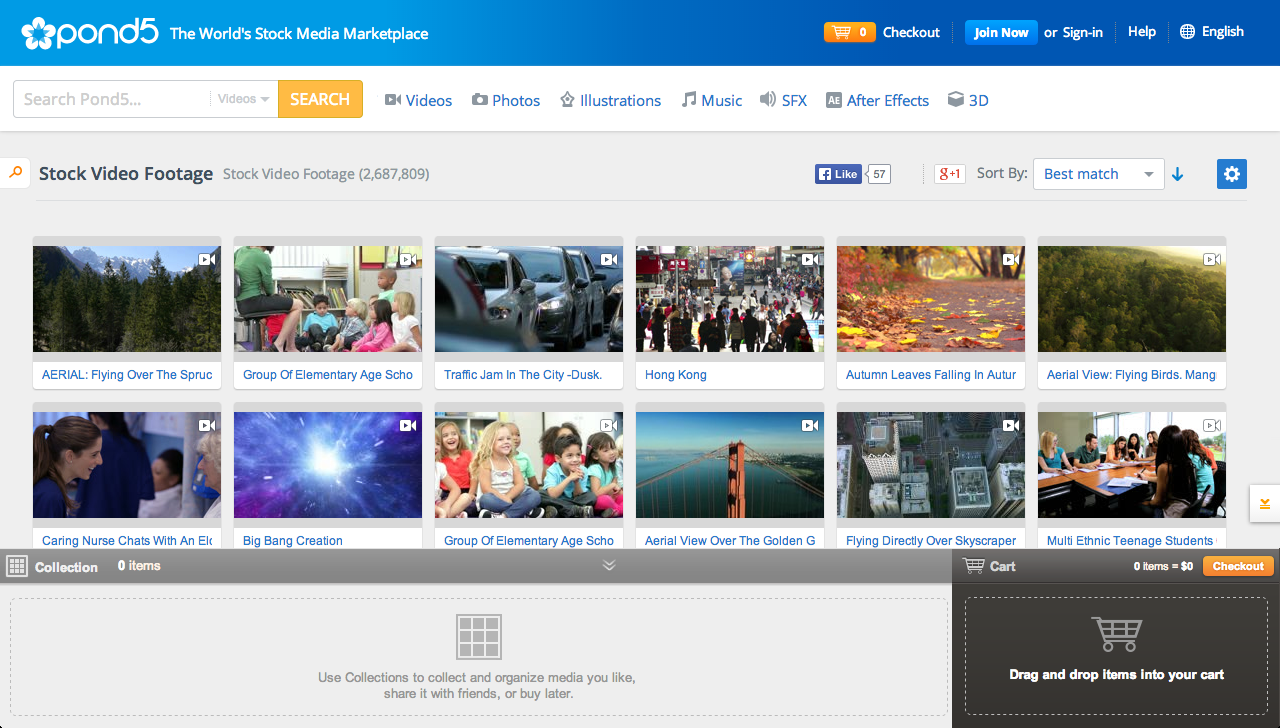

Pond5 is a New York-based stock video startup founded in 2006. It has said very little to the media since. But in that time, Pond5 has built itself into a large, thriving, self-sustaining marketplace on $500,000 in seed funding from angel investors. The company now has 70 employees in 18 countries. Its marketplace has around 40,000 creators who have uploaded 2.6 million videos, which Pond5 sells to several hundred thousand buyers. The company’s marketplace is available in seven languages, and it is on track to do $20 million in sales this year, doubling last year’s sales and turning a profit.

Pond5 says its new funds will go toward accelerating growth, including expanding into more languages, expanding its product team, and iterating faster on its product roadmap.

The company differentiates itself from other stock video offerings, such as Shutterstock’s video business, Getty’s video offering, or CorbisMotion, by positioning itself as the most artist-friendly. Pond5 allows artists to price their own footage—they average $45 to $50 per clip—and gives them a 50% split of the profits. (Its competitors offer as little as 15% to 30% in royalties.) Another big differentiator is that Pond5’s videos are all royalty-free, meaning buyers can purchase a clip once and use it for anything they want, saving both parties negotiations required for “managed rights” content.

Pond5 has been adopted by a diverse group of content creators including MTV, BBC, Netflix, the music producer Ryan Lewis (best known for his work with Macklemore), and the ad agency Weiden + Kennedy. There is also a long tail of small- and medium-sized customers, such as church groups, universities, non-profits, and wedding videographers.

Pond5’s path—moving from a bootstrapped existence to taking $61 million in venture capital—is not actually as unique as it seems. Most startups are fueled by venture capital from day one, raising capital every year or so until they go public, which is often effective, even if it means the holdings of the company’s founders and early employees are diluted by the time of the I.P.O.

But another class of startups toils away on next-to-no capital for years and builds a healthy, self-sustaining business that grows typically slower than that of a venture-backed company. These companies often decide to raise capital eventually. When they do, it’s a huge round, such as Github’s $100 million round from Andreessen Horowitz, valuing the company at $750 million after five years of bootstrapping. Likewise, when Imgur raised $40 million from Andreessen Horowitz after five years of bootstrapping, the company was valued at $200 million.

Accel is no stranger to the late-stage Series A deal.The firm led Braintree’s first outside investment round worth $34 million, which came five years after the company was founded. Accel was also the first outside investor in Atlassian, which self-funded its growth for its first eight years. When Squarespace decided to take $38 million in outside funding after six years of bootstrapping, the money came from Accel and Index. Qualtrics raised $70 million in 2012, 10 years after it was founded from—who else?—Accel, alongside Sequoia Capital.

Accel discovered Pond5 while talking to content producers about their favorite resources. The name Pond5 came up repeatedly. John Locke, who led the deal for Accel, says he was impressed by the way Pond5 was competing against big players in the category, such as Shutterstock and Getty, by catering to “emerging creators” with smaller budgets.

“We think the media world is dramatically changing with a new wave of creators putting out great content to the masses,” Locke says. “Major networks and ad agencies don’t have a stranglehold on content or viewers anymore, particularly as it relates to video.” He pointed to the success of online video startups such as YouTube; Netflix (NFLX); Maker Studios, a network of online video channels which Disney (DIS) purchased for $500 million (plus earn-outs); Vice Media, a fast-growing media company worth a reported $2.2 billion; and Vox, a media company in which Accel has invested.

Video creators are passionate about Pond5, Locke says. Many Pond5 users make a full-time living shooting stock video for the site, specializing in niches like Alaskan wildlife, motion graphics, or time-lapse videos, says Tom Bennett, the company’s co-founder and chief executive. “It feels like early Etsy, when we invested in 2008,” Accel’s Locke says. At the time, Etsy drew comparisons to eBay. Now, it’s clear the marketplaces are very different.

Pond5 was doing fine as a bootstrapped company, but the market for online video has been growing faster each year. With sudden, massive war chest, Pond5 can keep pace, if not race ahead. The timing made sense, Bennett says: “The overall market is evolving quickly enough that we weren’t able to do everything we want to do without bringing in additional firepower.”

Note: This post has been updated to correct the amount of seed funding Pond5 had raised from $250,000 to $500,000.